Industry Report: Consumer Residential Services Q4 2025 [Bridgepoint IB]

Key Report Highlights Steady Market Growth Driven by Demographics and Outsourcing Trends The U.S. residential landscaping market is projected to…

Tags

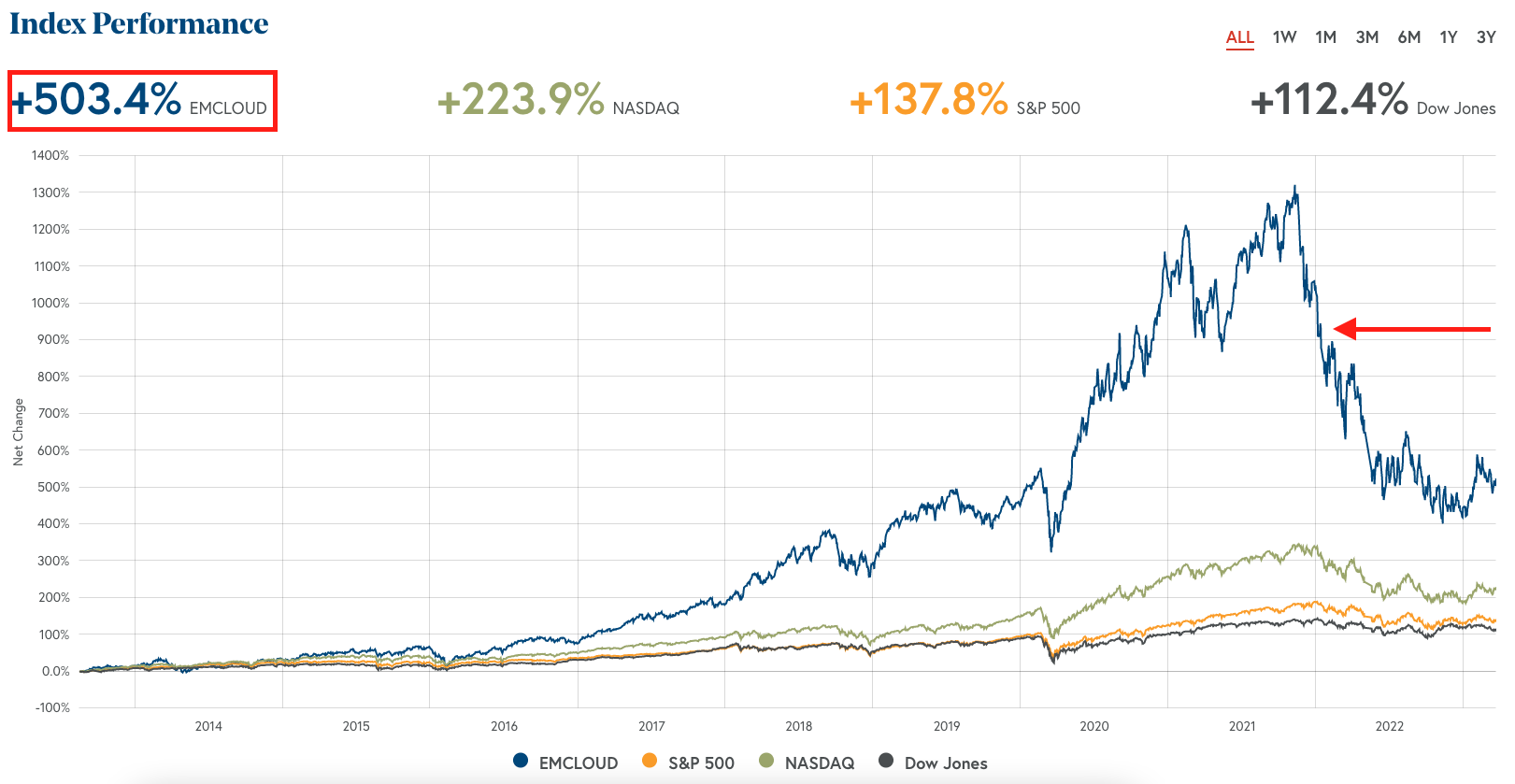

Cloud software was enjoying incredible growth in category size, market capitalization, and equity performance. Then the music stopped… Major changes in interest rate policy and other macroeconomic factors are forcing operators and investors to question how much of cloud software’s success and value creation is simply a zero interest rate policy (ZIRP) phenomenon.

