Who Will Buy Your HVAC Business?

If you’re an HVAC business owner thinking about selling—now or down the road—one question you might have is: Who will…

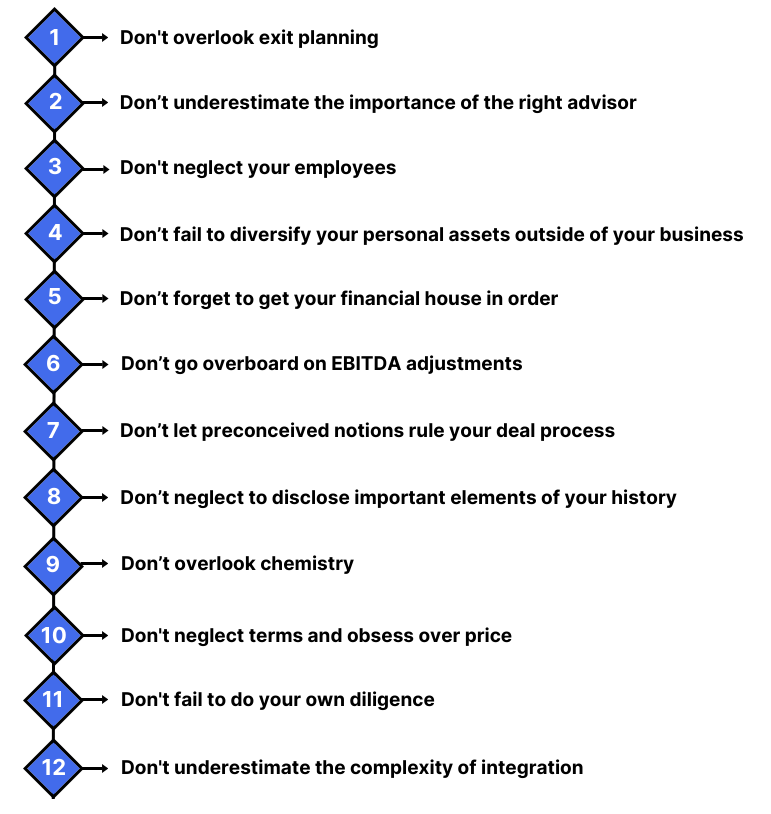

For most business owners, exiting their business is a once-in-a-lifetime event. It’s also an inherently complex process. Though every transaction is different, there are several common mistakes that owners can, and certainly should, avoid.

We compiled advice from investment bankers, investors, and business owners who have navigated through various transactions.

Below are 12 key tips on what not to do during an M&A process. To dive deeper into each section, you can download the eBook by entering your email below.

Preparing for a succession event significantly influences the financial success of the transaction. Despite the evident need for a succession plan, many fail to create one.

First, there is often a perceived urgency of day-to-day operational demands over “long-term” planning. Second, more often than not, leadership hasn’t been through a succession event and lacks the knowledge and experience of how crucial developing a plan can be.

Not all succession plans are equal; a well-developed one can ensure success, while a poorly designed plan can lead to failure. An effective plan should consider the interplay among business, ownership, and family, aligning with goals and addressing contingencies, gaps, and opportunities.

3 REASONS YOU NEED AN ADVISOR

The Advisor Finder program guides business owners through the M&A Advisor identification, interview, and hiring process. Leveraging 10 years of behavioral data and relationships on the Axial platform, we help you choose the right advisor for your business. Get started here.

When it comes to maximizing valuation before a transaction, there are countless strategies that business owners can implement. One of these strategic discussions is employee engagement.

Company culture is key.

Be sure people are connected to the mission and vision of the company and understand why their contributions are valuable and how they help drive the business forward. Not only will this help with retention, morale, and overall culture, but it will ultimately maximize your business’s value.

3 WAYS TO REDUCE YOUR DEPENDENCE ON YOUR BUSINESS

Getting your financial house in order is crucial to positioning the company well in the market, improving the company’s valuation, and running a smooth deal process.

3 THINGS TO KEEP IN MIND

Gaps in valuation expectations are an extremely common roadblock for M&A transactions. One way to avoid disputes in purchase price is for sellers to double and triple-check that all adjustments to restated EBITDA are appropriate and supported through proper documentation.

Conducting sell-side due diligence – which usually covers financial statements, taxation, information systems, and operations – is another way to ensure that EBITDA add-backs are appropriate.

To dive deeper into sell-side due diligence, check out the two resources below.

Sell-Side Quality of Earnings & The Benefits For Business Owners

Due Diligence and the Art of Preventing the Broken LOI

One commonality many business owners share is their preconceived notions surrounding the “right” buyer for their business.

Statements like the ones above can be relatively common and are all extreme generalizations. While a strategic buyer may be great for one business, an independent sponsor with niche operational expertise may be right for another. And while family offices can be fantastic partners, so can private equity firms.

It’s best to keep an open mind regarding contract terms, deal tactics, or anything else.

In today’s market, diligence processes are more comprehensive than ever, and if a good buyer is on the other end of the deal, nothing will go unearthed. It’s not enough to disclose what is essential, but to take stock of everything and anything that could accidentally be omitted.

Disclose everything. And then go back and double-check.

Every business owner wants the perfect fit when it comes to finding a buyer or growth partner. While financial considerations are important, the chemistry between the founder and buyer may be the most crucial indicator of a successful partnership.

The company and future partner must understand how each other functions and how to complement one another. Compatibility can be elusive and hard to quantify, so getting face-to-face time in today’s digital age remains so important.

It’s not worth it to maximize valuation at the expense of terms. Here are a few areas to focus on when evaluating the terms of a potential deal:

Earnouts, for example, are often a great solution to bridge valuation gaps and bring the buyer and seller to a middle ground. Good earnouts incentivize the people running the business to bring it to the next level. However, earnouts are not guaranteed, and sellers who take an earnout should be sure they understand exactly what it entails.

Be open to terms, but fully understand them before committing.

Integration can be the most difficult part of an inherently challenging process. Even when changes are for the better, they still need to be anticipated.

To ease the integration pains, focus on communication and transparency to ensure everyone is aligned on dates, timelines, and responsibilities. Not only will this help maintain a smooth transition, but it will quell uncertainties for the employees and make everyone more comfortable with the new chapter ahead.

To download the 12 Things Not To Do In M&A eBook, please enter your email below.

NOTE: This information does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only.

Notifications