Add-On Demand in the LMM: A Data-Driven Look at Buyer Activity

Most successful businesses adopt both organic and inorganic growth strategies. And add-on acquisitions remain one of the most widely used…

The recent events in Ukraine have thrusted the defense sector into the spotlight. Russia’s invasion kickstarted a flurry of defense spending in Europe and has forced the West to reassess its military posture. As a result, the aerospace and defense industry, a sector that has historically stayed out of the M&A spotlight, has garnered a new and increased focus from advisors and investors alike.

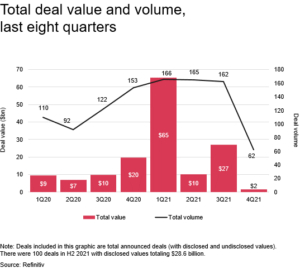

In its Deals 2022 Outlook, PricewaterhouseCoopers reported an increase in worldwide defense budgets in 2021. However, at the end of last year, deal volumes and value fell precipitously, reflecting a broader trend of lesser, specialized activity in the defense sector.

Source: PWC, Deals 2022 Outlook

What does all of this mean for the LMM? What new opportunities are there for businesses in the defense sector?

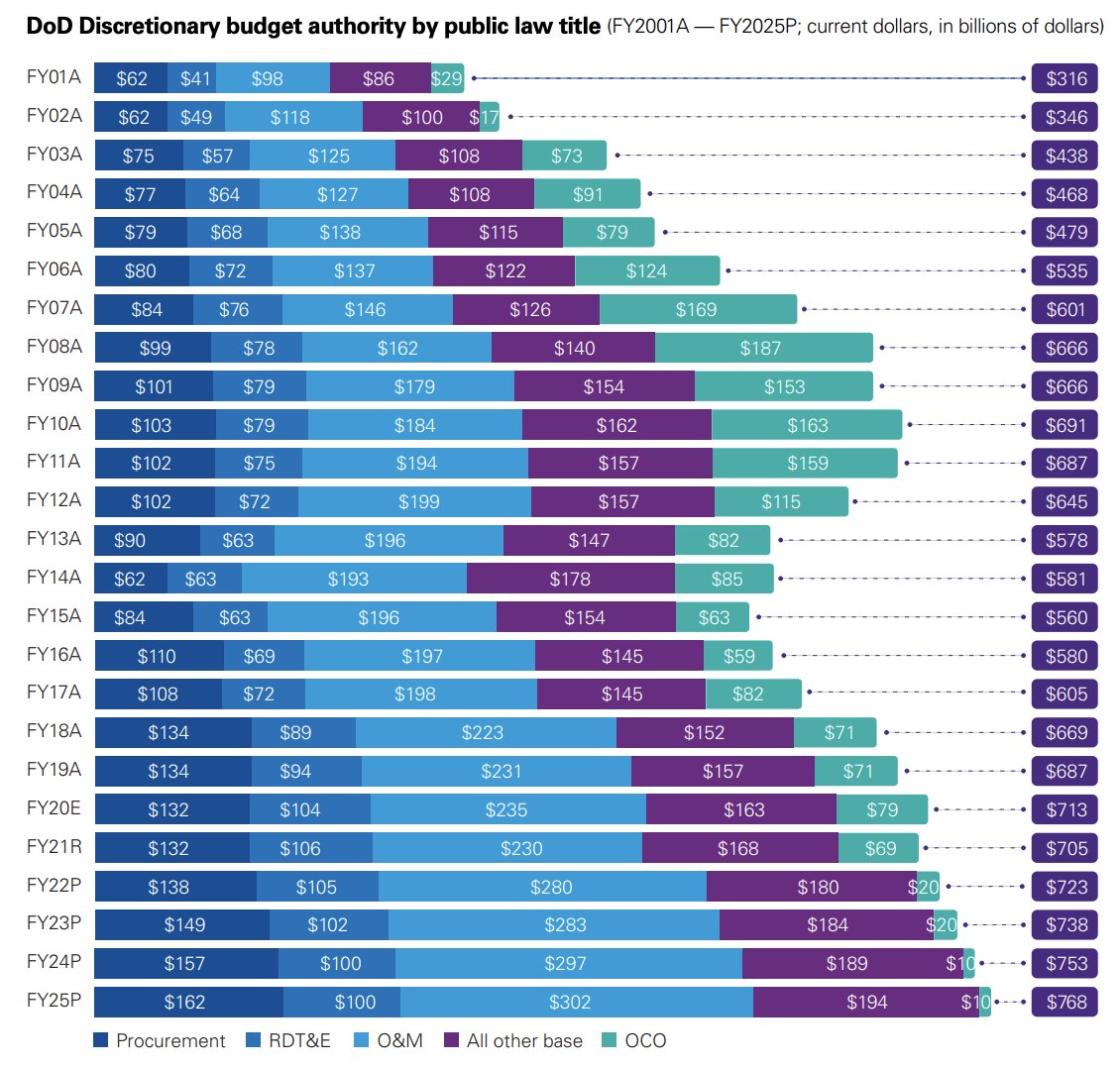

KPMG reports that the FY2021 US Department of Defense (DoD) budget projects 1.5 percent annual growth over the next five years, which is a small-scale increase compared to some other global players. The United Kingdom (UK), for example, announced an injection of $22.9 billion into shoring up defense capabilities over the next four years, representing a 10-15 percent increase over the current $58 billion annual budget.

