How to Value a Heating and Air Conditioning Business + 15 Factors to Increase Value

Whether you're ready to sell your HVAC business or just assessing its worth, we break down valuation methods and key factors that can increase its value.

Finding a company to sell your business is the right decision — specifically, partnering with a qualified M&A advisory firm with a proven track record of selling businesses like yours.

When you find the right company to represent you, you can:

But businesses often struggle to find the right company to sell their business. They may rely on word-of-mouth recommendations, which aren’t always effective for finding an advisor with relevant experience or aligned goals, or conduct time-consuming research that still requires knowing how to properly evaluate an advisor.

In this post, we look at:

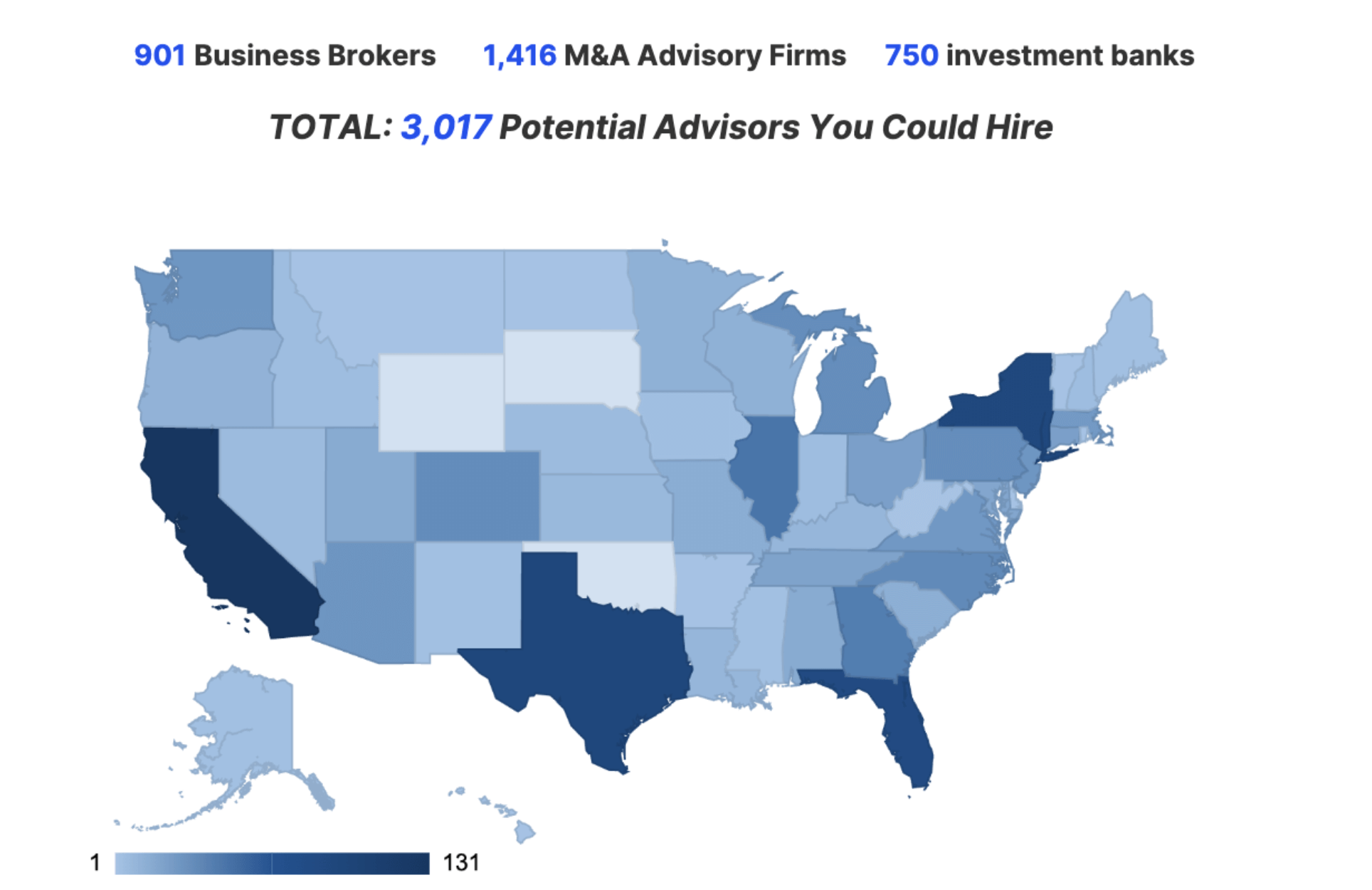

At Axial, we use our experience in working with M&A advisors to help business owners identify the best advisors, compare them, and pinpoint the best partner for their sale.

The process starts by pairing you with an Exit Consultant who gets to know your business and personal exit goals. From there, we analyze our network of over 2,000 M&A advisors to curate a shortlist of companies with the most relevant track record of success, providing detailed insights to help you evaluate your options.

We select 3–5 companies based on:

Your Exit Consultant will then guide you through your choices and help you prepare for the process of interviewing advisors. With access to an extensive library of resources, we ensure you fully understand the process and feel confident in selecting the best advisor.

If you’re ready to find the best advisor to help you sell your business, you can start the process here.

You can also keep reading to get an idea of the caliber and types of advisory firms we recommend.

The companies in this list represent some of the top advisory firms in the Axial network.

Some of the companies on this list are generalists with a great track record across sectors. These firms are large enough to have divisions dedicated to multiple industries. Others are specialists with deep expertise in a particular industry.

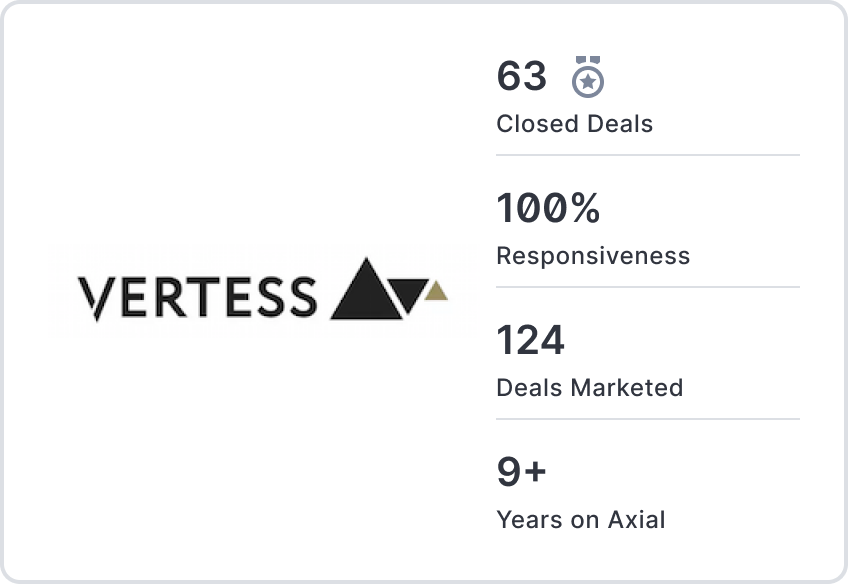

Vertess is a healthcare-focused M&A advisory firm. They specialize in middle-market healthcare companies and stand out for their industry expertise.

Through Axial, Vertess was recently introduced to a professional nutrition consulting and staffing business. Our data suggested they had represented at least six similar healthcare-related staffing businesses via Axial.

Vertess was founded by dedicated healthcare entrepreneurs who are also accredited M&A professionals. The team includes experts with previous experience as the founder of an innovative DME company, the COO of an international healthcare concern, and the owner of a pharmacy and home infusions provider.

The firm has been in business for over 10 years, teaching business owners how to enhance the value of their healthcare companies while keeping them informed about M&A trends in the healthcare market.

Through Axial’s process, your Exit Consultant may suggest this firm if your company focuses on medical devices, pharmacy, home health, hospice, urgent care, dental, health IT, or another specialized service or product in the healthcare industry.

Vertess’s deep-rooted healthcare M&A expertise helps them create a tailored approach that’s hard to beat.

Interested in working with Vertess? Request an introduction.

With a 20-year track record in M&A, Two Roads Advisors is another specialized M&A advisory firm — working with Consumer, Technology, and Services businesses.

They have extensive experience advising e-commerce related businesses, including Amazon FBA sellers, Amazon/DTC aggregators and technology/services businesses supporting marketplace businesses.

We recently recommended this firm to an apparel-focused business since our data suggested that they’ve represented at least 13 apparel, accessories, and other DTC brands via Axial.

With a 19+ year track record completing transactions totaling over $18 billion in aggregate value, Two Roads differentiates their offering based on their flexibility, their execution, their speed, and the depth of their relationships with their global network.

Your Exit Consultant might suggest this firm if your company is an e-commerce company in the apparel industry or other DTC sectors.

Interested in working with Two Road Advisors? Request an introduction.

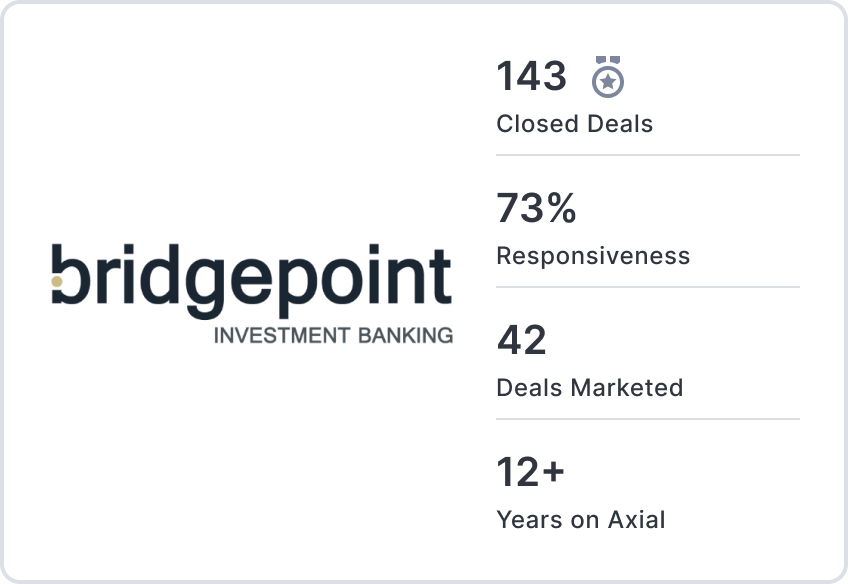

Bridgepoint Investment Banking serves a range of privately owned companies. They’ve successfully completed more than $50 billion worth of transactions in the trucking, transportation, and logistics space.

But they also have experience in healthcare, business and IT services, consumer, and technology. This gives them broad sector experience, which is paired with a depth of knowledge and extensive connections with corporate buyers, private equity groups, both domestically and internationally.

Combined, Bridgeport’s team have more than 360 years of investment banking experience, and they’ve moved more than $382 billion of capital across 475+ completed debt, equity, and M&A transactions. For business owners looking to join this roster of successful sales — especially family and founder-owned businesses — there are advantages to the wide net they can cast, and the broad range of industries where they can offer their insight.

We recommended this firm to a business owner in the transportation and logistics industry because Bridgepoint uniquely serves privately owned companies in the middle market, with a focus on family and founder-owned businesses. This was a perfect fit for this business owner.

Interested in working with Bridgepoint? Request an introduction.

The Peakstone Group has an impressive track record of selling businesses in the middle market. They’ve closed deals in many sectors including aerospace, retail, food and beverage, technology, industrials and logistics.

Because they have a very impressive industrials team, we introduced them to a manufacturer of home equipment.

The average Peakstone MD has 25 years of experience, and their team of over 40 investment banking professionals have completed hundreds of successful transactions with a broad global network of buyers. Their advisors work on the principle that there’s no standard “playbook” to apply to every transaction. This keeps their work entirely client-focussed, as they get to know their client’s wants and needs and develop thoughtful, creative solutions.

The Peakstone Group has substantial expertise to represent businesses with revenues of between $10m and $500m — whether that’s for M&A or capital raises.

Interested in working with Peakstone? Request an introduction.

Founded in 2009, New Direction Partners provides investment banking and financial advisory services to family-owned and closely-held firms — though they also serve the middle-market needs of publicly traded companies.

They’re one of the only investment banking firms dedicated to the print and packaging industry, and they have expertise in the media and marketing sectors, recently representing a business focused on graphic media, POP displays, and wide and grand format signage.

Together, New Direction Partners’ founders have more than 100 years of investment banking experience in the sale or purchase of more than 300 companies.

Interested in working with New Direction Partners? Request an introduction.

With more than three decades of experience, FOCUS Investment Banking is a trusted name in middle market M&A advisory services.

FOCUS are considered subject matter experts for 11 industries in the US and Europe, but they make this list for their focus on managed service providers, including the most active and successful MSP team in North America. Over the past 36 months, they’ve catapulted ten MSPs into “New Platforms” for private equity sponsors and advised MSP transactions with 55 different buyers and sellers.

For companies in the middle market who want an advisor with a proven track record, FOCUS has the expertise to advise buyers and sellers, and manage the process of raising capital for company growth, all with a focus on meeting their clients’ strategic and financial objectives.

Interested in working with Focus Investment Banking? Request an introduction.

41 North is a specialized full-service investment bank with expertise in mergers and acquisitions and growth capital advice for middle-market companies. Founded in 2009, they have long-standing relationships with professionals in their network. Their founder has over 25 years of experience in domestic and international capital markets, with a background working with IBM and in senior leadership roles at Deutsche Bank, Shearson Lehman Brothers, and Citigroup Global Markets.

Because of their focus on the food and beverage market, we recently recommended 41 North to premium chocolate manufacturers, a manufacturer and wholesaler of vegan protein bars, and a manufacturer of condiments, dressings, marinades and hot sauce.

Our data shows they’ve been involved in a further 25 manufacturing and 14 consumer goods transactions in recent years.

For companies who want to work closely with their advisor, this firm can help explore all the financial options to come up with the optimal solution for your company.

Interested in working with 41 North? Request an introduction.

Choosing the right M&A advisor is arguably the most critical decision to ensure a successful sale. Yet, even well-meaning advisors can unintentionally jeopardize a deal through misguided advice, poor judgment, or overestimating their capabilities.

For this reason, it’s essential to explore and compare multiple firms carefully to make an informed choice.

Here are four things to consider when evaluating your options:

Advisory firms can work with companies in one particular industry, or they might have several sub-specialties (especially if the firm is larger). Either way, we recommend that you look for advisors with experience in a) your industry and b) selling businesses like yours.

This experience will be helpful in all aspects of the M&A process, including:

On the other hand, an advisor who lacks experience with businesses in your sector (or businesses of a similar size and structure to yours) can run into some common pitfalls.

When you choose a company to represent you during your business sale, you’re bringing in a team of people who have different roles to play at certain stages of the process.

Some firms will have a larger team or will outsource some of their services (like tax and wealth management advice) to other professionals. For others, most of your contact will be directly with your advisor.

We recommend having a clear understanding of the caliber, track record, relevant experience and bandwidth of the advisory team.

Generally, the roles will be split as such:

When interviewing advisors, you can ask them to walk you through the team who’ll be involved in your transaction, perhaps explaining who’s involved at each stage and who your point of contact will be. With some firms, for example, you might have a direct line to your lead advisor throughout the process, while others will have a client relationship manager to deal with basic queries. It’s a case of deciding what you feel most comfortable with, and taking the advisory firm’s answer into account as you compare your options.

Most M&A firms charge a combination of a retainer and a success fee, though the exact breakdown varies between firms. It is important to request a detailed explanation of all costs, including how and when fees are charged.

Owners sometimes assume that selecting the best advisor means choosing the one with the lowest fee, but that isn’t the case. The best advisors have well-structured engagements where incentives between the business owner and the advisor are aligned. While their fees may not be seen as cheap at first, the business owner is more often than not generating an attractive ROI. Imagine you were evaluating two advisors with different fee levels. If the lower-fee advisor secured a sale price that was only 2% higher, while an alternate advisor—charging just 1% more—could deliver a 10% higher sale price. Who would you choose in that case?

This is why we encourage owners to focus on the value each advisor expects to bring to the table, examining their planned approach, fee structure, and proven track record in similar closing deals. This broader perspective can help ensure you select an advisor who maximizes your sale outcome, even if they are slightly more expensive than their competition.

Alongside finding, vetting, and negotiating with potential buyers, an advisor can bring a lot to the table to help you increase the amount your business sells for. Their expertise can help you prepare to exit your business with the best possible deal and with your legacy intact.

For example, an advisor might find actions you can take to grow or optimize your business before the sale, and even suggest postponing for 12 months until you’re in a stronger position. They might also be able to connect you with service providers with experience in wealth management, exit planning, or estate planning to help you transition well. This can add an incredible amount of value beyond the sale itself.

When you ask the advisors these questions as you compare firms, you can narrow down your list of options to identify the best choice.

You’ll find more questions to ask a potential advisor in this post:

Ask These Questions Before Hiring an M&A Advisor

In this post, we highlighted 7 companies we’ve recently recommended to businesses, based on their fit.

Finding and evaluating all available options can be overwhelming for many companies. At Axial, we narrow your options down to a curated list of picks (usually between 3–5 different companies). These picks are vetted by our team and chosen for you based on your industry, business type, and overall transaction goals.

We also help you interview and decide between those 3–5 companies, so you can confidently pick the right advisor to help you sell your business.

If you’re ready to start the process, reach out today.