What Buyers Want: Deal Demand by EBITDA Range

Understanding buyer demand plays a significant role for business owners and dealmakers when it comes to navigating lower middle market…

Significant tailwinds across the behavioral health sector propelled an active first quarter of 2021 with regards to merger and acquisition activity, keeping up momentum observed in the latter stages of 2020.

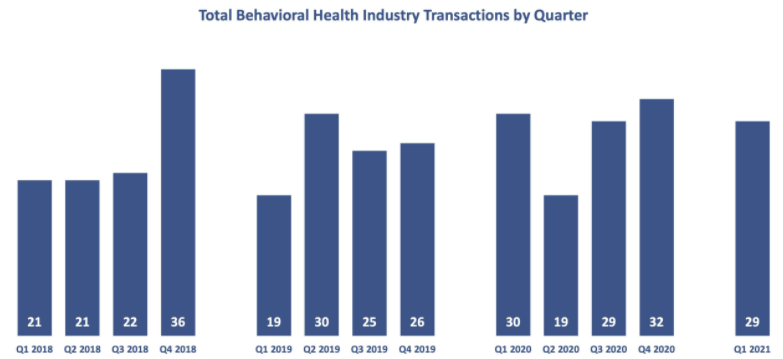

A total of 29 behavioral health industry transactions were announced in Q1. Outside of a dip in the second quarter of 2020 during which only 19 transactions were announced—a slowdown fueled by the onset of the COVID-19 pandemic—the sector has settled into a pattern of roughly 30 deals per quarter dating back to the beginning of 2020. The volume of deals for Q1 2021 is telling, but not unexpected.

And it’s pretty evenly split between addiction treatment, autism treatment and mental health. Mental health transaction volume has picked up significantly over the past two quarters, buoyed by the pandemic.

Private equity continues to play a large role in the space, accounting for 22 of the 29 deals announced in Q1, including three platform transactions and 19 add-on transactions. With many private equity-backed strategic companies operating in the space continuing to grow, there is a possibility that one could announce a public offering, either traditionally or through a special purpose acquisition company (SPAC) in the coming months.

Many treatment center owners, worn out by the pandemic could be ready to exit the space and sell, but the number of deals across behavioral healthcare to be announced over the rest of 2021 could hinge on the Biden-Harris administration’s stated intention to raise the capital gains tax. The administration’s recently announced infrastructure plan, however, does not directly address capital gains, instead focusing on corporate tax reform.

In the meantime, private equity has a mandate to invest and grow. Firms will be watching closely as industries get back on their feet in a post-pandemic world. A key factor to watch will be which structural changes enacted to keep businesses afloat in 2020—both in the behavioral healthcare space and other industries—will stick permanently.

Based on recent data, demand for addiction treatment services is expected to be high in the coming months. CDC reported that there were more than 88,000 deaths attributed to drug overdose in the 12 months ending in August 2020, the highest total for a 12-month period on record.

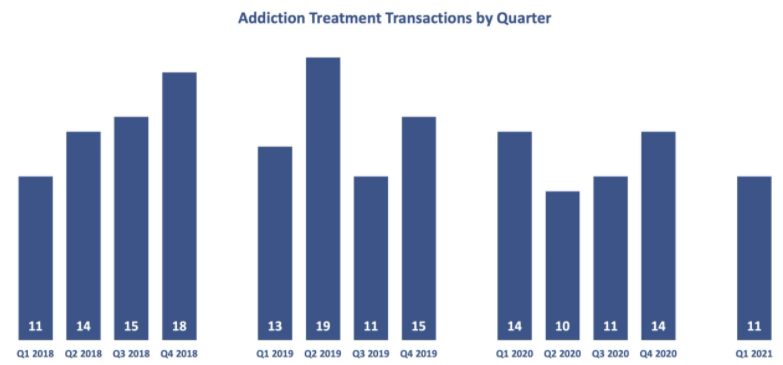

The 11 transactions announced in the addiction treatment space were down slightly from Q4 2020 (14 transactions), but on par with the prior two quarters.

After a busy quarter to close out 2020, BayMark Health Services stayed busy in the new year, announcing the acquisition of Partners in Drug Abuse Rehabilitation Counseling, a medication-assisted treatment provider in Washington, D.C. The deal for PiDARC was announced between two acquisitions of office-based opioid treatment (OBOT) programs by AppleGate Recovery, a BayMark subsidiary. In February, AppleGate acquired Redemption Recovery, a portfolio of five OBOT clinics in Tennessee, and in late March, the brand announced a deal for Montgomery Addiction Clinic, an OBOT located east of Nashville.

Platform deals were announced by private equity firms Health Enterprise Partners, which provided an investment in Aware Recovery Care in January, and Northlane Capital Partners, which announced an investment in global behavioral healthcare provider Empower Community Care in March.

Summit BHC acquired The Pavilion, a 66-bed inpatient psychiatric facility, and The Farley Center, a 70-bed substance use disorder treatment provider. Both programs are located in Williamsburg, Virginia. Summit BHC’s portfolio now includes 24 facilities.

The owner and CEO of Footprints to Recovery and Vogue Recovery, Michael Milch, added South Coast Behavioral Health to a portfolio that now includes seven facilities for the Costa Mesa, California-based group.

Discovery Behavioral Health added to its network of facilities by acquiring Prosperity Wellness Center, a 40-bed residential program in Tacoma, Washington. Prosperity became the 10th brand in the Discovery family, which is backed by the firm Webster Equity Partners.

Ohio-based BrightView Health announced a deal for Renew Recovery Centers, an SUD treatment provider with four Kentucky locations.

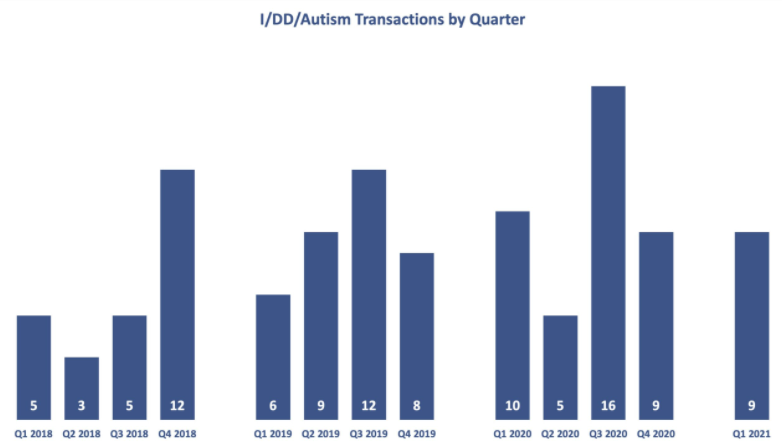

Nine deals in the autism services and intellectual/developmental disabilities space were announced in the quarter, matching the number of deals reported in Q4 2020.

Lighthouse Autism Center continued to build its presence as the largest provider of applied behavior analysis therapy in Indiana, acquiring Access Behavior Analysis and A Step Ahead. Lighthouse also opened a new facility in Valparaiso, Indiana, as well as a center in Niles, Michigan.

Acorn Health, which operates in seven states, strengthened its position in Florida with a deal for the assets of Sandcastle Centers.

Stepping Stones Group acquired EBS Healthcare in Pennsylvania, although while the two organizations are led by one combined executive team, they will continue to function as separate companies.

LEARN Behavioral has invested in Behavior Analysis Center for Autism (BACA), although the latter continues to operate as a separate brand.

Proud Moments ABA expanded its footprint in the Southwest with a deal for Bridges: Educational Services for Children with Autism, based in Albuquerque, New Mexico.

ACES continued scaling its clinical model with the acquisition of the Center for Language and Autism Support Services in Tulsa, Oklahoma.

Private investment firm Comvest Partners completed a sale of D&S Community Services to The Mentor Network.

After relocating its headquarters to North Carolina from Wisconsin last year, Broadstep Behavioral Health, part of the Bain Double Capital Impact Fund portfolio, added to its 90-plus facilities with a deal for Excalibur Youth Services in South Carolina.

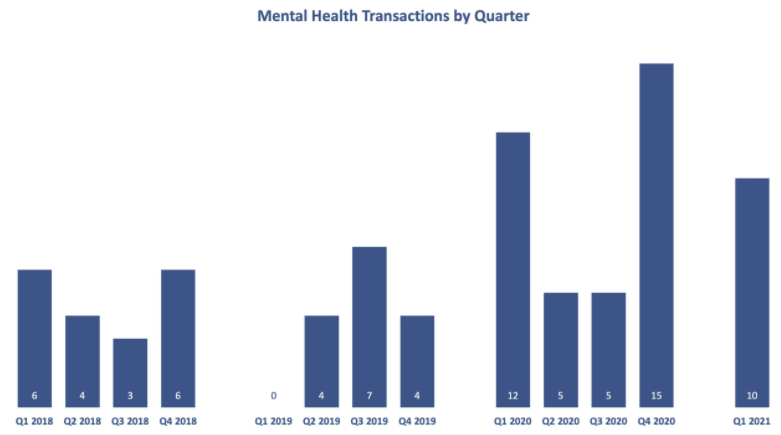

Although deals in the mental health sector dropped by 33% from Q4 2020, from 15 to 10, activity in this sector was still significantly higher than the second and third quarters of 2020. Moreover, demand for mental health services, much like the addiction treatment sector, is expected to be high in the coming months, as social isolation and anxiety resulting from the COVID-19 pandemic have exacerbated mental health conditions for many individuals.

Among the deals commenced in Q1, Marshfield Clinic Health System acquired Oswald Counseling Associates in Plover, Wisconsin, renaming the behavioral health practice Marshfield Clinic Health System-Plover Counseling Center.

Philadelphia-based outpatient practice CM Counsel was acquired by the investment and business development firm Centra Capital in a platform deal. Following the investment by Centra, CM Counsel formed a strategic partnership with Savia Community Counseling Services, an in-home care provider in New Jersey.

Two eating disorder programs, the Emily Program and the Veritas Collaborative, finalized a merger that allows the two brands to maintain their identities in their respective markets of Minnesota and North Carolina. Meanwhile, Nashville-based eating disorder program operator Odyssey Behavioral Healthcare acquired Shoreline Center for Eating Disorder Treatment, which operates multiple locations in Southern California.

Talkspace, a digital and virtual behavioral healthcare company, and Hudson Executive Investment Corp., an SPAC sponsored by Hudson Executive Capital, announced a merger, as well as plans to become listed on the NASDAQ as the first exclusively virtual behavioral health company to be publicly traded.

Mental health and wellness platform Modern Health reached a deal for mental health startup Kip, allowing the former to enhance its personalized care plans.

Adventist Health Vallejo, a 61-bed psychiatric hospital in Vallejo, California, was acquired by Acadia Healthcare.

Mertz Taggart is an industry-leading mergers and acquisitions firm specializing in home health, home care, hospice, and behavioral health.

This article was originally featured on Mertz Taggart’s Industry Insights publication.