Small Business Exits: M&A closed deal data

Welcome to the October edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

Macroeconomic headwinds have hit M&A activity hard this year. Geopolitical tensions, inflation, and pandemic-related supply chain challenges continue to stymie deal activity. Per PitchBook’s latest figures for 2022, North American M&A extended its quarter-over-quarter decline in deal value and volume, with 4,571 transactions closed that generated some $547.7 billion in aggregate value. These results represent a fall from Q4 2021 results by 30.2% for volume and 37.6% for value.

But as we’ve noted, one corner of the M&A market has bucked this trend so far this year, thanks in no small part to the lower middle market’s resilience and relative value. Macro-level uncertainty has played to the strategic advantage of investors leaning into uncertainty and volatility to find attractive growth prospects for their portfolios. In particular, disruptions to supply chains have presented reshoring or supply-chain consolidation opportunities for small businesses able to capitalize on them.

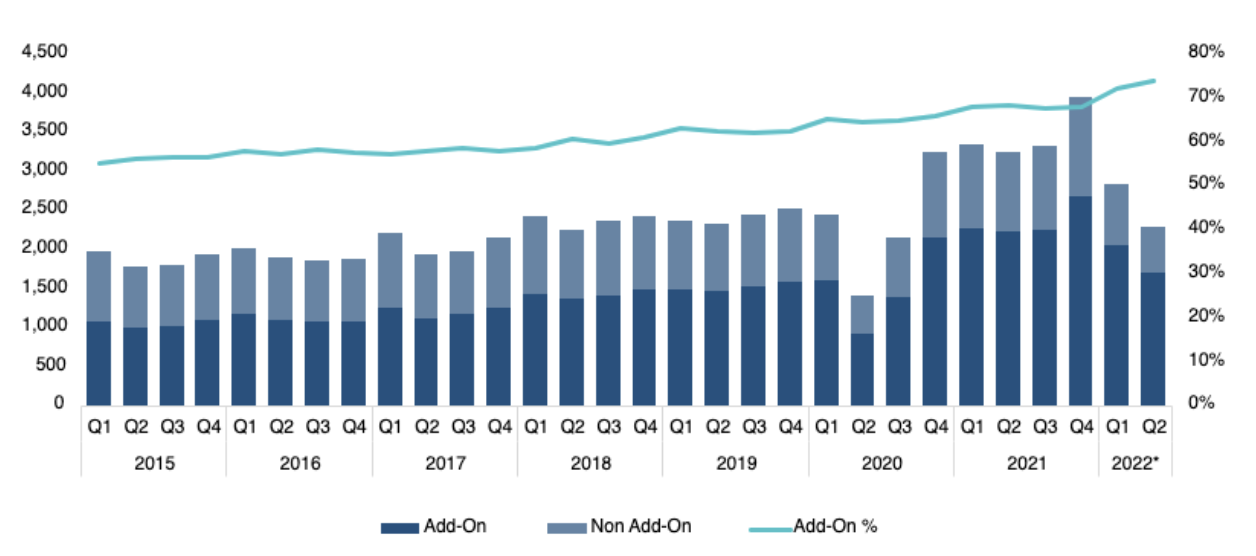

As a result, add-on activity backed by financial sponsors has remained as strong as it has ever been of late. This development reflects the larger appetite of investors for targets in the industrials and manufacturing sector.

The strength of the LMM’s fundamentals has proven itself out as a consequence of this momentum across verticals. As Axial’s latest Lower Middle Market Pursuits report reveals, the first half of this year represented record-breaking deal activity in terms of new targets brought to market and the number of buy-side mandates initiated by prospective acquirers. For instance, sell-side activity on the Axial platform — a proxy for North America’s LMM — expanded by 8% during the opening six months with 4,990 new sale processes initiated. Meanwhile, buy-side activity swelled by almost a third year-over-year.

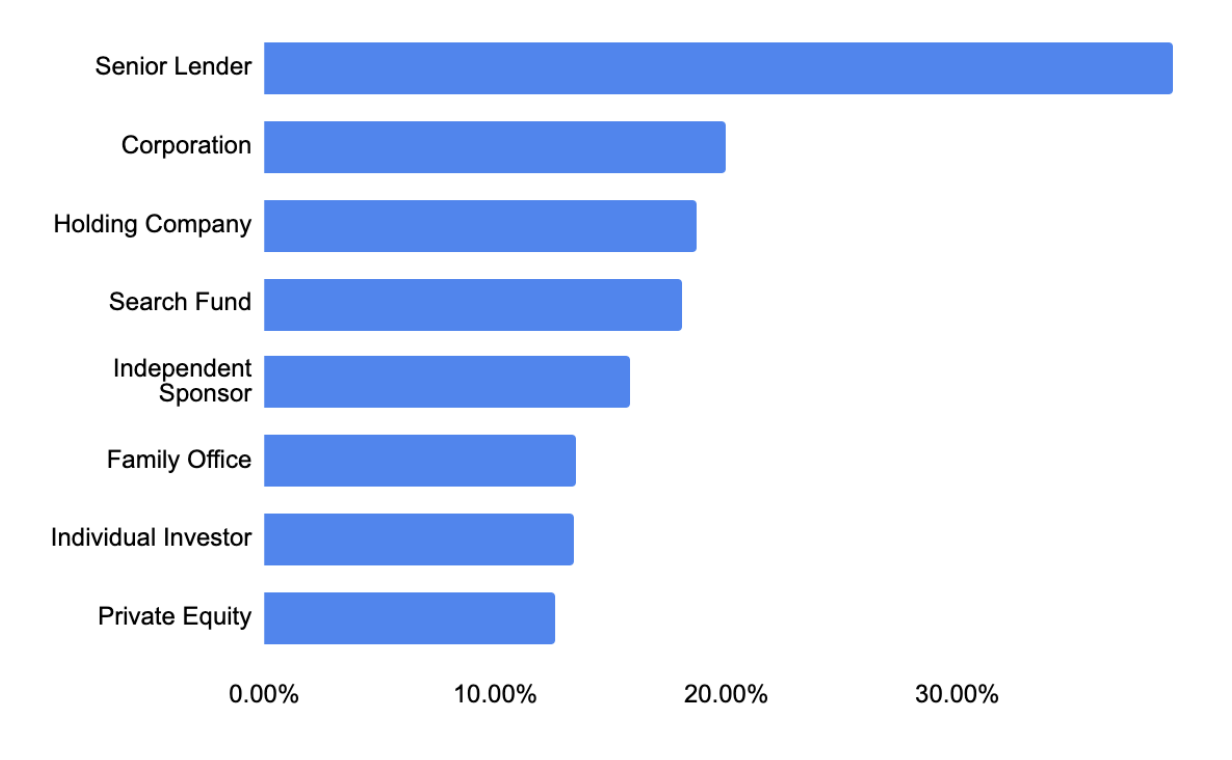

In this environment, holding companies have emerged as a significant driver of LMM consolidation and a peer to both strategics and financial sponsors. On the buy-side, the proportion of activity attributable to holding companies grew over last year in line with wider trends. And holding companies represent one of the highest pursuit rates tracked by Axial.

But before tucking into the numbers further, a necessary caveat: deal activity conducted and tracked via Axial does not represent a comprehensive record of all LMM transactions. Rather, with thousands of active members using the platform, Axial’s dataset captures the drivers of dealmaking in this vibrant corner of the private capital markets.

Moreover, corporates and holding companies close deals at a comparable pace with around a 10% completion rate, per Axial data. This competition for deals has helped to accelerate innovation among holding companies. Likewise, doing deals in a volatile market has deepened the distinction between asset trading from investing in an operational business. Principally, a holding company is a company that owns shares in other companies. But controlling an entity outright and taking a small stake are two different things.

As a result, holding companies may be organized for different reasons, including to manage a group of companies as a single entity, to provide financial or managerial support to portfolio companies, or to make investments in new businesses. And diversification across LMM strategies has flourished as a result.

In recent years, though, an increasing number of holding companies are making acquisitions and taking controlling stakes in portfolio companies. There are several reasons why holding companies have become more active in the M&A market. First, holding companies can provide significant financial resources to help their portfolio companies grow and scale. Second, holding companies can offer operational and managerial support to help portfolio companies improve their performance. Finally, holding companies can provide access to new markets and customers.

That’s all accomplished by some without taking on capital allocated by limited partners, which is really where the differences with traditional private equity fund structures and investment practices differ.

“We’ve witnessed a major expansion in the number and types of holdcos over the last decade,” Emily Holdman, managing director with Permanent Equity, has observed. “Those with a strategic, patient approach to an industry seem to be scaling particularly well, and are positioned to take on opportunities in need of immediate, active intervention with lower-risk methodologies.”

Likewise, Kelcey Lehrich, partner and CEO with 365 Holdings, has remarked that holding companies have evolved considerably of late in response to network effects facilitated by technology.

“Today there are hundreds, maybe thousands, of entrepreneurs intentionally building groups of small businesses (aka HoldCos) as an intentional career path,” Lehrich has observed. “Many of those entrepreneurs are connecting via online communities and social networks and consuming media from a small group of thought leaders curating content in the form of newsletters and podcasts.”

In short, companies are hardly a uniform bunch. Lehrich finds far more diversity than similarity among holding companies—with unity reflected in shared challenges.

“It seems as if no two HoldCos are alike, and yet they all face the same challenges: finding, financing, and operating deals,” Lehrich has observed. “The vast majority have an orientation of holding for long term cash flow vs. the traditional private equity buy-and-flip model. Many start without outside capital and bootstrap with SBA funding.”

The ability to provide financial, operational, and managerial support to portfolio companies has put holding companies in a strong position to help small businesses grow and scale thanks in no small part to holding company access to new markets and customers to fuel consolidation across the LMM.

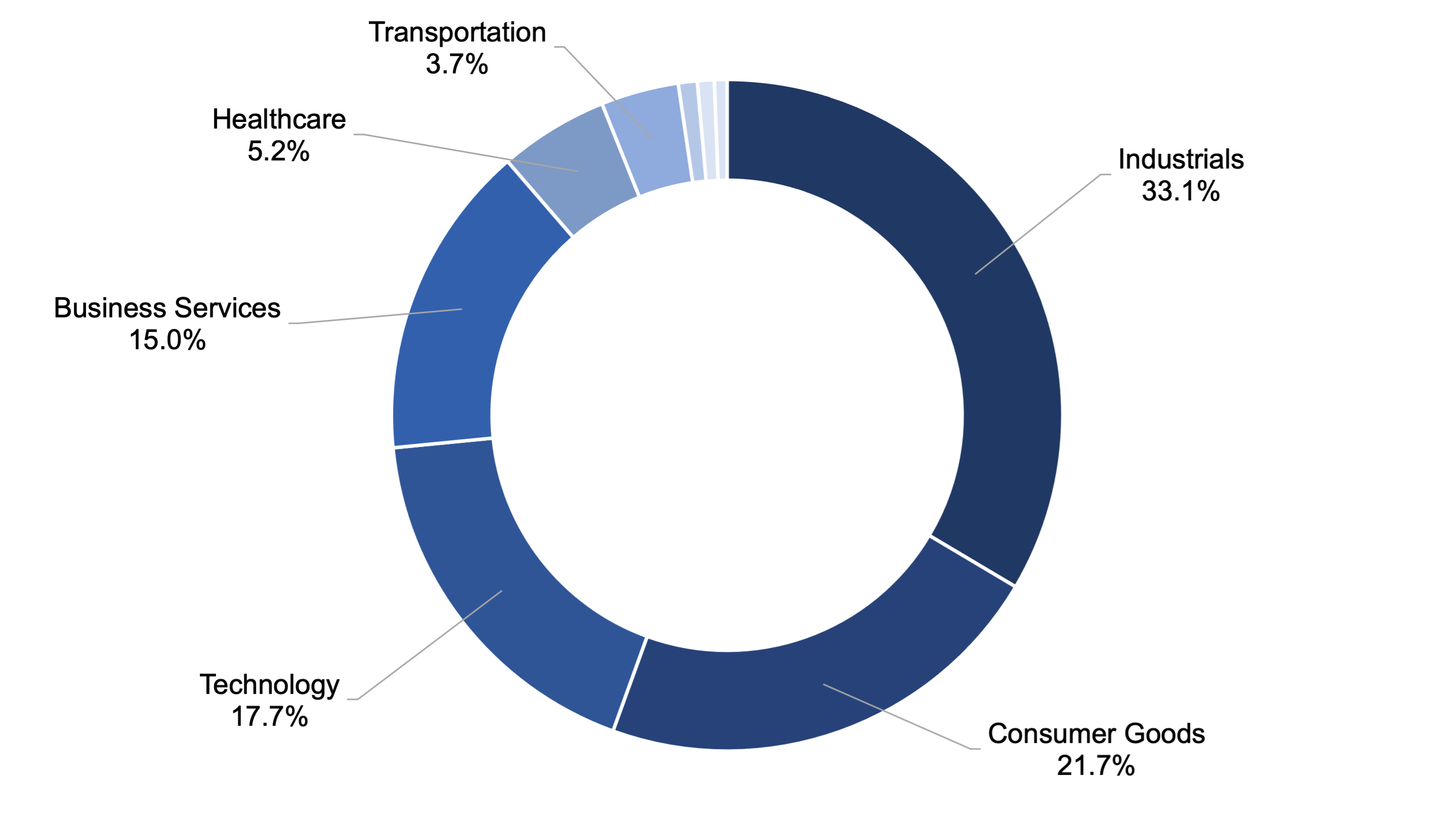

The strategic activities of corporates and holding companies was disproportionately higher in industrials than most others, accounting for 20% of all new mandates in the first half of 2022. Combined with consumer goods, the preponderance of holding company pursuits focus on these sectors. But another third of pursuits has focused on business services or technology:

“With pressures on materials, logistics, warehousing, and labor, goods-related businesses are taking the biggest hit right now,” Holdman has observed. “Conversely, the enthusiasm for asset light and recurring revenue software and services continues to grow among seemingly all investor types.”

Likewise, Lehrich notes that a trio of related challenges confront holding companies going forward informed by recent survey data:

With these considerations in mind, it would nevertheless appear that holding companies remain poised to reap a greater share of the benefits as M&A markets emerge from recent macro-level displacement.