The Winning M&A Advisor [Volume 1, Issue 9]

Welcome to the latest issue of The Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

One of the leading causes of M&A deaths is misaligned valuation expectations. Fair value, or the price that a business can be sold to a knowledgeable third party, can often display as two drastically different numbers based on which side of the table you’re sitting on.

Knowledge is power in valuation negotiations, and knowing what to avoid is key in achieving a successful outcome. Below is a list of common valuation misconceptions that we’ve compiled based on our experience advising business owners throughout the years.

Businesses are valued on multiples of EBIDTA.

This is a common misconception. Businesses are valued on Free Cash Flow discounted for the risk of the business. Free Cash Flow includes deductions for taxes, capital expenses and an owner’s salary. Many business sellers and brokers who do not understand business valuation often mistakenly say the business is valued based on an industry standard multiple of EBIDTA or even SDE (Sellers Discretionary Earnings).

Try telling that to the bank!

The only number that matters when it comes to business valuation and financing a business is Free Cash Flow. Free Cash Flow is the cash that is available after paying taxes, capital expenses and a salary to the owner. While it is true that depreciation is added back to cash flow, large depreciation write-offs are typically an indication that there are significant capital expenses that will come up either sooner or later to replace assets that will wear out. These capital expenses impact Free Cash Flow and must be taken into consideration.

I will get credit for potential future growth in the valuation.

While there are exceptions, a growth rate is typically not included in most small business valuations for the sale of a company. There are several reasons why. First, since a new buyer will be taking over the responsibility and risk of running the business, shouldn’t they get credit for the growth after buying it?

Second – and this involves some theory – a high implied growth rate would mean that even the smallest of businesses would grow exponentially over time to a company worth hundreds of millions of dollars or even more. Since this is not possible, only very limited growth rates are factored in when they are used. Also, most lenders are required to use 3 years of past financials when calculating the cash flow available from the business. They will not give credit for future growth in their valuation calculations.

I should expect to receive the industry average valuation.

No, you most certainly should not. The industry average is just that – an average. That number includes valuations much lower and higher than the average. Each valuation is dependent on a number of factors that vary significantly from company to company, even within the same industry.

For example, if two companies in the same industry have the same amount of Free Cash Flow, but one company has a few customers that account for all the revenue each year and the other one has dozens of customers, there would be much more risk for the one with only a few customers. That company would receive a lower valuation. There are many factors that vary from company to company even in the same industry. These factors are what impacts the final valuation, not industry averages.

I’ll sell the stock, not have to pay off loans and taxes will be capital gains at a lower rate

Wrong! The vast majority of all small business acquisitions are asset sales. That means the buyer will only be acquiring the assets of the company. The seller will keep all long-term liabilities and pay taxes based on selling the assets not the stock of the company.

In an asset sale, the seller is most often responsible for paying off all the long-term liabilities out of the proceeds of the sale. The proceeds will be subject to higher taxes from an asset sale than capital gains tax that are paid on a stock sale. It is critical to consult with a tax professional who can help develop the right strategy and advise on how the tax liability will impact your net valuation.

I’ve been running a large amount of expenses through the company to reduce my taxable income, but I can just add them back to my “adjusted” cash flow and get credit in my valuation

In today’s post-financial-crisis world, lenders have to use tax returns to substantiate cash flow. This means that the cash flow that is reported on the tax return will be used in their valuation. Many sellers are caught off guard by this as they typically try to reduce taxable income to minimize taxes. The best strategy for this is to simply suck it up, recognize the income, and pay the taxes. In the long run it will not only increase valuation, but it will add substantial credibility as well. A potential buyer may be thinking, if you cheat on your taxes what else will you cheat on?

There is only one acceptable method to value a business

Since I teach and consult in the area of business acquisitions and valuations of privately held companies with no market to buy or sell their shares, my focus in this article has been in that area.

However, supply and demand and market forces can also establish value. Especially when it comes to early stage or venture capital investment, or when there is a large market of buyers and sellers, and certainly when there is a publicly traded market.

However, the question that valuation theorists would still ask at that point would be, “Is the market price really the fair value price?” Think back to the internet bubble of the late 1990’s or crash of 2007–2008. In hindsight, greed and fear drove the markets to unsustainable highs and unrealistic lows. Valuation purists would argue that expected cash flows discounted for the risk would still be the best way to value a company even if there is a public market or large enough number of buyers and sellers to set a market price.

Valuations won’t change much over a short time period

Valuations – even those of small privately held companies with no market for the shares – can change at any given minute. Anything that impacts the free cash flow of a business or the risk associated with them will change the value.

As an example, we were in the middle of several valuations when corporate taxes were cut to 21%. Since this increased the free cash flow of the companies we were valuing, we increased our valuation based on the expected increase in free cash flow from the tax cuts. Think about the value of a company at the time they lose their biggest customer, key manager or a new innovative competitive product hits the market. The value of that company will change immediately.

All of our valuation reports have a specific disclaimer that says the valuation is only good based on the effective date of the valuation report. Don’t be fooled by estimating value based on a report that is not up to date

The value of my business is equal to my land and building plus my business

A challenge we see in seller owned real estate is when the value of the real estate has appreciated and the fair market rent expense that is charged to the business has not kept up with the increase in property value.

We recently completed a valuation on a business with real estate. Over the years the land value increased to several million dollars. The business had cash flow of several hundred thousand dollars but was not recording any rent expense. When we added back fair market rent, virtually all the profits from the business disappeared. The business in its location had no value because the profits could not cover the cost to buy the real estate and pay the debt payment or rent the real estate at fair market value. The owner was unhappy and insisted that we separate out the value of the land & the business and then add them together. But the only way we could do that would be if he sold the real estate and moved the business. He said, “If I do that, I would have to relocate the business and it wouldn’t be worth much.” Exactly our point! The business was not worth much if moved from the prime location, but if charged the true rental cost to keep it there it was worth very little as well.

The more assets I have in my business the more valuable it is.

This is another very common valuation misconception. Business value is based on a company’s ability to generate cash flow. The assets within the business are just a part of the component that creates cash flow. Lenders, investors, business buyers and entrepreneurs want a return on their investment in the form of debt repayment, dividends or capital gains from the ultimate sale of the business. They do not want to liquidate assets to achieve this.

Many business owners and students are often surprised to learn that an asset light business, like a software or service company, with the same revenue and income as an asset heavy business are typically valued higher. The main reason for this is that equipment, machinery and other tangible assets will wear out and will have to be repaired and replaced thus using cash flow that could have otherwise gone to investors, lenders or the business owners.

While it is true that having a lot of tangible assets may make “borrowing” easier, it does not mean that the business will be valued higher.

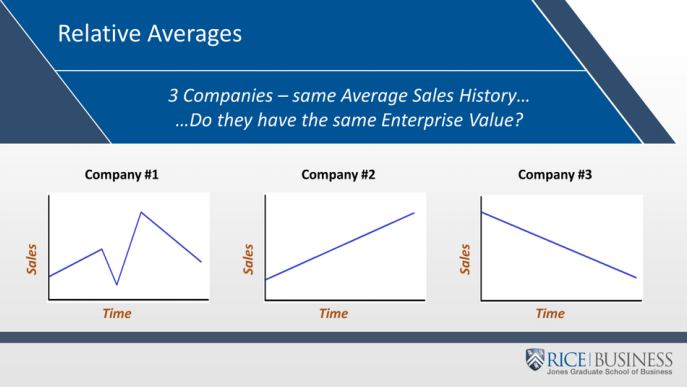

Companies with similar sales and revenue averages within an industry will have the same valuation.

The above statement is one of the most common Business Valuation Misconceptions I hear. The image below is from my MBA class on valuation. The three companies below all have the same revenue and income averages. Without knowing anything about each company or even valuation, do you think they have the same valuation?

I know the standard valuation multiple in my industry, so I can just apply that to the Cash Flow to get a ballpark valuation?

Don’t ever forget that companies in the same industry, in the same city with the exact same revenue and income can have a wide range of value. The value of a business should not ever be based by simply comparing it to another company in the industry or by saying this is the “average” in my industry. There are just too many different variables and risks that are unique to each specific company. The “average” is just the central point of a wide range of values. As I tell my MBA students, if I ever hear them say the valuation of the company is just based on a multiple of the cash flows times an industry average, I will revoke their MBA!

About Exit Advisors

Exit Advisors is a Houston, TX based firm that specializes in Mergers & Acquisition (M&A) Advisory and Exit Strategy for privately held companies with transaction sizes ranging from $10-$50 million. Founded by entrepreneurs who have built, operated, and grown successful businesses, Exit Advisors’ partners are not only experienced in handling major transactions for clients but have also engaged in acquisitions and exits of their own. Exit Advisors understands M&A transactions from both the business owner’s and buyer’s perspective and can share that knowledge with their clients.