The Winning M&A Advisor [Vol. 1, Issue 5]

Welcome to the latest issue of The Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

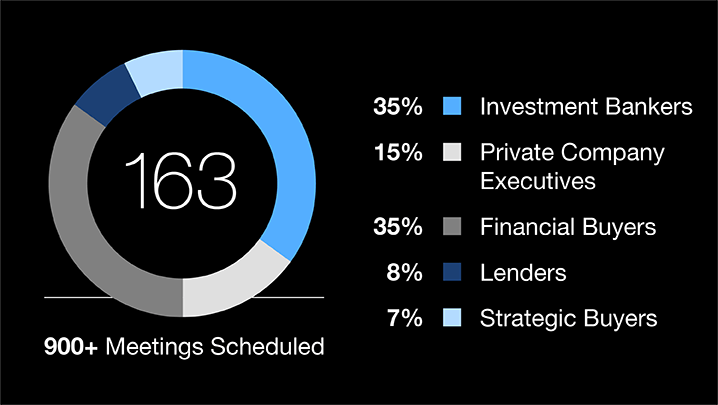

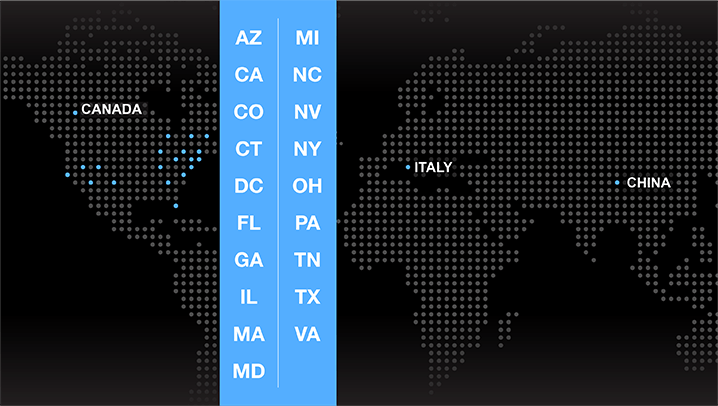

On October 24th, Axial Concord convened 163 of its members, hailing from four countries and 23 US states. Axial’s in-house business development team pre-scheduled each attendee’s with six to ten 1-on-1 private meetings that leverage Axial’s in-house member matching data and matching expertise.

For those who have already viewed the Concord highlights and wanted to know more, we are sharing with you the keynote slides and commentary delivered by Peter Lehrman, Axial CEO.

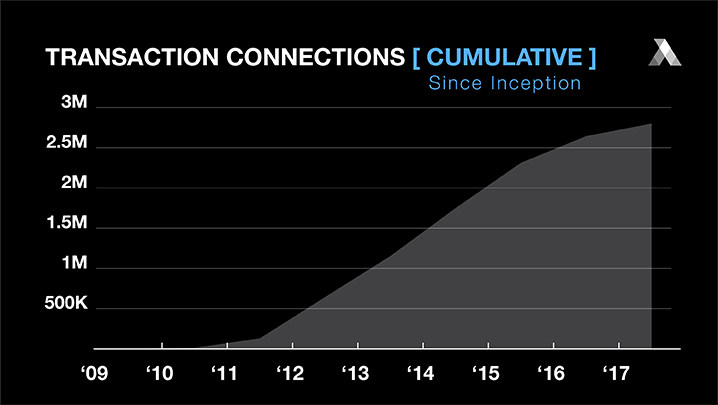

“Axial is a connection engine for our members. Members want us to do one thing for them: help connect them to the right professionals and the right transaction opportunities at the right points in time. With that in mind, this chart measures the total number of connections that we have enabled among and between our members since the inception of Axial. It’s one of the yardsticks of value by which we measure our impact at Axial.”

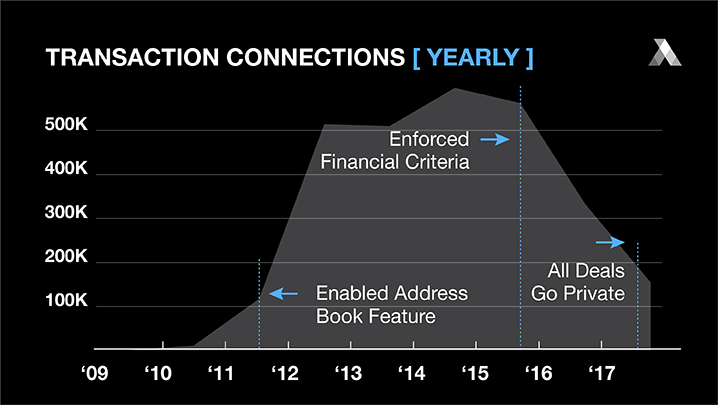

“In 2012, we enabled a set of product features that made it easier to share deals on Axial, not just with other Axial members but also with contacts in your own personal network. That’s the primary driver of connections growth occurring in 2012.”

“But we realized that our initial focus on growing the number of member connections was not precise enough; we were not sufficiently discriminating between a quality connection versus just a connection. The above slide shows the profound effects of our change in focus to prioritize quality connections over quantity and the product and pricing changes we have made to align to quality.”

“We’ve continued to focus on quality over quantity.” Effective in June 2017, all deals on Axial became 100% private with the elimination of all posting, blasting, and publishing features. Instead, members working on deals privately share deals one to one with qualified capital partners inside a private invite-only deal room.

“By continuing to align how our platform works with our focus on quality member to member connections, connection volumes are down and connection quality as a percentage of total connections is way up. And the number of quality connections is leading to an acceleration in the number of closed transaction by Axial members, leading to an acceleration in the number of deals closing between Axial members.”

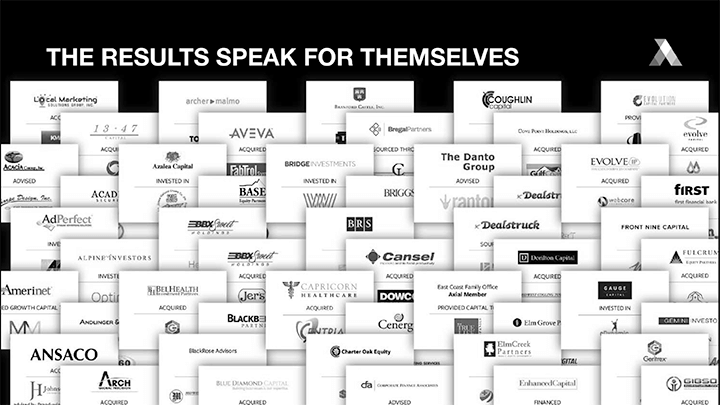

Above is a snapshot of transactions that closed through Axial platform in the last 18 months.

“Below is a slide revealing 30 boutique investment banks that joined Axial since June 2017, when we decided to make all deals 100% private on the Axial platform.”

“Over the years, many investment bankers have been hesitant to work with Axial; Axial is a novel technology for the corporate finance industry and practitioners in this market are slow to adopt new tools and technology. In addition, many of these bankers were concerned that using Axial created a chance that deal information on their client would be visible to buyers or investors whom they had not granted express access. Now that 100% of deal activity on Axial is private, and bankers in the market are hearing about the significant lift in reach of the Axial buyer network, bankers are taking a second and serious look, experiencing membership, and quickly improving deal outcomes for their clients and themselves.”

