Advisor Industry Awards: The Top 12 Deals of 2024

Axial first introduced quarterly League Tables in 2019 to recognize the top Investment Banks and M&A Advisory Firms on Axial…

Tags

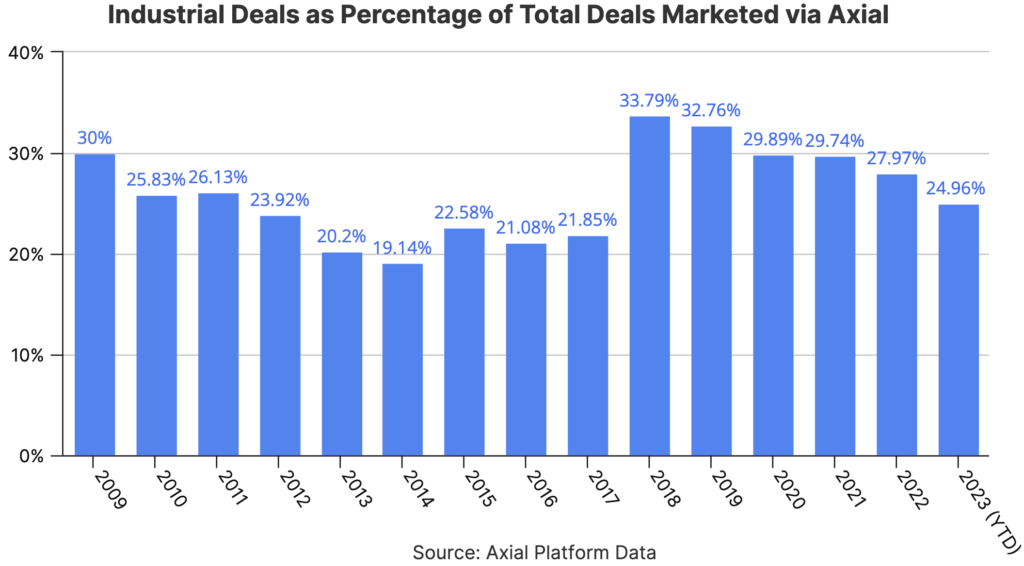

For many years, the Industrial sector has served as the driving force of lower middle market M&A. On Axial’s deal origination platform, it has accounted for the highest volume of deals each year, representing anywhere from 20% – 34% of total annual deals since 2009.

Encompassing a wide range of sub-sectors with a significant volume of small and medium-sized enterprises, the sector has been ripe with opportunities for consolidation through M&A activities.

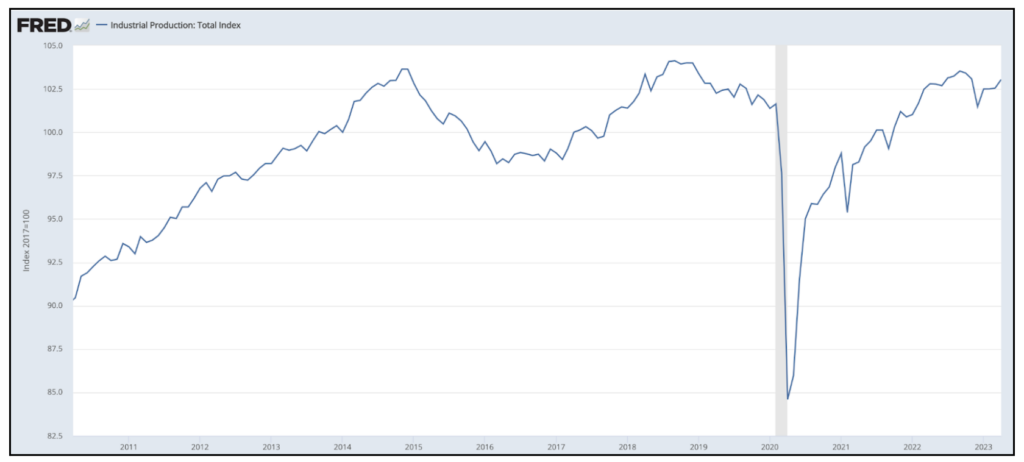

Then came the COVID-19 pandemic, resulting in economic uncertainty, supply chain disruptions and labor shortages, creating production interruptions that were difficult to sidestep.

