The Winning M&A Advisor [Vol. 1, Issue 4]

Welcome to the 4th issue of the Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

The single biggest fear we hear from business owners is how disruptive change may impact their business. They are concerned that this change could dramatically alter the value of their company. A powerful example of disruptive change is the taxi cab industry. Think of how Uber transformed it, causing disruption (and in some cases bankruptcy), to many long-term, very successful taxi companies. In addition, consider how Uber transformed the lives and daily habits of the consumers that use it.

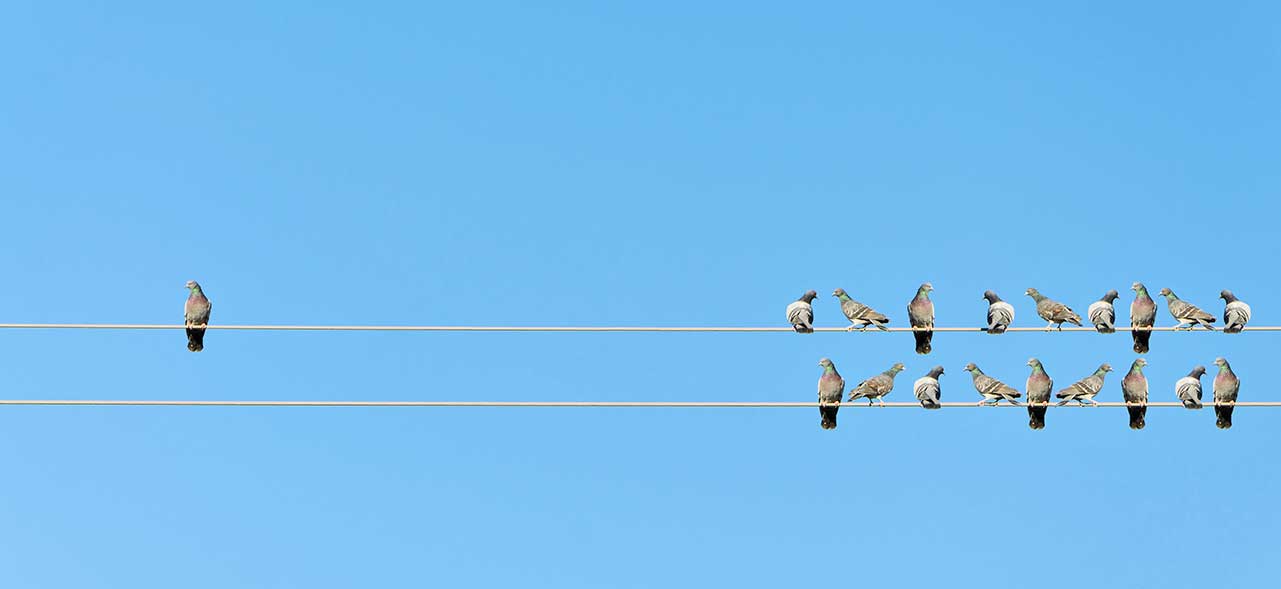

Disruptive change is when there is a shift in the underlying forces of an industry segment. It is not localized to the everyday challenges of running a business; it affects the entire value network. Many times business owners are so busy in the business they do not see the indicators that will ultimately revolutionize their entire industry. This type of disruptive change is going on in every industry, driven by changing technology and consumer behavior. This can be a very positive and profitable time for owners that can step back and look at their business in a different way.

How a business owner responds to these changes will directly impact the value of their company. Companies that remain static and do not fundamentally adapt new methods and a new culture will see its value deteriorate rapidly. On the other hand, those companies that are embracing new technologies, staying nimble, and adapting their business models to the market demands will end up the leaders. In today’s market, standing still is not an option for any business owner.

Acquisitions can be an answer for some companies, as acquiring the talent or technology to be competitive could be an ideal way to meet the market demand. Even in “hot” markets like we have now there are still great opportunities for acquisitions. Since the M&A market is largely inefficient the greatest opportunities are with businesses that are not “on the market.” Where proprietary sales exist, bargains can be had. The key here is understanding how to identify and approach businesses preemptively.

Selling a business at the right point in time can also be a good move for some business owners that want to maximize the value of their investment or manage their risk.

Business magnate Commodore Vanderbilt asserted that he made his fortune by selling all his businesses “too early.” Knowing when is the right time to sell a business is one of the greatest strategic challenges for a business owner. Sell too early and you leave money on the table, sell too late and you will regret it forever.

A business owner should sell their business when they can get the greatest value for their lifetimes work. Making that decision is also a matter of balancing risk and reward. Which is riskier – doing something or doing nothing? Owners need to determine if it is worth investing in the company to keep it competitive and if so, how long it will take for that investment to pay off. Many owners recognize there is a new business reality impacting their company. Factors such as decreased customer loyalty, increased competition, new technologies and industry consolidations are creating a greater risk today than ever before. For many owners cashing out, either in a full or partial sale is the ideal business investment decision. These owners determine that the amount they would need to invest is more than they want to risk, given the uncertainty of the return.