Source: KPMG, The Private Equity Opportunity in Aerospace & Defense

Interestingly enough, all of these announcements occurred before any news of Russian aggression. Barry Calogero, Managing Director and Government Team Leader at Focus Investment Banking, believes these moves may have occurred due to changes in the geopolitical picture that are unlikely to shift soon.

“The United States has to fundamentally decide if we’re going to disengage or if we’re going to put forward troops in place to create a defensive posture,” he says. “The use of newer technology will change how the US does forward planning in the future.”

Given Europe’s aging defense infrastructure, purchases of American-made equipment are imminent. Furthermore, supply chain delays across a slew of industries and a commitment to reshoring American defense manufacturing promises to create significant opportunities for LMM businesses.

“If you look around army bases in the US, you’ll find a local contractor support community,” says Calogero. “There are large companies involved in deployment, but there is a huge number of small companies out there as well.”

Over the last few years, manufacturing has moved back onshore to reduce dependency on countries like China, creating significant opportunity for US manufacturing businesses to step up to the plate. Because of this, procurement and supply will continue to offer LMM firms a great way to leverage the increased spending on defense.

Following news that circuit boards in Lockheed Martin’s F-35 jet were manufactured by a Chinese-owned firm Exception PCB, there were immediate calls to onshore sensitive manufacturing processes. This is just one example among many that demonstrates the opportunity that lies inservicing, maintenance, micro-electronics, and training sectors. And being that military sectors in the US have done a great job spotting and integrating smaller firms in the past, it is expected that this trend will only continue to increase.

“Whether you forward deploy soldiers or human intelligence officers, there’s a long supply chain,” says Claudio Ochoa, Managing Director at Donovan Capital Group. “One of the biggest growth areas we’ve seen is analyzing the massive amount of data from different sources.”

Given the sensitive nature of defense contracts, one would imagine there is a need for firms to vertically integrate their services. However, this isn’t always the case. Ochoa points out that much depends on the nature of the service offered and the business in question.

Technology offers the most obvious opportunity for LMM tech firms to contribute to the defense sector, with everything from micro-electronics to cybersecurity components acting as main priorities across the industry.

It is not only businesses that stand to benefit from these changes, but LMM investors stand to benefit as well. According to National Aerospace and Defense Industry leader Jim Adams of KPMG, cash flow crunches caused by the COVID pandemic will force the vertical re-integration of tier 3 and 4 suppliers to create economies of scale.

With OEMs and Primes focusing on reducing Capex, conserving cash flow, and de-prioritizing vertical integration, the opportunity for PE to drive value is immense. However, this is not an easy feat and generalist funds will face significant challenges when going up against the experts. The defense sector speaks a unique language, and the sell-side values industry knowledge and experience just as much, if not more so than money in the bank.

“It’s not just the language,” says Calogero. “You have to understand how the procurement process works to be really effective in this space. Several firms specialize in certain aspects of defense contracting.” He further believes that it will be these firms that appeal to business owners who are looking for a partner. “Understanding their space is really important.”

Company founders across the industry tend to have a defense or contracting background and they typically specialize in one portion of the procurement process before consolidating multiple services. Generalist firms can work with a consultant to gain access to opportunities, but given the slowdown in the commercial aerospace sector, there will continue to be competition for deals in defense.

“We’re seeing a lot of competition,” Ochoa says. “There are private equity players in this space with traditional buyout strategies and larger shops rolling out a debt strategy. We’re also seeing a lot of generalists with capital entering the market since last year, offering generous terms.”

Governments worldwide have responded to the latest geopolitical events by shoring up defense allocations. However, how long will this push last, and is there any risk of this trend fading away? “Money flowing into government budgets has fundamentally changed,” says Calogero. “Unfortunately, this conflict is not ending soon. Remember, the US was in Afghanistan for 20 years.”

“There’s this thought that we might be entering a period of indirect tension, if not direct conflict,” Ochoa says. “As long as that exists, there will be a need to strengthen our ability to respond. That goes beyond the number of soldiers to supply chain, manufacturing, technology, and so on.”

Time will only tell the direction that global relations will take us. But as for right now, the defense sector is in the spotlight and will continue to provide opportunity across the lower middle market.