After a few years of hardship, the sector has recently reverted back to pre-pandemic production levels. This presented an ideal time to check in with some of the top M&A bankers and industrial acquirers in the lower middle market, which we gauged by looking at which firms were most active on the Axial platform over the last 2 years.

Axial recently surveyed these top 50 members in the industrial space about current challenges and opportunities as they navigate an evolving market. Our findings are structured in 4 sections:

This article cites 7 of those leaders. We are grateful for their contributions and perspectives:

According to Brian Franco, Founder of M&A Advisory Firm, Meritage Partners, “technological disruptions, sustainability pressures, and regulatory compliance” are causing a slowdown in traditional industrial sub-sectors, and creating opportunities in non-traditional sub-sectors that are more favorable.

Through the soundbites below, Brian articulates why sub-sectors focused on emerging domains such as technology and sustainability are leading in today’s market, while more traditional sub-sectors are lagging.

Leading 📈 |

Lagging 📉 |

| Renewable Energy

“The sub-sector of renewable energy has been experiencing significant growth as countries around the world focus on reducing carbon emissions and shifting towards cleaner energy sources. Companies involved in solar power, wind energy, energy storage, and related infrastructure have been performing well due to increasing demand and supportive government policies.” |

Traditional Energy

“The sub-sector of traditional energy, including oil and gas exploration, production, and refining, has faced challenges due to volatile oil prices, increasing focus on renewable energy, and environmental concerns. The transition towards cleaner energy sources has led to uncertainties and reduced investment in traditional energy projects.” |

| Electric Vehicles (EVs) and Charging Infrastructure

“With the growing adoption of electric vehicles, the sub-sector of EVs and charging infrastructure has seen substantial growth. Companies manufacturing electric vehicles, producing EV components, and building charging stations have been experiencing strong demand, driven by factors such as environmental regulations, consumer preferences for sustainable transportation, and advancements in battery technology.” |

Heavy Machinery and Equipment

“The sub-sector of heavy machinery and equipment has been impacted by economic uncertainties, trade disputes, and reduced capital expenditure in certain industries. Companies involved in manufacturing heavy machinery, construction equipment, and industrial machinery have faced challenges due to lower demand and delays in infrastructure projects.” |

| Aerospace and Defense Technology

“The aerospace and defense sub-sector has been resilient and continues to perform well. Defense spending by governments, technological advancements, and increasing air travel have contributed to the growth of companies involved in aircraft manufacturing, defense equipment, and aerospace technologies.” |

Automotive

“The automotive sub-sector has experienced challenges due to various factors, including global supply chain disruptions, semiconductor shortages, and changing consumer preferences. The shift towards electric vehicles, autonomous driving technologies, and shared mobility has also created disruptions and required significant investments from traditional automakers.” |

| Industrial Automation

“The sub-sector of industrial automation has been thriving as companies seek to improve efficiency, reduce costs, and enhance productivity. Automation technologies such as robotics, artificial intelligence, and advanced manufacturing solutions are in high demand, particularly in industries such as automotive, electronics, and pharmaceuticals.” |

Commercial Aerospace

“The commercial aerospace sub-sector has faced headwinds due to the COVID-19 pandemic’s impact on air travel demand. Reduced travel, grounded fleets, and delays in aircraft deliveries have significantly affected companies involved in aircraft manufacturing, parts suppliers, and commercial aviation services.” |

| Water Infrastructure

“The sub-sector of water infrastructure encompasses companies involved in water treatment, desalination, wastewater management, and water-related infrastructure projects. With increasing water scarcity concerns and the need for sustainable water management, companies operating in this sub-sector have experienced growth opportunities.” |