Source: The BVP Nasdaq Emerging Cloud Index

As such, we thought it was a prescient time to check in with some of the top M&A bankers and software acquirers in the lower middle market in 2023, which we gauged by looking at which firms were most active on the Axial platform last year.

Axial recently surveyed these top 50 members in the software space about current challenges and opportunities as they navigate a changing software market. Survey questions included:

This article cites 10 of those leaders, a mix of buyside and sell-side firms:

This is part 1 of a 2 part series:

Part 1: A Focus on Profitability | Advice for Investors & Operators

Part 2: Deal Activity | Buyer Interest | Hot & Cold Sectors

📈 |

📉 |

| “Our expectation is inflationary headwinds will continue to be offset by the Fed but the expectation of a deep recession may be overblown”

Michael Gravel – iMerge Advisors Inc |

“While recession appears to be receding as a concern, its potential is far from being eliminated. In addition, the dramatically higher cost of capital looks to be with us for a while, mandating discipline when pricing a deal”

Martin Magida – Berkery Noyes |

| “No need to be more cautious. Deals are still getting done. Plenty of capital available from Private Equity firms which keeps the activity going”

John Norton – ACT Capital Advisors |

“As threat of deep recession is still looming, interest rates remain elevated in the near term could lead to a long road to recovery ahead, therefore impact on valuation multiples and could impact exit timing and returns due to tech volatility”

Muhammad Azfar – Auctus Capital Partners |

|

💨 Tailwinds |

Headwinds 💨 |

| Plenty of dry powder available from Private Equity firms, with many new buyside market entrants | Continued interest hikes might come and the cost of capital may continue to rise |

| General stability within Lower Mid Market M&A compared with other asset classes | Existing valuation comps may no longer be relevant |

| Software companies that offer mission critical solutions with high switching costs are always appealing. And this becomes especially relevant in a market where making safer bets is a top priority for buyers | Companies could run into cash flow problems if they are not properly navigating the turbulent waters |

| $5M-10M revenue businesses in attractive sectors (e.g. cybersecurity, gov-tech, health-tech, fintech) that are resilient to the macro environment and have a clear path to profitability (if not already profitable) will continue to be in high demand | Buyers and sellers are nervous about the economy, which slows down activity |

In the software industry, revenue growth has historically been emphasized as the primary indicator of company value. Over the past decade, executives and investors in the software space have prioritized it at the expense of profitability. As Scott Mitchell from Investment Bank SDR Ventures says, “many buyers are looking at EBITDA multiples for the first time in a long time instead of just basing multiples off ARR growth. Most software companies had historically focused on topline growth over optimizing their operating cash flow.”

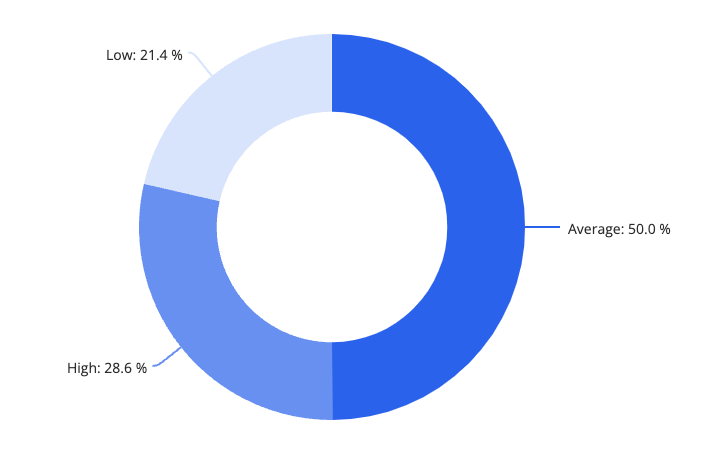

This growth at all costs operating philosophy has been upended largely in line with the rout in equity prices for fast growing cash burning software companies. Investors, boards and management teams have pivoted towards a disciplined focus on profitability due to macroeconomic pressures and uncertainty.