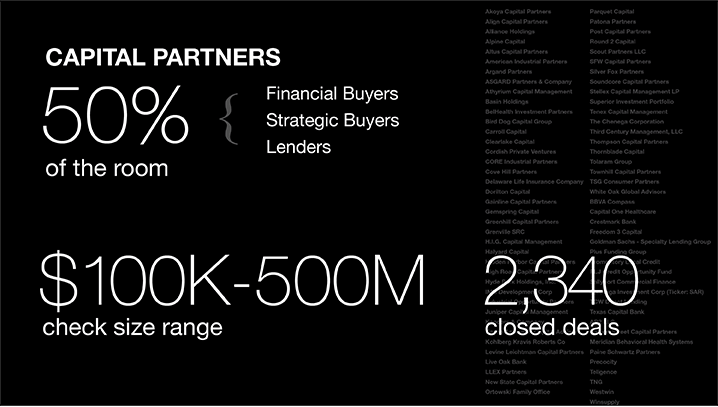

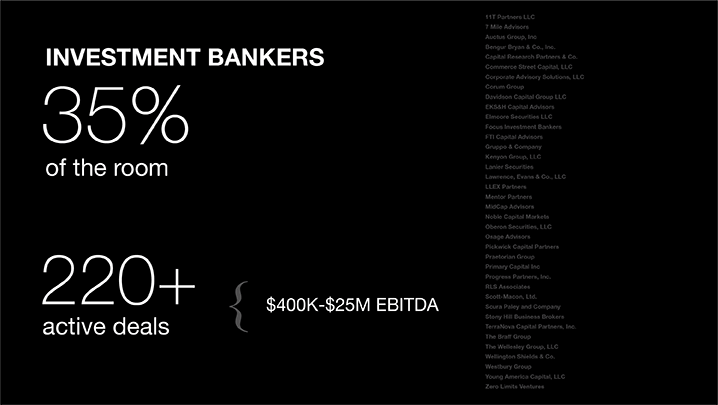

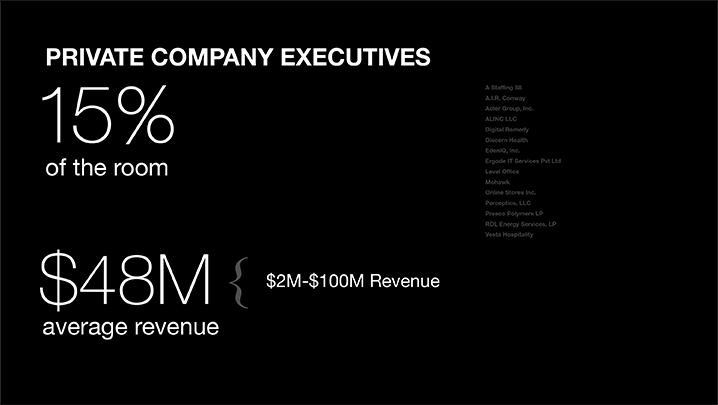

The following three slides shows the composition of this year’s Concord attendees within our three key constituencies: investment bankers, middle market CEOs, and capital partners.

“Axial invests heavily in building a balanced network of sell-side and buy-side members. That’s at the root of creating high-value connections and experiences for our members, and one of the things that we work really hard at.”

“The investment bankers in this room today currently have 220 deals under assignment today and a forward pipeline of over 500 transactions coming to market between now and end of 2018. ”

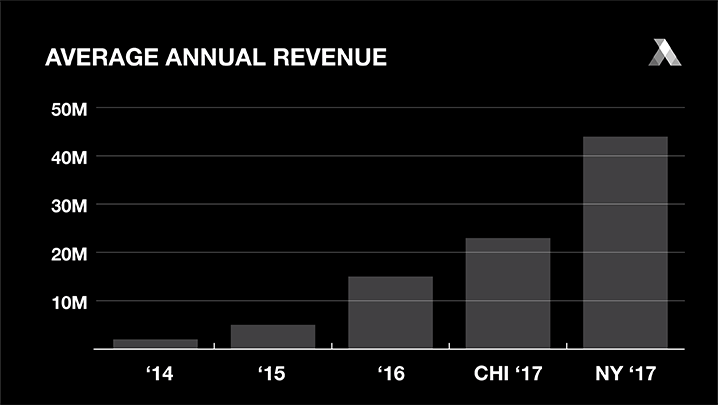

Unlike other membership organizations, Axial engages all three key participants in the private capital markets, including the CEOs and entrepreneurs. A trademark of Axial’s membership and our events is the significant presence of CEOs, and over the years, the size of the companies whose CEOs are joining Axial has risen steadily from the low single-digit millions to now between $20m and $50m in annual revenues.

Today at Axial Concord, the CEOs in attendance preside over companies whose average annual revenue in 2016 was $48m.

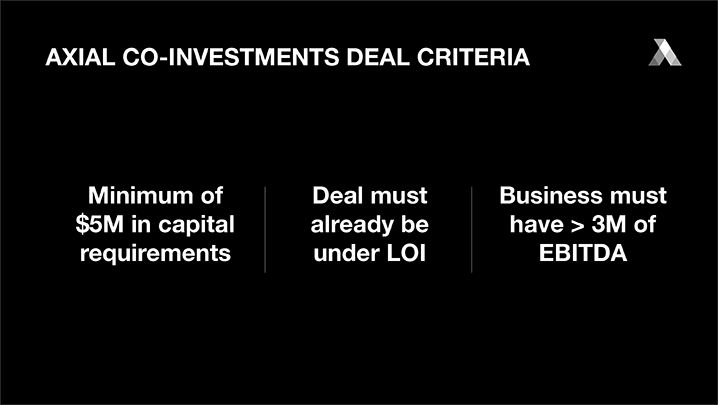

We have been privately piloting a co-investment service for our members in 2017 and today I’m excited to formally announce “Co-investments via Axial.” The “Co-investments via Axial” offering allows any member of Axial to tap into a pre-vetted pool of co-investment capital available only to Axial members.

The pool of capital is made available to Axial members by three family offices who have partnered with Axial to make this co-investment capital available on demand. These family offices are focused on lower middle market transactions and the owners of these family offices are either current or former senior partners and executives from Blackstone and KKR.

“By partnering with these family offices, both our private equity committed capital and independent sponsor members can pursue deals with greater confidence in their ability to close them, regardless of whether they have sufficient committed capital through a fund structure or through a deal by deal structure. By providing Axial members with the these sources of pre-vetted and lower middle market specialized co-investment capital, we make it easier for our members to get their deals done, and we give sellers and investment bankers greater confidence that when they engage with Axial members on the buy-side, they are not wasting their time.”