Traditional Manufacturing

“Some traditional manufacturing sub-sectors, such as textiles, basic metals, and certain consumer goods, have encountered challenges due to increased competition from low-cost production regions, changing consumer preferences, and supply chain disruptions. These sub-sectors may struggle to remain competitive in a rapidly evolving global marketplace.” |

The priorities of operators in the industrial arena can vary depending on their specific industry, region, and individual circumstances. However, many survey respondents agree that there is a broader sense of uncertainty in the market due to rising cost of capital, supply chain disruptions, labor shortages, technological advancements, and environmental regulations. These challenges are currently top of mind for industrial operators and continue to drive their priorities as they explore a sale.

Navigating Rising Cost of Capital

Higher borrowing costs are presenting significant challenges in financing industrial M&A transactions. As seen in the anecdotes below, both M&A advisors and their clients are concerned about the implications of rising interest rates. This is especially prevalent for those operating in cyclical sub-sectors.

|

Rising Cost of Capital |

| “We are focused on ensuring the quality of an asset and its earnings, as debt underwriting is certainly tougher these days”

– Matthew Bradbury, Managing Director of Investment Bank, Business Acquisition & Merger Associates |

| “Most owners right now are stressed with the cost of capital and finding good employees.”

– Ken Miller, Founder of M&A Advisory Firm, The BlackRose Group |

| “Many business owners in the industrial arena feel that they are in a tough position. They finally have a year or two of strong financial performance under their belts, but now see the headwinds that the economy is facing.”

– Jeremy Manista, Associate at M&A Advisory Firm, Plethora Businesses |

Overcoming Supply Chain Disruptions & Labor Shortages

The reliance on complex global supply chains is causing shipping delays and material shortages for industrial businesses. Many operators feel that this will impact their M&A objectives, as investors may be hesitant to acquire companies that heavily rely on certain suppliers or face ongoing supply chain challenges.

Survey respondents also indicated that labor shortages are driving concerns in the market by resulting in increased labor costs, delays in project timelines, and reduced productivity.

| Supply Chain Disruptions & Labor Shortages |

| “Owners of industrial businesses remain optimistic based on continued strong demand for their products, but continue to struggle with availability of qualified labor and some ongoing supply chain issues related to raw materials.”

– Stephen Sleigh, Managing Partner of Investment Bank, Peakstone Group |

| “Across the board, the labor market continues to frustrate business owners. What worked for them to recruit and retain staff in the past is no longer as effective.”

– Alan Clark, Founder of M&A Advisory Firm, The Hatteras Group |

| “Some industrial OEM’s had a positive blip from Covid as their customers went longer on inventory builds to make sure they had components. We are seeing a little softness as these customers work through their current inventory.”

– Matthew Bradbury, Managing Director of Investment Bank, Business Acquisition & Merger Associates |

Navigating Technological Disruptions & Environmental Regulations

The industrial sector has been experiencing several technological disruptions that are reshaping operations, processes, and business models. According to Brian Franco, Founder of M&A Advisory Firm, Meritage Partners, “automation, robotics, and Internet of Things (IoT)” are the three most prominent in today’s market.

While these innovations offer opportunities for improved efficiency and productivity, they also pose challenges for traditional industrial companies. Franco says that operators “need to understand the impact of these technologies to adapt to the changing landscape.”

Environmental regulations are also top of mind for industrial operators. “The increasing concerns about climate change and environmental sustainability have led to stricter regulations in the industrial sector,” continues Franco. He adds that operators “need to assess the potential risks and opportunities arising from environmental regulations, and transition to more sustainable practices.”