The dynamic is also forcing software business operators to pay extra attention to controlling costs and striving for financial stability, while their customers take a harder look at their spend. “Software businesses are facing somewhat of an industrial revolution,” remarked Ryan Khan of PE firm Atlasview Equity. “The cost of capital has increased and is now forcing businesses to keep a close eye on the bottom line. This means becoming leaner and more efficient.” In this new economic climate, he believes that “companies are going to look closely at their core business model and start to reevaluate non-core assets due to capital allocation decisions.”

Sustainably Funding Organic Growth

“Across the board, we are seeing owners and founders trying to figure out sustainable growth,” comments Matt Althauser of holding company, Polychrome. “This has become increasingly difficult with so much venture money being thrown after inefficient marketing & sales channels.”

Many operators are now understanding that exorbitant valuations are not in the cards for the foreseeable future. To accommodate this shift, they are either adjusting to the market or delaying the sale of their businesses until the market recovers.

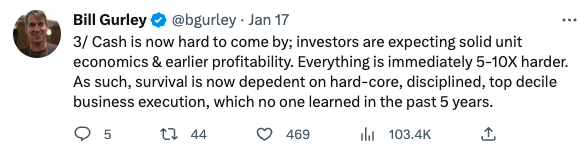

Source: Axial Deal Activity Data

We’ve seen this trend reflected in Axial’s deal activity within the software space. Businesses with breakeven or negative profitability have accounted for significantly lower portions of total software deal volume over the past four quarters, suggesting that businesses with lower margins are less prominently going to market to find an acquirer.

Focus on Retention

When facing macroeconomic headwinds, businesses have to be laser focused on both employee and customer retention. “For our segment of the market (the lower middle market) finding and retaining talent is still an issue,” says Martin Magida, Managing Director at investment bank Berkery Noyes. “Layoffs are not part of their current plan.”

On the customer side, retention remains a critical priority for software businesses as customers scrutinize their expenses and seek cheaper alternatives. According to Scott Mitchell from SDR Ventures, “digital transformation is being viewed by some companies as ‘discretionary’ as they buckle up for tighter budgets this year. This is causing some softness in new opportunities for suppliers of software products and services.”

Customer retention challenges are more prevalent for certain software businesses based on the end-markets they serve. Scott Mitchell of SDR Ventures mentions, “products that enhance marketing efforts or enable travel, entertainment, and events” are bound to have a tough time with retaining customers due to their discretionary nature. Meanwhile, Stan Gowisnock of Focus Investment Bank says, “Cybersecurity and MSPs are better positioned to weather continued volatility in the market” due to their non-discretionary nature.

Level-Set Valuation Expectations

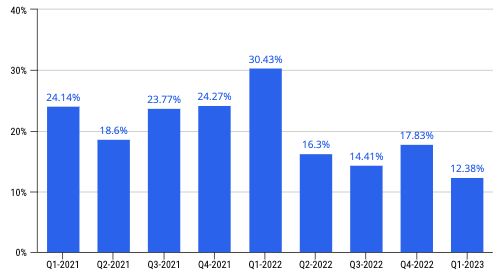

When polled, 50% of survey respondents indicated that they expect software valuations to remain at average levels.

Source: Axial Survey Data

That said, many respondents agreed that software businesses continue to face greater degrees of scrutiny from potential acquirers. Despite this reality, acquirers say that those committed to selling have yet to stray away from a valuation methodology predicated on revenue multiples. “The sell side of the software industry is facing increasing pressure to be able to reduce the spread between the buyer and seller price. Sellers are emotional and they are anchored to the high ARR multiples, and buyers are looking at cash flow positive / EBITDA multiple deals,” remarked Ryan Khan of PE firm Atlasview Equity. This mismatch in valuation metrics has made it difficult to reach a mutually acceptable purchase price in recent months.

