The Winning M&A Advisor [Vol. 1, Issue 4]

Welcome to the 4th issue of the Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

Preparing a business for sale should begin more than two years before your ideal exit date.

There are two key benefits to starting this process early:

First, it allows you to gain clarity on why you want to sell and determine whether it’s the right time to begin the lengthy, complex process of selling your business.

Second, you’ll have the time to develop a strategy to make your business “exit-ready,” more attractive to potential buyers, and assemble the team of experts needed to navigate the M&A process successfully.

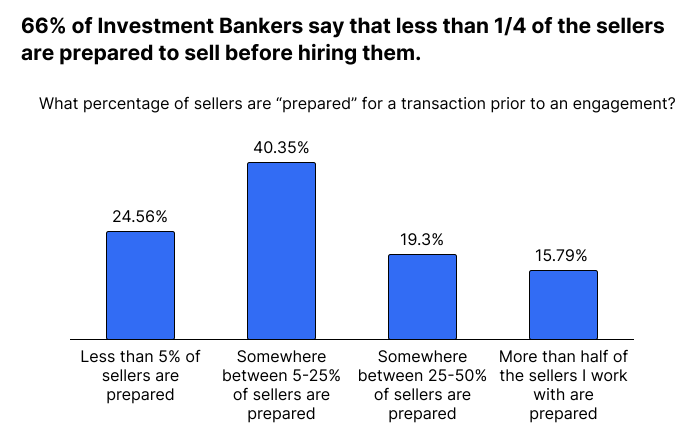

However, when we recently surveyed Investment Bankers within the Axial network about exit preparation, 66% of respondents said fewer than 1 in 4 of businesses that reached out to them were properly prepared.

To help businesses like yours, this post breaks down the process of preparing a business for sale into three phases:

At Axial, we have over 14 years of experience in small business mergers and acquisitions. We connect business owners with M&A advisors from our unrivaled network of over 2,000 firms to help them secure the smoothest exit at the best terms. If you’re ready to start working with an M&A advisor, we can recommend 3–5 professionals that have experience in selling businesses like yours.

Exit planning is the foundation of a successful business sale. This phase begins by clearly defining your motivations for selling, optimizing business operations, and establishing a clear transition plan.

However, despite the importance of exit planning, Investment Bankers we recently surveyed reported that very few business owners were “prepared” when they first reached out to begin the process of selling their business.

With this in mind, let’s take a detailed look at the preparations to consider while planning your exit:

One respondent to our Investment Banking survey, Chris Perfect from Concept and Perspective, views motivations and goal-setting as foundational to the exit planning phase. He defined the key task as follows:

“Develop your waterfall and think through what your true number is.”

Your “true number” is shaped by your reasons for selling, the funds needed to sustain your lifestyle post-sale, your vision for the business’s future without you, and your ideal timeline.

This number can vary depending on your circumstances. For instance, your number for an urgent exit due to health challenges may differ from one with a more flexible timeline, where you can focus on maximizing your exit value.

Whatever your motivation, it’s important to define it and solidify your commitment to selling. Buyers can tell if sellers aren’t fully committed to exiting their business. In such cases, they’re likely to walk away rather than risk wasting their time. Confirming your commitment to selling is vital for planning a successful exit.

Involving your family in the exit planning phase, if possible, is equally important. Openly discussing your reasons for selling and your objectives for the sale ensures everyone is aligned and prepared for the changes ahead. This fosters a smoother transition by reducing potential conflicts and helping the family adapt to shifts in time, energy, and focus.

During exit planning, you’ll proactively ensure that your company is operationally ready to withstand the questions buyers may ask during due diligence, including:

As you prepare your business for sale, work alongside a lawyer or accountant to resolve as many of these issues as possible before starting the M&A process. You’ll find more information on these key people in your deal team in the next section.

A business with a wide, healthy customer base is a more attractive prospect for buyers. As you prepare for your sale, focus on maintaining or expanding your customer base.

In particular, buyers are likely to be cautious about:

Key person dependencies — where a large portion of the business’s value is tied to one individual’s expertise, experience, or network — are a significant red flag for potential buyers. Exit planning should include creating a clear plan to eliminate these dependencies.

In fact, our survey respondents emphasized that resolving key person dependencies is one of the most important steps for a business owner preparing to sell:

Develop a succession plan identifying key employees who can step into leadership roles. Begin discussions with these individuals early in the exit planning process and provide the necessary training to ensure they can run operations smoothly during the transition.

Selling a business is rarely successful without a qualified team. There are many moving parts, and the sale requires expertise that most business owners don’t have in-house.

In our experience, business owners who try to manage the sale alone spend about 30+ hours per week on the process. It’s a major time commitment that can be avoided with the right team.

