Building an Effective Teaser: Insights From Axial Investors

In lower middle market M&A, the teaser is often the first introduction a potential buyer has to a company. This…

Business brokers have become more active within the private markets, almost doubling in number over the past decade. Their role in mergers, acquisitions, and overall investment activity has also expanded. And the deals they execute run the gamut — from medical billing, property management, or commercial cleaning operations to electrical contractors, medical offices, law firms, urgent care, or senior care facilities. They also include e-commerce sites and Amazon storefronts, software companies, digital marketing firms, internet registrars, or hosts.

To classify business brokers as such, Axial employs the following criteria:

1) Deals are listed on a public website (their own or external)

2) Are affiliated with a broker franchise or self-identify as a business broker

3) Work on Mainstreet deals (i.e., single location mom-and-pop shops)

Since the start of 2017, business brokers have brought to market 19,828 deals via the Axial platform. Thus far this year, business brokers have already added 3,130 deals to the pipeline — 15.8% of all deals brought to market over the past five years and 27.1% more than the full-year results for 2017. With these prospects spanning the LMM, the recent surge in business broker activity illustrates its diversity as well as its concentration by vertical and geography while underscoring the strengths of its fundamentals.

As a result of this rapid expansion, business brokers have played an increasing role in facilitating transactions and connecting buyers and sellers across LMM sectors — helping business brokerage expand to a $1 billion+ industry in its own right.

And as the intermediary between parties of all types, business brokers can offer small business owners a wide-ranging perspective on market trends and can help identify potential growth opportunities.

“The best brokers are able to bring two strangers together, build the necessary trust and get the deal to close,” David Jacobs, a broker with the technology group of Zoom Business Brokers, has observed. “Most of what I do is coaching my sellers to appreciate the perspective of the buyers. This enables the seller to work collaboratively with the buyer to get a deal done.”

Before joining Zoom Business Brokers, Jacobs marketed seven deals, with 619 total recipients and 79 total pursuits. His total deal count since 2019 stands at 12 deals marketed overall with 956 total recipients and 100 pursuits. And the deals that Jacobs has marketed via Axial cover the technology, business services, and manufacturing sectors. Thus far this year, he’s closed one deal on Axial — a transaction that wrapped up not long before he joined Zoom this summer.

For its part, Zoom has marketed four deals via Axial since joining earlier this year, with 609 total recipients and 42 pursuits. These deals have been in retail & e-commerce, manufacturing, and telecom.

Florida leads California, Texas combined

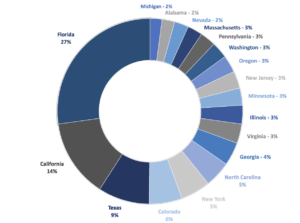

Axial’s data on business broker-led deal activity across the LMM reveals some tangible geographic trends taking shape since the start of 2017. Over this period, Florida has represented the source of 18.7% of all business broker-assisted deals brought to market, with California, New York, and Texas accounting for another 23.6% in aggregate.

Likewise, a fifth of all mandates this year have been sourced from Florida alone. But other historically active states have fallen off pace in 2022, with 10.5% for California and 6.9% for Texas — both of which boast sizable populations, dynamic economies, and considerable LMM deal activity overall. However, similarly sizable, dynamic states with otherwise considerable LMM deal activity like Illinois or New York rank thus far alongside the likes of Colorado and Georgia.

Per Axial’s data, business broker-assisted deals coming to market in 1H 2022 represent M&A targets with median revenue of $1.4 million and median EBITDA of $312,502. But these figures lag those for the past five years inclusive of 1H 2022 — and not inconsiderably. Looking at the same Axial data set starting in 2017, business broker-assisted deals represented a median revenue of $2.2 million and a median EBITDA of $410,000.

Sector specialization is another tangible trend across Axial’s data on business broker-led deals. Often, brokers focus on particular industries or lean on prior experience as small business operators in their own right to connect a seller with an appropriate buyer at a fair price to get a deal done. Likewise, sector discipline is essential to facilitating the types of add-on deals that drive much business broker activity across the LMM. “We have had tremendous success with a buy-side broker that has sourced the majority of our deals,” Elliot Luchansky, president of Airiam Ventures, has observed. In an integrated space like [Managed IT and Managed Cybersecurity Services], the process of sourcing add-ons and smaller-platform-sized transactions is a mix of a brute force numbers game, coupled with clear industry specialization that earns credibility, and a deep network within the space that includes many prospective targets that multiple brokers have been in discussions with for years.”

Broker trends consistent with overall deal activity in 2022

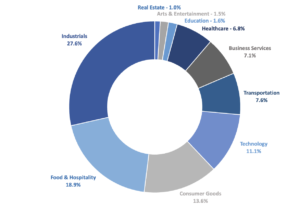

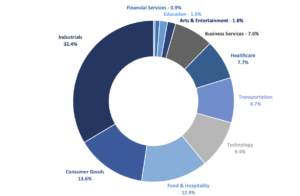

The industrials space commands the greatest share of mandates in broker-assisted LMM deals currently in the market. This result falls squarely in line with the trend taking shape since the start of 2017, as some 32.4% of all broker-assisted deals on Axial have come to market from industrials. That status is also consistent with wider LMM trends of late, as the manufacturing, industrials, and construction markets are commanding the lion’s share of attention from prospective buyers at the moment.

But the combined interest in deals for companies operating in tech or business services cannot be understated going forward. Beginning in 2017, mandates for tech companies have comprised 9.4% of all broker-assisted deals brought to market, with business services contributing an additional 7.6% while still lagging behind other sectors.

It remains clear that the fallout from the COVID-19 pandemic continues to disrupt the food & hospitality sector. The industry was hit particularly hard by lockdown measures taken to combat the spread of coronavirus, and it continues to see historically elevated mandates at 18.9% for this year compared to 12.9% since the start of 2017 inclusive of 1H 2022.

Broker trends for 1H 2022 demonstrate the pandemic’s lasting impact on food & hospitality

“My focus is on software and service-based businesses. Many of these businesses did well through COVID. With the opportunity for travel opening back up, the sellers are beginning to consider moving forward with retirement plans,” Jacobs has observed. “Also, the tightness in the labor markets is benefitting some of the recruiting and staffing companies that can effectively supply technology to increase productivity. I see many potential acquisitions being driven by the more sophisticated players in order to achieve scale.”

Secular trends confirm that the role of brokers will continue to remain impactful to the overall health of the LMM ecosystem going forward: