The Winning M&A Advisor [Volume 1, Issue 9]

Welcome to the latest issue of The Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

Tags

There are plenty of misconceptions and generalizations about the differences between a business broker and an M&A advisor. This can make it challenging to know who you should partner with to sell your business.

Both brokers and advisors help with:

How they go about certain processes does change significantly, often because brokers and advisors work with different types of businesses. A business with an EBITDA of $4 million, a large management team, and highly sought-after intellectual property requires different considerations than one with a smaller EBITDA and a straightforward product line.

The goal is to understand when to use a broker and when to use an advisor, so you can assess your business and determine the best option for achieving your desired exit.

In this post, we cover:

To write this post, we used data from our network of brokers and advisors, which includes over 1,100 investment banks and M&A advisory firms, as well as 900 brokerage firms.

If you’re ready to start looking for advisors and brokers to sell your business, reach out to us today. We can provide 3–5 vetted options with experience representing businesses like yours.

Our network of over 2,000 advisors and brokers is vetted based on relevant deal experience, success in securing bids and closing deals, and their professionalism and reputation.

M&A advisory divisions within banks

Standalone M&A advisory firms

At Axial, we work with 600 M&A advisor firms that specialize in the small-to-midsize market, often referred to as the lower middle market. These firms typically focus on businesses with $1M+ EBITDA that are large and complex but not yet big enough to attract attention from larger banks and advisory firms.

M&A advisors can operate as smaller, standalone firms or as divisions within boutique investment banks.

In both models, M&A advisors facilitate the sale process and provide strategic guidance, ensuring that business owners maximize value and navigate the transaction’s complexities successfully.

A business broker specializes in helping small and mid-sized business owners sell their businesses. Their role is primarily transactional, meaning they focus on facilitating the sale rather than providing in-depth strategic or financial advice.

Business brokers operate under various models, each with distinct approaches to facilitating the sale of businesses.

A business broker and an M&A advisor both assist in the sale of businesses but generally serve different types of businesses based on their size, complexity, and industry.

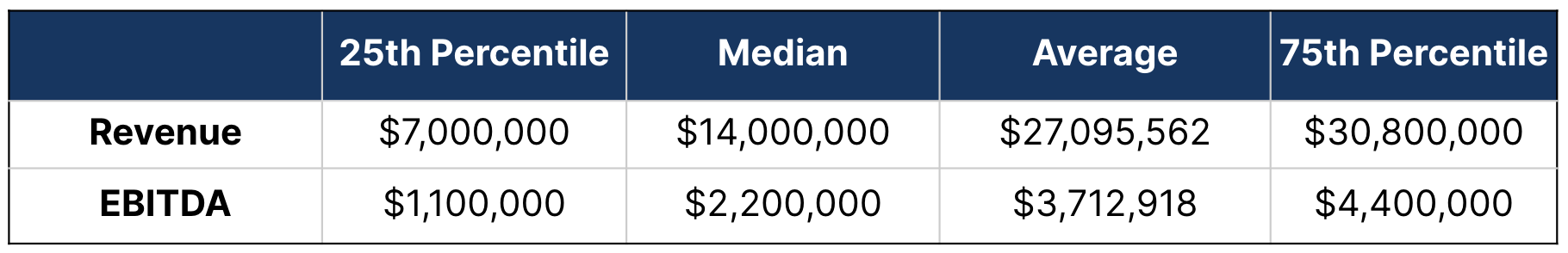

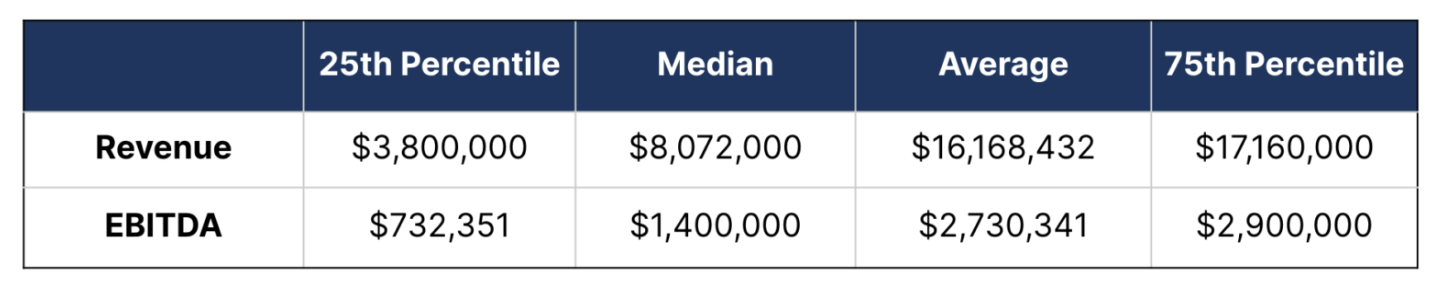

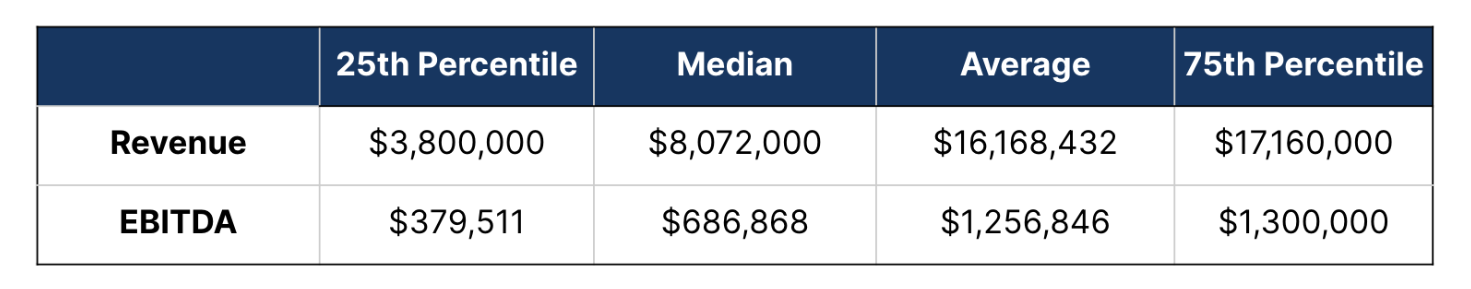

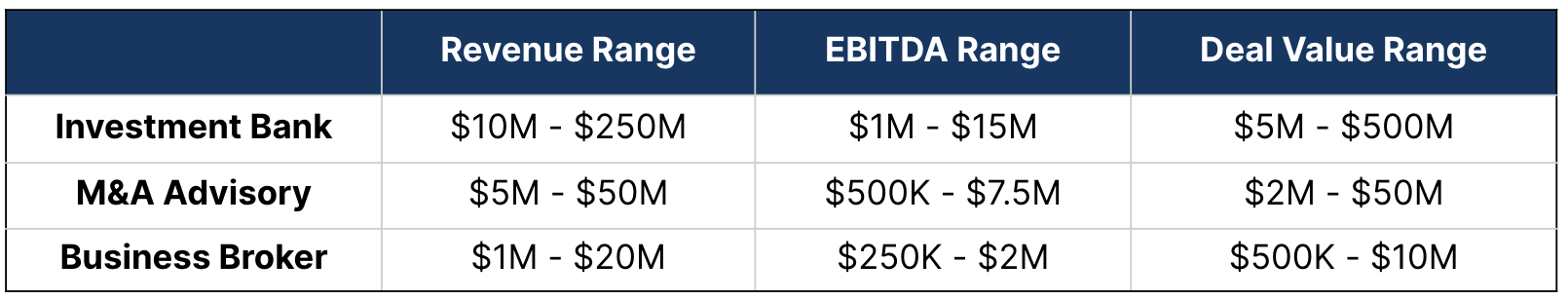

Brokers generally work with businesses with an EBITDA range of $250k–$2 million. These businesses usually have smaller teams and lower operational complexities, making attracting buyers and structuring deals fairly straightforward. Some of these businesses get sold to regional or local buyers who are looking to buy and run them.

Advisors generally work with businesses with an EBITDA of $1 million+. These companies tend to have multiple layers of financial, operational, and management structures that require sophisticated analysis. These companies also require a much more detailed approach to deal structuring to meet the seller’s goals while maximizing value. They tend to have a larger team, including a management team, and so transition planning becomes much more critical to the success of the sale.

This distinction in client profiles leads to the main differences between brokers and advisors, including:

Below is a general breakdown of each, though it’s important to note that this represents typical industry practices. Over our 14 years in business, we’ve encountered numerous exceptions where brokers operate more like advisors and, conversely, advisors operate more like brokers.

M&A Advisors

Since they work with larger and more complex businesses, advisors take a more nuanced and lengthy approach.

They offer sell-side services that include working closely with clients for an extended period so they can properly help plan the exit, prepare the business for sale, structure the deal, and get you the best price with the best buyer.

Business Brokers

Business brokers offer sell-side advisory services but in a more transactional manner. Again, there are exceptions. But typically, a broker’s strength is making connections between buyers and sellers rather than detailed support work, like analysis and deal structuring.

M&A Advisors

Advisors provide detailed valuations based on in-depth financial analysis and market conditions. They are skilled in structuring deals with elements like earn-outs, stock swaps, or performance-based payments to optimize the sale for all parties.

Business Brokers

Business brokers conduct basic valuations, which are sufficient for smaller, less complex businesses. Their deals are typically structured as straightforward asset or stock sales.

M&A Advisors

Advisors generally take a targeted approach to finding buyers. This involves proactively reaching out to a curated list of potential buyers. These buyers are strategically identified based on their industry, acquisition history, and likelihood of interest in your business. This casts a more narrow net, but you get more qualified leads.

Business Brokers

A business broker will generally take a non-targeted approach, as this fits best with the types of deals they handle. This is because there is generally less demand for smaller businesses, so brokers will cast a wider net to attract enough interest. Typically, this means sharing an anonymized business profile with a large group of buyers via public listing sites and mass email marketing. While this approach casts a wider net, it often results in a less personalized outreach and may attract buyers with varying levels of interest and relevance.

For the past three years, we’ve put together an authoritative source on sell-side M&A fees in the lower middle market. The information in the sections below is based on the data that you can find in our complete annual fee guide for 2023–2024.

M&A Advisors

While exact fee structures will change based on the advisor and your business, it’s typical for M&A advisors to charge a retainer and a success fee (a commission for when they complete your sale).