Working with M&A professionals, lawyers, and accountants who specialize in business sales is crucial. Even if you have a trusted accountant, they may not have the specialized experience needed for a complex business transaction.

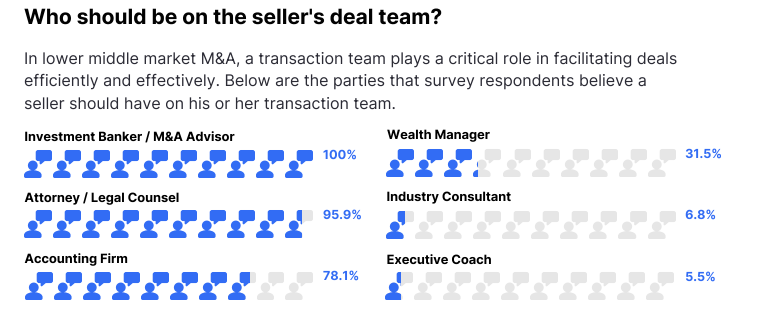

You’re more likely to sell your business successfully and at a better price when your deal team includes:

An M&A advisor can manage several processes as you prepare your business for sale and engage with buyers. Their role focuses on maximizing the value and success of your sale through:

Your advisor will also be there to answer your questions and explain the process, making it beneficial to connect with one early in your exit timeline.

We recommend researching and shortlisting advisors around 18 months before your ideal exit date and hiring one 15 months out. While advisors are often seen as negotiators who step in once you engage with buyers, they can also help stress-test your goals during exit planning to assess their feasibility and review your strategy for achieving them.

One respondent to our Investment Banking survey, Matt Slawson of Next Level, aptly stated:

“Engage an advisor in advance to implement the best plan and practices for the best future results.”

Finding the right M&A advisor can be challenging. You need someone who is not only professional and experienced but also has relevant expertise in selling businesses like yours. This niche experience can be hard to find on your own.

At Axial, we specialize in connecting business owners with M&A advisors for their exit.

Our process begins by pairing you with an Exit Consultant who understands your business and your specific exit goals.

Next, we tap into our network of over 2,000 M&A advisors to identify the best matches for your goals, business type, and industry.

We evaluate the options in our network based on:

1. Relevant Deal Experience

2. Down Funnel Success

3. Professionalism & Reputation

We send you a curated list of 3–5 highly qualified and vetted advisors, along with detailed insights to help you evaluate each one.

The final interview process is efficient, as you’ll be speaking with top-tier advisors. Additionally, your Exit Consultant will be available to help navigate any nuances as you make progress on identifying and hiring the best partner.

If you’re ready to get started, you can begin the process here.

In addition to an M&A advisor, your ideal deal team should also include:

The attorney handling your business transaction is essential to its success. Business sales are legally complex, requiring extensive review of documents such as Letters of Intent (LOIs) and the purchase agreement.

While you might not engage with your attorney extensively during the initial sale preparation, they’ll play a vital role later in the process. They’ll help you navigate hurdles, keep the sale on track, and offer legal advice on structuring the final deal.

In our survey, 95.9% of respondents identified an attorney as a key member of the deal team.

The accountant on your deal team ensures that your business follows standard accounting processes, conducts a Quality of Earnings analysis, and prepares your financials for the due diligence process required in selling your business.

78.1% of our survey respondents believe a dedicated accountant should be part of the deal team.

As they prepare the necessary financial statements, an accountant will clean up your records and ensure they comply with generally accepted accounting principles. Non-standard accounting practices can raise red flags for potential buyers, making it crucial to address this early in the process.

It’s vital to work with a skilled business accountant who can review your company’s finances thoroughly at this stage.

Once your exit plan is in place and your deal team is hired, you can start the M&A process and focus on connecting with or attracting buyers. However, it’s important to remember that, in reality, the M&A process typically begins around 12 months before your ideal exit date.

At the start of the M&A process, your advisor will conduct a valuation. Some businesses may get a valuation earlier, during the exit planning phase, to identify areas for improvement and optimize company value.

Even if you’ve already had a valuation during exit planning, an M&A advisor will conduct another one to assess how the valuation may have changed based on any operational improvements you’ve made.

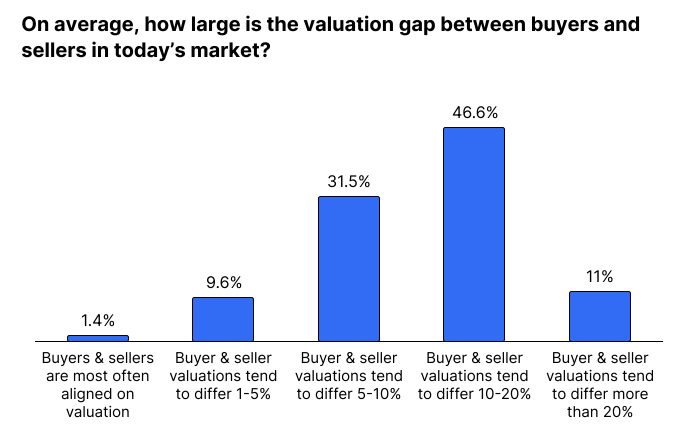

Our survey shows there’s frequently a discrepancy between the seller’s valuation and the one from the buyer and their team.

