What Buyers Want: Deal Demand by EBITDA Range

Understanding buyer demand plays a significant role for business owners and dealmakers when it comes to navigating lower middle market…

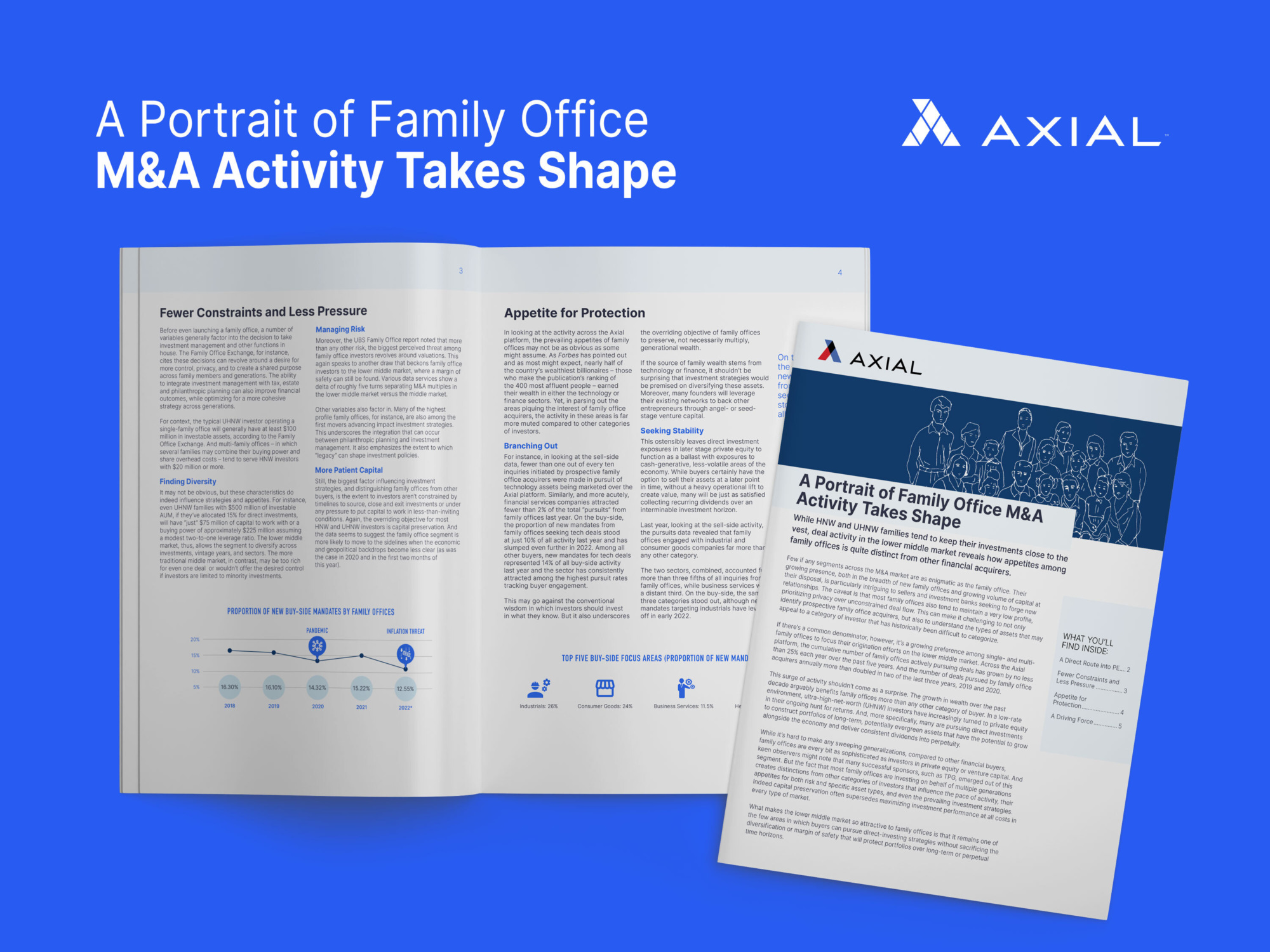

Much has been made about the role of family offices both as an investor in private equity funds and, increasingly, as a competitor to private equity in M&A auctions. Yet, this segment of the lower middle market ecosystem remains among the most enigmatic participants in dealmaking today. While family offices tend to be a little more withdrawn as it relates to promoting their strategy or articulating their investment theses – probably because they don’t have to raise capital every few years – certain trends have begun to surface that provide a rough sketch of their appetites and investment behaviors.

To help dimensionalize the growth of the family office segment, across the Axial platform, the cumulative number of family offices actively pursuing deals has grown by no less than 25% each year over the past five years. And the number of deals pursued by family office acquirers more than doubled in two of the last three years, 2019 and 2020.

These trends run parallel to the rapid growth of high-net-worth and ultra-high-net-worth families, the latter of which grew by nearly a quarter between 2020 and 2021, according to the Credit Suisse Global Wealth Report. Moreover, a survey from UBS confirmed what most investment bankers probably knew to be true, which is that the proportion of family offices pursuing PE through direct investments has grown considerably.

The Axial Family Office report explores several trends shaping family office activity, such as which sectors generate the most interest from buyers — it’s not necessarily what most casual observers might assume. The report also delves into why family offices have gravitated to the lower middle market, in particular, for their direct-investment exposure.

A few metrics, however, seem to stand out that speak to why so many M&A participants are eager to make inroads into the segment. Across the Axial platform, family offices represent more than 13% of the active acquirers in the lower middle market. Moreover, the engagement data around sell-side targets reflects that family offices may be more discerning than other categories of buyers. That being said, they accounted for a disproportionate share of completed transactions. The upshot is that when family offices are interested, they are more likely than most to see the deals through to completion (trailing only PE and independent sponsors).

If imitation is the highest form of flattery, the recent trend in which private equity managers roll out “long-dated” funds – designed to mimic the more perpetual structures favored by family offices – suggests the family – office pitch does indeed resonate to business owners. And to the extent these strategies help family offices preserve and grow their wealth, it’s likely their presence will only grow in the years ahead.