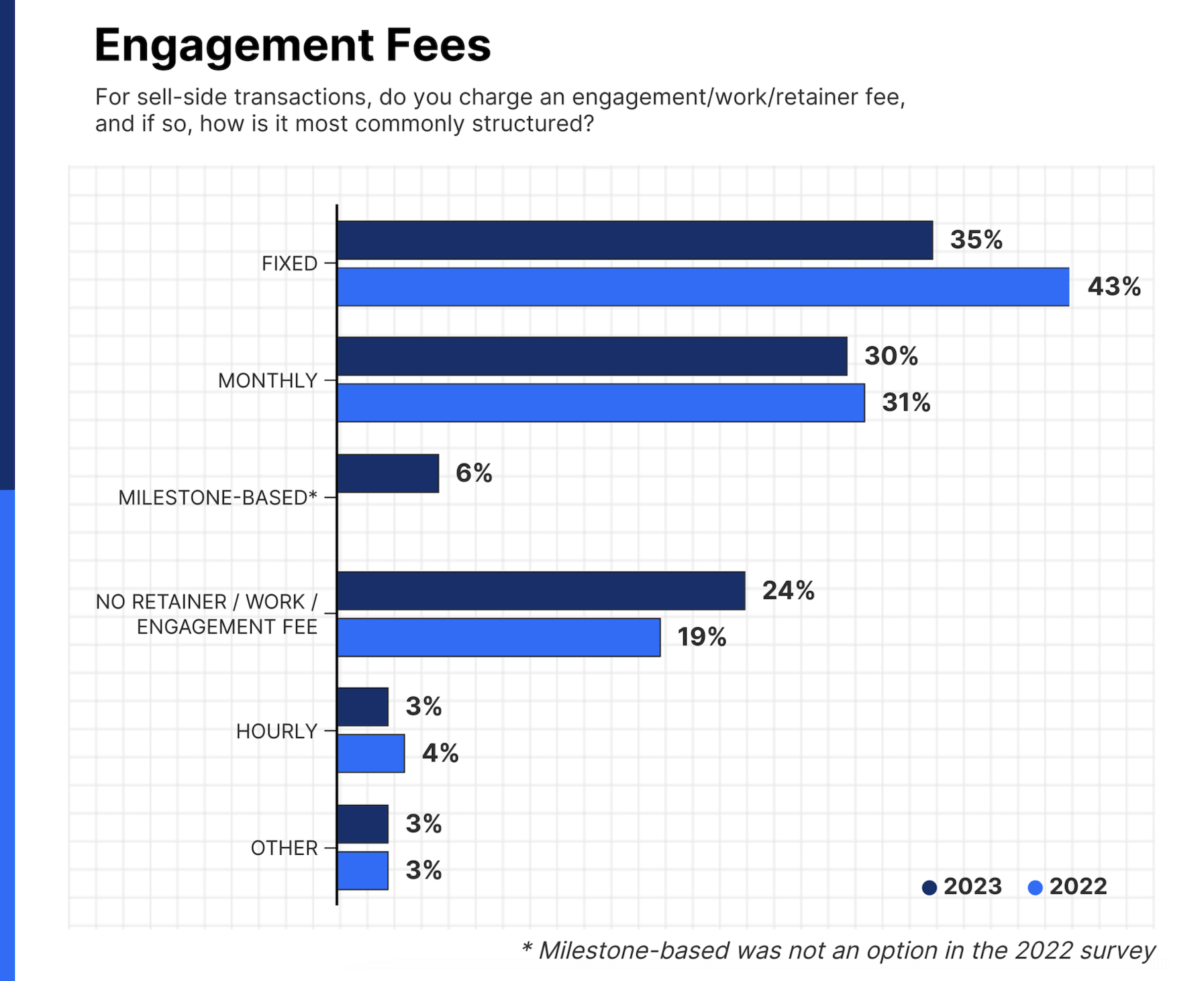

Our data shows that just over 70% of M&A advisors in 2023 charged a type of engagement fee, whether a fixed rate, a monthly fee, or milestone based.

Broker

A broker will generally only charge a success fee/commission fee. This makes sense, as they’re not doing as much work to help you with exit planning, transitioning, and optimizing your business for sale.

Instead, they generate more of their value through the connections they make between you and buyers, which advisors do as well.

When you’re ready to find someone to help you sell your business, evaluate your business and exit goals to determine whether you should seek a broker or an advisor.

Ask yourself:

After you figure out whether your business warrants a broker or advisor, the challenge is finding one.

At Axial, we can help you find the right advisor or broker for your exit, though we specialize in pairing small-to-midsize businesses with M&A advisors.

Our process starts with pairing you with an Exit Consultant who understands your business and your specific exit goals.

Next, we tap into our network of over 2,000 M&A advisors and business brokers to identify the best matches for your goals, business type, and industry.

We evaluate the options in our network based on:

Relevant Deal Experience

Down Funnel Success

Professionalism & Reputation

We send you a curated list of 3–5 highly qualified and vetted advisors, along with detailed insights to help you evaluate each one.

The final interview process is efficient, as you’ll be speaking with top-tier advisors. Additionally, your Exit Consultant will be available to help you navigate the nuances as you make progress on identifying and hiring the best partner.

You can start the process here.