Scott Mitchell of SDR Ventures also brought this to attention. He said, “euphoric multiples on modest ARR were somewhat common over the last 5 years, but are mostly not available right now if companies aren’t truly best in class.”

According to Stan Gowisnock at Focus Investment Bank, “Valuations for high quality assets will likely remain unchanged (as is common regardless of the economic cycle). Conversely, low quality assets (i.e. unproven technology, lack of scale, small addressable market) will struggle to raise capital at competitive rates.” Software operators will need to thoroughly understand the current market and set expectations based on the states of their businesses.

Finding Goods Deals at Good Prices

While survey respondents indicated that it is difficult for investors to find good acquisition targets in any environment, it has become especially difficult over the past three or four quarters. As a result, investors are increasingly becoming highly selective with the deals they choose to pursue.

This has heightened the importance of business development, especially for buyers and investors that don’t have exceptional brand-name recognition in the industry. Matt Althauser at Polychrome, is turning to “outbound efforts, where we generate the relationship ourselves.” Meanwhile, Ryan at Atlasview plans to “lean heavily on intermediaries for platform searches while strategically pursuing proprietary deal flow.”

Source: Axial CRM Data

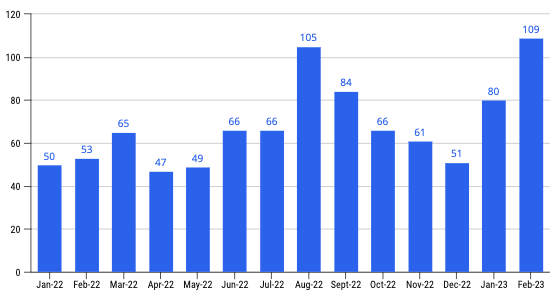

Investors’ increased focus on business development and differentiated deal sourcing channels is apparent in Axial platform data, where we’ve seen an influx of acquirers joining during the first two months of 2023.

Prioritizing Mission Critical Software

Mission critical software is the key area of M&A focus based on survey responses. According to Scott Mitchell of SDR Ventures, these are software solutions like “horizontal software that supports core business operations, the common operating environment or spend reduction”, or “vertical software in industries that are less prone to cyclical end-markets”.

Mission critical software is appealing because it is used to manage sensitive information or processes, where downtime can have significant implications. Software companies that offer mission critical solutions with high switching costs are “especially relevant in a market where making safer bets is a top priority for buyers” according to Matt Tortora from BMI Mergers & Acquisitions.

Maintaining a Deep Bench of Capital Sources

Higher borrowing costs are presenting significant challenges in financing software M&A transactions. “The debt markets can shut down at any time and buyers need to be able to use cash to close the gap at any moment,” says Ryan Khan from Atlasview Equity. “We have a 100% close rate on LOIs because we have relationships across multiple capital stacks, and this gives confidence to sellers in our ability to deliver on our promises.”

As a result, acquirers are proceeding with caution, examining leverage ratios and optimizing capital structures. “Too much leverage can potentially derail growth and too little leverage can leave a lot of value for buyers” continues Khan. His firm is spending a lot of time “understanding different business cases to get the optimal leverage” for their deals.

Obsessing over Deal Structures & Due Diligence

Many investors are saying that the current environment places a heightened importance on innovative deal structures and thoughtful, deliberate deal diligence. We’ve started to surface some of these interesting deal terms and structures in our bi-weekly newsletter, the “Winning LOI.” At the end of ‘22, Axial also launched a Q of E referral program, responding to claims from buyers that their typical Q of E relationships were booked, and they were in need of finding new relationships. To learn more, check out the program here.

Tune into Part 2 of this piece in the coming weeks where we feature:

Axial’s Top 50 software list was generated based on a weighted formula leveraging private transaction data from the Axial platform.

Metrics in the formula include: