EBITDA Multiples by Industry: How Much Is Your Business Worth?

We present data on EBITDA multiples across eight industries, along with detailed analysis and tips to improve your multiple before exiting.

Tags

When it comes to selling a business, owners would do well to set aside their own views of value and look at their companies through the eyes of a potential buyer. The stronger the acquisition target is for a buyer, the better the chances that a business will fetch a premium at time of sale.

So what is the best way for a seller to strengthen the business and win the buyer’s beauty contest?

Financial benchmarks can be used to compare a company’s performance relative to competitors of like size. One source of industry benchmarks are database providers like Sageworks© who track the financial performance of thousands of industry participants.

Operating below industry averages may be a signal that something is wrong with a company’s cost structure or business processes. These benchmarks can be very useful in identifying shortfalls, strengthening, and then leveraging them to market the business in a sale process.

Financial buyers look at dozens of investment opportunities a week and initially screen them based on profit, deal size, and industry space. If there is a fit with their investment criteria, they will then seek additional information and financially model the business based on historical and projected company growth, margin, risk, and cash management.

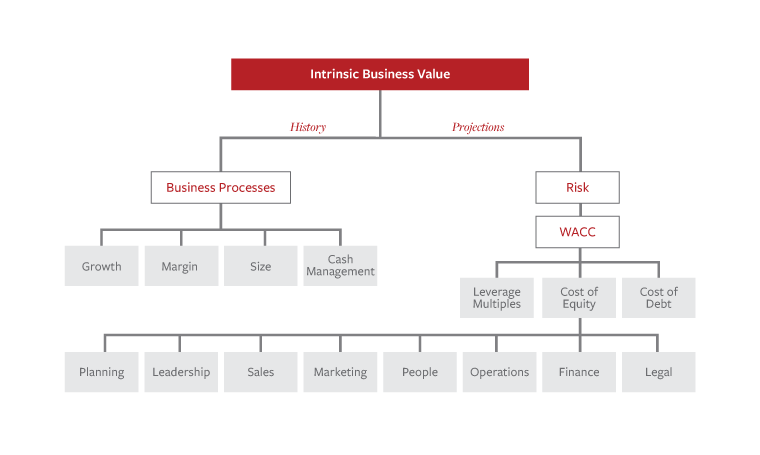

The combination of a company’s growth, margin, risk, cash management, and size constitute the intrinsic value of a business and attractiveness of an acquisition as an investment. Knowing a company’s intrinsic value is a good starting point for sellers as it can lead to action plans to improve attractiveness and enhance value of the business before entering into a sale process. The elements of intrinsic value and their relationship are shown below.

Elements of Intrinsic Business Value

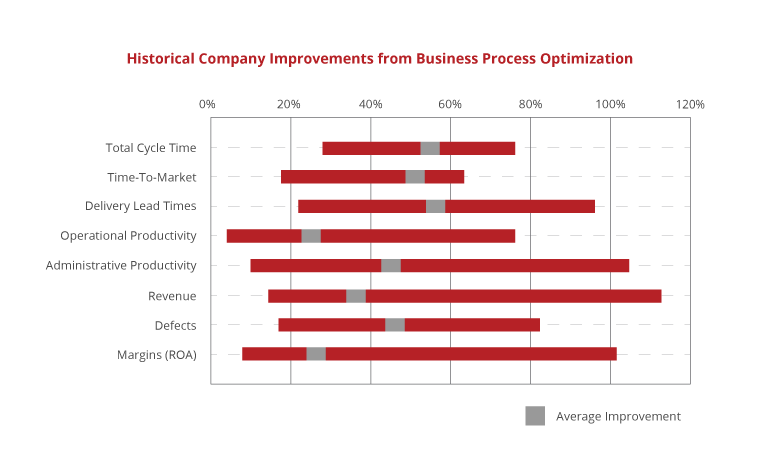

Adding more sales or support people is often a consideration in growing a business. Expense reduction is the first thing that comes to mind when considering how to improve profit. Shortening the receivables cycle can improve cash flow. But how do you achieve the improvements you seek? Analyzing and, if necessary, re-engineering business processes can provide significant insight into how to improve the operating and financial performance of a company.

Charting the flow of information from prospect identification to order and from order to cash can reveal shortcomings in efficiencies, quality, and processing time. The table below (sourced from R3D2 Consulting) shows the kinds of improvements possible from optimizing a company’s business processes.

Historical Company Improvements from Business Process Optimization

Courtesy of R3D2 Consulting

Buyers determine value through the judicious application of both science and art. Historical financials form the basis for projections. Both play a critical part in a buyer’s value assessment as does the debt that can be secured to support the purchase. The cost of debt is almost always cheaper than the cost of equity but the amount of debt is limited to some multiple of EBITDA. The amount of debt leverage available, along with the cost of equity, combine to establish a weighted average cost of capital (WACC). This becomes the discount rate applied to the financial projections to determine the Net Present Value of the company’s future cash flow stream. This financial re-engineering results in a proposed re-capitalization of the business and basis for a purchase offer. That’s the science.

The art comes in the assumptions that drive the Net Present Value calculations and linking the future risk to the cost of equity. Models by software developers, like Corporate Value Metrics, attempt to analyze the components of planning, leadership. sales, marketing, people, operations, finance, and legal, along with the role they play in creating risk of future growth. These models compare a company’s current risk factors to a benchmark business that operates like an entity ready for an initial public offering (the maximum price paid for a private company). The gaps between a company’s actual and ideal can represent opportunities for risk reduction and value improvement.

While value determined by a strategic buyer is unique to the combination of the potential acquisition and the buyer’s existing company, value of the acquisition target (as determined above) still provides an important first step. To this base value is added the value of the synergies (increased sales, lower costs, better leverage) that are a result of the combined businesses.

This “synergy value” can take years to capture and often generates considerable disruption if not carefully planed and well executed. For the most part, synergies are difficult to extract because they require the melding of business processes, people, and culture to be realized. While this may add an additional impetus for a potential acquisition and contribute to a premium price, they are not under the control of the seller and sellers rarely receive full credit for synergies in a purchase offer from a strategic buyer.

Investment bankers and brokers have processes they use to identify the most likely buyers and provide them the information they require for evaluation. These advisors also help market the business, move the sale process along, and negotiate deal terms.

While it may take fewer than 90 days to identify the value enhancement opportunities available in a business, it can take up to two years to achieve them, so they must be identified and developed long before a sale process is initiated.

While it is true that a business is worth only what someone will pay for it, identifying and optimizing its value should be one of the initial steps when thinking about selling. Getting a business ready for a sale requires skill in knowing what has the biggest payback and where to go to get help to accomplish what needs to be done.

The ROI on this effort can be significant. Benchmarking, business process re-engineering, and risk reduction not only make the company stronger and more valuable for existing owners but more attractive (leading to an increased price) to potential buyers in the future.

It’s a heads you win, tails you don’t lose proposition.