56% of respondents indicated that valuations are misaligned by 10% or more.

Situations like this led many respondents to emphasize that knowing and understanding your valuation is the most important step a seller can take to ensure a successful transaction. Warren Rose of Groce, Rose & Moore advised sellers to:

“Know your valuation ahead of time and be transparent and prepared to answer tough questions.”

In addition to understanding your advisor’s valuation range, it’s essential to understand how they’ve calculated your business’s EBITDA, how they’ve compared your company to similar businesses recently sold, how they’ve assessed the value of your intellectual property and inventory, and how they’ve projected your company’s future value.

When you can answer these questions — and support them with financial records — you’ll have the watertight valuation needed for a successful sale.

The next step is finding buyers.

How you approach this depends on the goals you set when you first planned your exit. For instance, if your primary goal is a high-value sale, you might focus on attracting strategic buyers. Strategic buyers, such as competitors, are looking to absorb your business and operate it under their own brand. They often offer a high price for the opportunity to acquire your products/services and customers.

On the other hand, if your goal is to find a trusted steward who can continue growing your business, you’re more likely to target financial buyers. These buyers typically retain your company and brand, running it as a standalone entity.

In discussion with your M&A advisor, you can decide the best way to find these buyers:

Whichever strategy (or combination of methods) aligns with your goals, the size of your business, and the current market conditions, your advisor will also prepare key materials to engage with buyers. This includes the:

Once buyers begin expressing interest, negotiating deal terms can become a complex and often drawn-out process. Your M&A advisor will manage and assess inquiries from multiple potential buyers while still providing initial information to new leads.

In its simplest form, the sequence of finding and vetting serious buyers follows a clear track:

An IOI is when a potential buyer expresses interest in learning more about your business.

At this stage, your M&A advisor filters out any interest that doesn’t align with your ideal terms or from buyers showing signs of being “tire kickers” (those not seriously considering making an offer).

An LOI signals the emergence of a serious buyer. While LOIs are non-binding, they serve as an initial offer, outlining the buyer’s proposed purchase price. If you receive multiple LOIs, you’ll review and compare them with your advisor, who will help you weigh the benefits and challenges of each offer. They’ll focus on the purchase price, payment structure, contingencies, and transition period to guide you toward the best option based on your exit goals.

When you select an LOI that aligns with your objectives, you formally agree to the outlined terms, allowing both parties to proceed with due diligence. Ideally, aim to execute an LOI about six months before your desired deal closure.

After the LOI is signed, both the buyer and seller conduct due diligence before finalizing the purchase agreement. You’ll provide the data requested by the buyer (typically the detailed records from the exit planning phase) to your M&A advisor, who will manage the flow of information to keep everything on track.

During this stage, you may face in-depth questions from the buyer, and your advisor will help prepare you by explaining the motivations behind those questions. An in-person meeting with the buyer may also take place during an on-site visit.

Meanwhile, your advisor will conduct their own due diligence to ensure the buyer has the necessary capital to fund the transition. Though both parties are committed at this stage, they are also focused on protecting their respective interests.

Your advisor will negotiate the final terms of the sale, including:

These terms, along with any necessary contracts, will be included in the purchase agreement.

Once the sale is closed, your role as the business owner shifts to facilitating a smooth transition for the new owner, employees, vendors, and clients.

When you’re asking, “How do I prepare my business for sale?” it’s clear you’re focused on your exit. But to bring that goal closer and improve the outcome, you must continue working on your business.

Even after assembling your deal team and receiving offers from potential buyers, your business must continue to run smoothly and maintain its growth trajectory. If you shift your attention away from day-to-day operations and performance dips, it could make your business less attractive to buyers and jeopardize negotiations.

Akash Taneja from Momentum Advisory Partners told us that the most important thing a seller can do to prepare for a transaction is to:

“Have a solid runway ahead of them for revenue growth. Any hiccup in revenues that occurs during negotiations or diligence often undermines the process since it adds to the buyer’s anxiety.”

Along with other reasons for failed transactions — such as lack of formal planning and unclear goals — business owners should understand that losing focus on business performance is a significant obstacle to a successful sale.

As you work through the stages of preparing your business for sale, here are some helpful resources we’ve created:

We’ve also created a resource center for business owners preparing for sale, featuring guides on finding the right M&A advisor, key questions to ask during interviews, and more.