How to Maximize Business Value Before You Sell

Whether you’re planning to sell or aiming for growth, these five strategies will help you understand and maximize your business value.

Advisors, Business Owners, Buyers, Family Offices, Private Equity

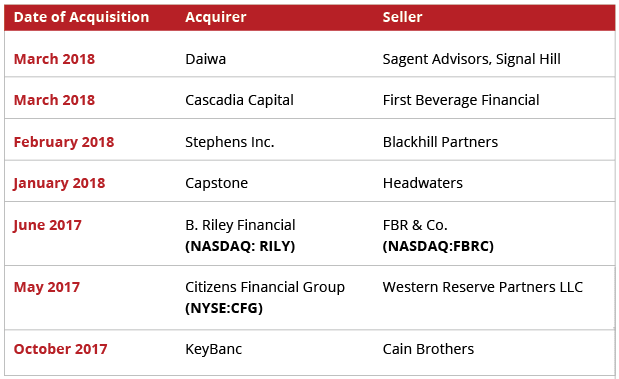

In today’s competitive M&A environment, private equity firms and strategic acquirers are hungry for deals. At the same time, they are offloading saleable assets while valuations continue to soar. To capture as much market share as possible, investment banks have been looking for ways to expand their reach. And just like many of their clients, investment banks know the fastest path to growth is through acquisitions. Banks such as Daiwa Securities Group, Capstone Partners LLC, and KeyBanc among others have all bought complementary investments banking businesses recently. Most professionals believe this is a trend that will continue.

“You will see more M&A in the banking industry. There was an intense period of consolidation of banking firms until 2000 and then new platforms were built and now there is a period of consolidation again,” says Scott Wieler, newly minted chairman of DCS Advisory, Daiwa’s newest U.S.-based banking entity, and founder of Signal Hill, predecessor firm to DCS Advisory. “I am sure we will see platform creation again in the next 10 years. That’s the circle of life.”

In March, Signal Hill Holdings and Sagent Advisors merged after being bought by Daiwa Securities, Japan’s second largest brokerage firm. The new firm, DCS Advisory, expanded Daiwa’s reach to the U.S. with the goal of giving clients greater access to buyers and sellers all over the world.

“We have scaled and from a portfolio perspective, we have reduced our risk profile as well. We are balanced with our product offering and the industry vertical expertise. That gives us staying power,” says Wieler.

John Ferrara, the founder of Capstone and now CEO of Capstone Headwaters, says he also expects to see more deals announced in the investment banking sector. “The days of the local or even regional firm are over. Having scale, reach, reputation, and senior people with industry expertise is the ante today. Private business owners are more sophisticated and expect more from investment banking firms today. The competition has intensified so I think banks will continue to make strategic moves to gain a competitive advantage. We see the landscape shifting and are getting out in front of it,” he says.

In January, Capstone acquired Headwaters to form Capstone Headwaters. The combination brought 150 professionals together and took the bank from having expertise in seven industry verticals to 16, spanning 20 offices in the U.S., U.K., and Brazil.

The investment banks that did engage in M&A transactions did so for different reasons, but the majority of them added industry vertical capabilities and expect to benefit from the scale of having a larger presence, in some cases globally.

“The economy is international in nature and fully integrated today and that accounts for why a healthy amount of international deals exist. Global thinking will not only continue, but increase,” says Doug Ellenoff, a founding partner with Ellenoff Grossman & Schole, a full services law firm that specializes in financial services transactions. “And if you are pitching business, the greater the footprint you have, the higher likelihood you will be selected for the business.”

This is of particular importance to Daiwa as Japanese corporate buyers have recently become more aggressive internationally, as a result of limited opportunities in their own country. Japanese buyers are more frequently seeking technology, intellectual property, and corporate assets in the higher growth markets of Europe and North America.

According to Thomson Reuters, in 2016, total M&A transactions in Japan reached $198 billion and over half the volume came from outbound deals— a 13 percent increase from the year before. Buying and then merging Sagent and Signal Hill gave Daiwa expertise in the U.S. in multiple sectors. As part of the Daiwa Securities Group, DCS Advisory in combination with DC Advisory, Daiwa’s European arm, and other alliance partners, will have more than 900 professionals in 37 offices throughout the Americas, Europe, and Asia.

“Institutional clients in Asia, and particularly in Japan, want to invest into other markets. They have a need to diversify. Most companies in Japan are cash flow positive, but they can’t find sufficient internal growth so investors need to look at other markets,” says Wieler.

Conversely, as Japanese buyers scour the U.S. for deals, U.S. investors hope Japanese buyers are willing to pay the highest prices to diversify their holdings. “U.S. sellers are always wondering if a Chinese or a Japanese buyer may be the biggest payor in the space and they very well may be,” says Wieler.

However, while scale plays a role, most banks will say that size is not the only thing they’re after.

“Not every firm is expanding and merging in M&A for the same reasons, but it does allow the firms to compete more competitively as it broadens out their capabilities. It’s not just about getting larger for the sake of getting larger,” says Ellenoff. “But the larger size does allow banks to go after more complex deals.”

Adding skilled talent was one of the reasons Headwaters agreed to sell to Capstone. The bank struggled to find skilled bankers with the specialization needed to sell a diverse group of businesses founded by aging baby boomers.

“Bigger doesn’t mean better, but bigger can help you get better because you are adding great talent and raising the bar. It’s not dissimilar to the buyers we work with that seek the power of scale,” says Ferrara.

Being part of a larger investment bank also helps with talent retention. Years ago investment banking was a profession unto itself. Today, investment banks are competing with private equity firms, technology companies, and many Fortune 500 companies for the brightest talent. “The experience you are giving people really matters. We give people a window into many industries and it’s easy for them to cross the street. To be a great firm you have to challenge and retain these people. By joining forces, we have really upped the quality of the experience for our professionals,” says Wieler. “It’s really hard to grow your business one investment banker at a time, and it takes enormous effort to recruit and train the right people.”

The buyout of Headwaters quickly made Capstone a much more recognizable entity, much faster than if they had embarked on a build strategy alone. “When considering a transaction like this the question is always should I build it or buy it? The market is so strong right now. Speed to market is very compelling so buying made the most sense,” says Ferrera.“We now have 150 active transactions in the market at any given point in time. That makes us more relevant. It’s not because we are just bigger. We have deeper expertise and we are out in the market more aggressively with more sophisticated capabilities. The transaction represents a leadership move for us and the early synergies are already paying great dividends.”

Other banks have seen the same opportunity. In 2016, commercial bank Citizens Financial Group, Inc. [NYSE: CFG] published its sixth annual Middle Market M&A Outlook, in which the bank realized that having investment banking capabilities would be key with 73 percent of potential buyers and 53 percent of potential sellers responding to the survey that they are either currently involved in or open to considering a strategic transaction — not surprising given the aging baby boomer population.

As a result, the bank launched a broker dealer arm in 2016 and in May 2017 acquired Western Reserve Partners LLC, a Cleveland-based M&A firm with a focus on middle market clients. The acquisition, Citizen Capital Markets’ first, accelerated the build out of its M&A and financial advisory capabilities.

Nine years into a bull market, bankers know that they need to be ready for the next cycle. Having more capabilities, including potentially recession-proof industry expertise, is one way for investment banks to offset risk.

For example, KeyBanc Capital Market, the investment banking arm of the $136 billion-asset KeyCorp., purchased Cain Brothers in the third quarter of 2017. New York-based Cain Brothers advised both for-profit and not-for-profit healthcare organizations on M&A strategies. While KeyBanc already provided services to the healthcare sector, Cain Brothers significantly expanded its reach at a time when healthcare M&A is booming as a result of the aging baby boomer population. The healthcare sector is expected to grow faster than the U.S. economy over the next several years and this deal supplements KeyBanc’s capabilities.

More recently, in February, Stephens Inc., a New York-based investment bank, bought Dallas-based Blackhill Partners to lead its new North American restructuring advisory business.

“We have experienced a strong appetite for restructuring expertise in our Stephens Europe Limited operation, and the addition of Blackhill better positions us to service the growing opportunity in the domestic market,” said Brad Eichler, executive vice president and head of investment banking at Stephens. Stephens’ U.S. restructuring advisory practice comprises of 14 former Blackhill professionals.

Ellenoff Grossman & Schole attorney Ellenoff also notes that while he expects consolidation among the investment banks to continue, he wonders who will handle the smaller deals when the economy reserves course.”There is a pull to get larger and move up market. As firms get larger they won’t be able to handle smaller assignments because it won’t make sense from an economic standpoint,” says Ellenoff. “When you look at the pyramid of opportunities everyone is chasing upward deals, but what will happen to the small dealmakers?”