Add-On Demand in the LMM: A Data-Driven Look at Buyer Activity

Most successful businesses adopt both organic and inorganic growth strategies. And add-on acquisitions remain one of the most widely used…

Business Services is a general term that refers to the incredibly broad and diverse business-to-business (B2B) economy – businesses dedicated to increasing the operating efficiency of other businesses. In a world where digital capabilities have become table stakes, the reliance on B2B service companies has only grown. Recent data from Statista revealed that the US B2B services sector is on pace to generate $550B of revenue in 2021, a 10% increase from 2017.

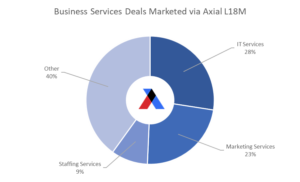

That growth in top line revenue closely mirrors the growth in B2B services M&A activity. Q4 2020 saw an 18% increase in B2B services M&A deal volume compared with Q4 2019, an encouraging indicator of prospective M&A activity to come. B2B services transactions also made up almost 20% of all deals brought to market via Axial over the last 18 months, with a majority of those deals falling into the IT Services, Marketing Services, and Staffing Services verticals.

In this report we profile 50 of the top business services-focused private equity firms and M&A advisors transacting in the lower middle market via Axial today (see below for detailed methodology on how we arrived at the list).

Click here to see the full list

We’ll also present an analysis of key trends in the B2B services space, supported by commentary from the following industry specialists and Axial members:

Like this report? It’s the fifth in an ongoing series (click here for the Software Top 50, here for the Healthcare Top 50, here for the Consumer Top 50, and here for the Industrials Top 50). Email us at [email protected] if you have questions, ideas, or additions.

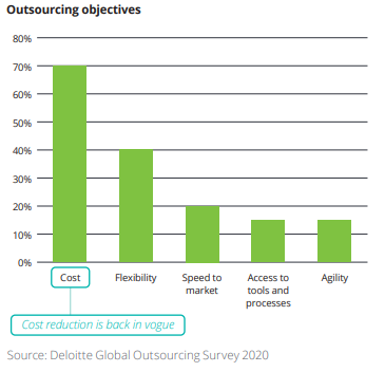

A recent Deloitte survey revealed that 70% of companies which leveraged outsourced services in 2020 did so to reduce cost. That’s in contrast with results from the same survey just two years prior, which listed “speed to market” as the number one impetus to outsourcing.

A recent Deloitte survey revealed that 70% of companies which leveraged outsourced services in 2020 did so to reduce cost. That’s in contrast with results from the same survey just two years prior, which listed “speed to market” as the number one impetus to outsourcing.

The almost ubiquitous focus on cost management over the last 18 months, combined with an increasingly positive sentiment towards outsourcing in general has fueled a rapid uptick in business services activity. B2B service companies who saw the writing on the wall in early 2020 doubled down on shoring up their product offerings in preparation for the impending influx of interest in outsourced services. “The B2B industry has largely been divided into the haves and have-nots over the last few years,” says Jim Russell, Partner at New Direction Partners, a business services focused investment bank and 2x Axial League Table recipient. “The haves continue to evolve with the industry by providing diverse digital capabilities to their clients. The pandemic has only increased that focus on product development, product stickiness, and providing an overall great service to customers at an affordable price.”

These converging digital tailwinds accelerated by Covid-19 have presented B2B companies with unprecedented optionality when it comes to financing growth. “The recent growth in the B2B space has allowed a lot of companies to leapfrog the SMB lifecycle stage,” says Nick Canderan, VP of Business Development at Chicago-based CIVC Partners, a PE firm with over $1.8B of AUM. “When you’re a young company experiencing 30-40% YoY growth, you have the luxury of choosing whether you’d like to sell your business at an attractive multiple, or continue to expand via self-funded growth.”

The high-growth potential of B2B businesses in today’s increasingly digital economy is just one of the attractive characteristics that have recently lured investors to the space. Others include the typical makeup of B2B balance sheets (cash heavy + asset/CapEx light), and, perhaps most importantly, the people component of B2B businesses. “The people nature of B2B service companies is both a major selling point and challenge for a lot of prospective buyers,” says Russell. “The industry tends to be very relationship oriented, which requires a different type of diligence process and transaction structure, which might include the business owner remaining involved post-transaction.”

Aside from understanding how dependent customer retention can be on an owner’s relationships, investors also like to understand employee retention at B2B service companies. “Assessing a company’s ability to manage human capital is a critical part of the diligence process in the B2B space,” says Canderan. “Understanding data like employee retention and processes around scaling human capital costs up or down depending on the workload at any given time will tell you a lot about a business’s prospects of succeeding. It’s almost impossible to achieve scalable growth if you’re experiencing issues like employee churn in a people-dependent industry like the B2B space.”

The operational success of B2B businesses has created tremendous competition for buyers targeting the space. Financial buyers interested in the return profile of fast-growing B2B businesses have had trouble outbidding the strategic buyers, who are generally focused on acquiring new capabilities and/or customers. Like in many other industries, the strategics have had the upper hand for the better part of 20 years now.

Few have had more direct exposure to this dynamic than James Johnsen, MD at Johnsen, Fretty & Co LLC, an investment banking firm with 30 years experience in the B2B media space. “Since the year 2000, in our very niche vertical of place-based media and out of home advertising, deals have traded at cash flow multiples ranging from 10-20x. That’s put a lot of financial buyers on the sideline for an extended period of time. Almost 70% of our deals are done with strategics for that reason.” Johnsen continued to explain how the pandemic shook up this decades old trend in the financial buyer’s favor. “When the pandemic hit, a lot of strategic buyers put a pause on acquisitions, creating an opening for financial buyers to get in the ring and buy their first platform. Once a financial buyer has a platform business, the lines get blurred between who is a strategic buyer and who is a financial buyer.”

Outsourced managed IT services companies were already in high demand as acquisition targets prior to the events of 2020. That demand skyrocketed alongside the work-from-home trend and all of the additional technical and security complexities that came with it. Managed IT service providers are especially crucial for SMBs according to Phil Bronsteatter, MD at Pfingsten Partners, a private equity firm who recently made an investment in the MSP space. “The technical competency of any small or medium sized business cannot be met by one or two employees – no single professional can be an expert in all areas of IT.” Bronsteatter continued, “customers are seeking a one-stop solution to handle all of their needs, including technical support, networking, business continuity, security, hosting, unified communications, infrastructure design and hardware/software.”

According to a recent report from Hampleton Partners, spending on cloud infrastructure grew by 37% in the first half of 2020, while expenditure on cloud services is projected to grow by 18% to $305B in 2021.

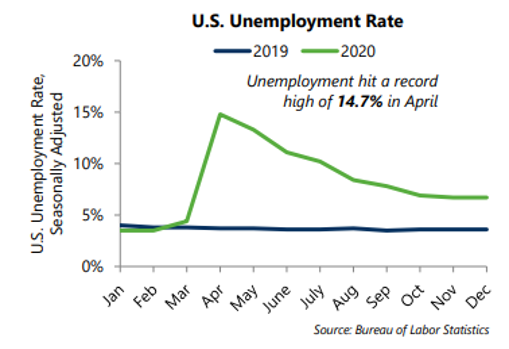

Similar to the increase in IT requirements, businesses have relied heavily on outsourced staffing businesses to meet their increasingly complex employment needs. One of the most immediate and harsh side effects of the pandemic was a soaring national unemployment rate, which reached 14.7% in April of 2020.

Similar to the increase in IT requirements, businesses have relied heavily on outsourced staffing businesses to meet their increasingly complex employment needs. One of the most immediate and harsh side effects of the pandemic was a soaring national unemployment rate, which reached 14.7% in April of 2020.

When businesses began to reopen in Q3 and Q4 of last year, companies serving defensible end markets (such as healthcare and IT) immediately resumed hiring. Demand for staffing businesses specializing in those end markets rose accordingly. Nick Canderan commented, “The demand for technical talent at so many different types of firms is massive right now, and growing. That demand protects IT staffing for the most part from volatile economic cycles. Regardless of what’s happening, the need for IT expertise will likely outweigh any setback in economic activity.” Investors have specifically targeted staffing firms focused on supporting the remote workforce, and mission critical end markets like information technology and nursing / ICU workers. According to a Capstone Partners HR & Staffing report, EBITDA multiples for staffing firms have already surpassed pre-pandemic levels.

The continued growth of e-commerce and social media-based sales have paved the way for a new generation of digital-based marketing and advertising companies. “Advertising has become much more targeted over the last 20 years,” explains James Johnsen. “The companies who are able to most granularly define their target audience are the ones who will have the most success leveraging today’s digital-first advertising solutions.”

Businesses have significantly increased their expenditure on digital marketing and advertising accordingly, with some reports projecting the US digital marketing software market to reach $159B by 2027 with a 17.7% CAGR. The tremendous growth in marketing services has attracted both new and existing buyers to the space, who are willing to pay a premium for the best assets.

The last 18 months has been a perfect storm of sorts for the business services industry. The work-from-home movement, combined with pandemic induced cost cutting measures, opened the door for specialized, outsourced service providers to step in. Businesses in the space have benefited tremendously in the form of rapid growth and unprecedented financing opportunities.

To conclude, we’re excited to present Axial’s 2021 Top 50 Business Services Investors and M&A Advisors, whose work both advising and partnering with B2B services business owners deserve recognition.

Axial’s Top 50 Business Services list was generated based on a weighted formula leveraging private transaction data from the Axial platform. Metrics in the formula include the number of business services deals brought to market via Axial (sell-side), how much interest those deals generated from Axial’s buy-side member base (sell-side), the number of specific business services-focused investment mandates created in the platform (buy-side), and the number of business services deals that progressed through the deal funnel achieving an executed LOI or successfully consummated transaction (buy- & sell-side).

Axial is the trusted deal platform serving the lower middle market ($5-$250M TEV).

Over 3,500 advisory firms and 1,800 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.

Email [email protected] to learn more.