Axial’s survey suggests that industrial investors are finding it challenging to discover good investment opportunities at fair price points. As a result, they are prioritizing their efforts to identify motivated sellers with reasonable expectations. Given the friction caused by the current macroeconomic conditions, investors are also placing a heightened focus on the quality of earnings of each business they evaluate.

Finding Quality Assets With Motivated Sellers & Reasonable Valuations

While survey respondents indicated that it is difficult for investors to find good acquisition targets in any environment, it has become especially difficult in recent months due to valuation expectations combined with the rising cost of capital.

| Finding Quality Assets With Motivated Sellers & Reasonable Valuations |

| “The combination of tighter lending standards, aspirational seller expectations, and uncertain economy is a challenge for buyers.”

– CL Turner III, Founding Partner of Private Equity Firm, Crescendo Capital Partners |

| “Valuation expectations are high as usual and always make deals tougher to close with buyers.”

– Alan Clark, Founder of M&A Advisory Firm, The Hatteras Group |

| “There are too many companies trying to sell that are not ready to sell. This naturally causes a challenge for buyers.”

– Ken Miller, Founder of M&A Advisory Firm, The BlackRose Group |

These dynamics are forcing investors to place a heightened emphasis on differentiated deal origination, with the goal of finding motivated sellers with realistic valuation expectations.

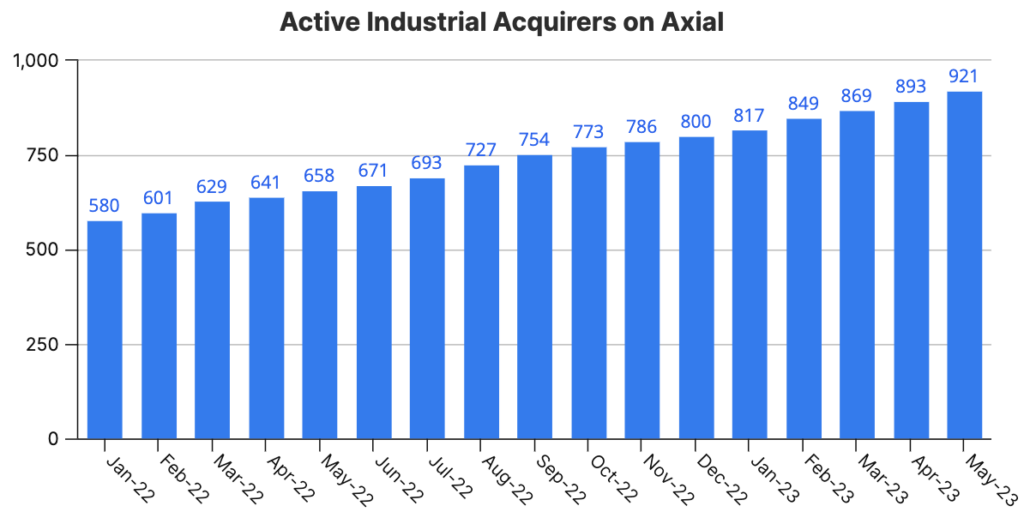

Investors’ increased appetite for business development is evident based on Axial platform data. The universe of active acquirer sourcing industrial investments has increased by 40% between May 2022 and May 2023.

Obsessing Over Financial Performance & Due Diligence

The ongoing tightness in the debt capital market is leading investors to scrutinize the quality of assets and their earnings. Axial’s survey suggests that industrial investors are conducting very thorough due diligence to ensure that businesses can withstand the covenants of the debt required for acquisition.

| Obsessing Over Financial Performance & Due Diligence |

| “Buyers of industrial businesses are conducting very thorough due diligence related to raw material input costs and the sustainability of historic gross profits – i.e. how much gross profit is coming from the pass-through of higher raw material prices vs. sustainable value-added production.”

– Stephen Sleigh, Managing Partner of Investment Bank, Peakstone Group |

| “Investors are trying to navigate the softness. While no-one knows how soft some of these markets will go, for now it is anticipated that we could have 1-2 quarters of soft sales to work through excess inventories.”

– Matthew Bradbury, Managing Director of Investment Bank, Business Acquisition & Merger Associates |

To support investors’ with due diligence, Axial recently launched a Q of E referral program, based on feedback from our most active members. The program connects investors who have issued an IOI or LOI with Q of E firms from our curated roster. To learn more, check out the program here.

Mixed Outlook on a Buyer Versus Seller Market

Some firms like Meritage Partners predict the remainder of 2023 to be a strong market for investors. “We foresee a strong buyer’s market for the remainder of the year, driven by a combination of strategic players and acquirers with a focus on growth. The debt markets have played a significant role in contributing to a buyer’s market in mergers and acquisitions (M&A) in several ways.” says Brian Franco, Founder of Meritage Partners.

Sharing Franco’s sentiments on the market, Alan Clark, Founder of The Hatteras Group comments, “We expect the remainder of 2023 to be an above average buyer’s market. I could see deals getting pushed into next year by buyers and sellers looking for more certainty in the economy.”

Other firms like Plethora Businesses feel that demand for quality assets will continue to remain steady. “There has been a lot of pent up demand in the market over the last few years. There will continue to be strong companies coming to the market, along with buyers who seem to still be sitting on cash that they need to utilize,” says Jeremy Manista, Associate at Plethora Businesses.

Strong Outlook on Equity Heavy Acquisitions

Most survey respondents agreed that investors will need to mobilize more equity to get deals done. “There are plenty of buyers around, however, banks are pulling in their leverage box,” says Matthew Bradbury, Managing Director of Business Acquisition & Merger Associates. He adds that “buyers need more equity and some return expectations are getting adjusted.”

As a result of the heavy reliance on equity, survey respondents predict the remainder of the year to be driven by strategic and growth focused acquisitions. “I think synergistic buyers will be most aggressive over the next 6 to 12 months. Interest rates and uncertainty will make it tougher for financial buyers to close deals,” says Alan Clark of The Hatteras Group.

Agreeing with Alan, Matthew Bradbury of Business Acquisition & Merger Associates comments, “We foresee strategic and financial buyers with a strong portfolio of companies putting money to work.”

Some firms also see an opportunity in transacting with family offices focused on the industrial sector. Ken Miller, Founder of The BlackRose Group, feels that “family offices that are not focused on LBOs” will be active in today’s market given their lack of reliance on debt financing.

Takeaways For Operators

For operators exploring a sale, it is crucial to overcome the challenges associated with supply chain disruptions, labor shortages, environmental regulations, and rising cost of capital.

To mitigate the risks associated with global supply chain disruptions, operators may consider exploring local suppliers to reduce dependence on their overseas sourcing channels. In addition, implementing new playbooks to hire, train and retain good talent will be critical for operators given the ongoing issues associated with labor shortages.

Industrial operators need to keep a pulse on the technological advancements and environmental regulations that are impacting their sub-sectors. Adapting to these changes will be critical for remaining competitive.

In light of rising interest rates, operators contemplating a sale should continue to build out their bench of strategic buyers and family offices, given their lower reliance on debt financing.

Takeaways For Investors

Identifying quality assets with motivated sellers is top of mind for industrial investors. To successfully do so, investors will need to continue expanding their deal origination channels in order to connect with as many sellers as possible.

Investors may consider targeting sub-sectors focused on emerging domains such as technology and sustainability. Industrial technology will offer investors the opportunity for improved efficiency and productivity, while a focus on sustainability will allow them to capitalize on supportive government policies.

Given tighter lending standards, it will also be critical for investors to scrutinize the financial performance of each business to gauge whether it can withstand the potential debt obligations. This can be done effectively by working with a sophisticated Q of E provider.

Axial’s Top 50 industrial list was generated based on a weighted formula leveraging private transaction data from the Axial platform.

Metrics in the formula include: