The SMB M&A Pipeline: Q4 2024

Welcome to the Q4 2024 issue of The SMB M&A Pipeline, the quarterly series that surfaces a top-of-the-funnel breakdown of…

If it seems like the discussion of environmental, social, and governance is everywhere these days, you’re not wrong: it is. As one commentator recently observed, “From the humble bank loan to a complex swap, there is virtually no corner of finance for which an ESG product hasn’t been created.” But the development of these financial products is far from mere opportunism—far from more “greenwashing.”

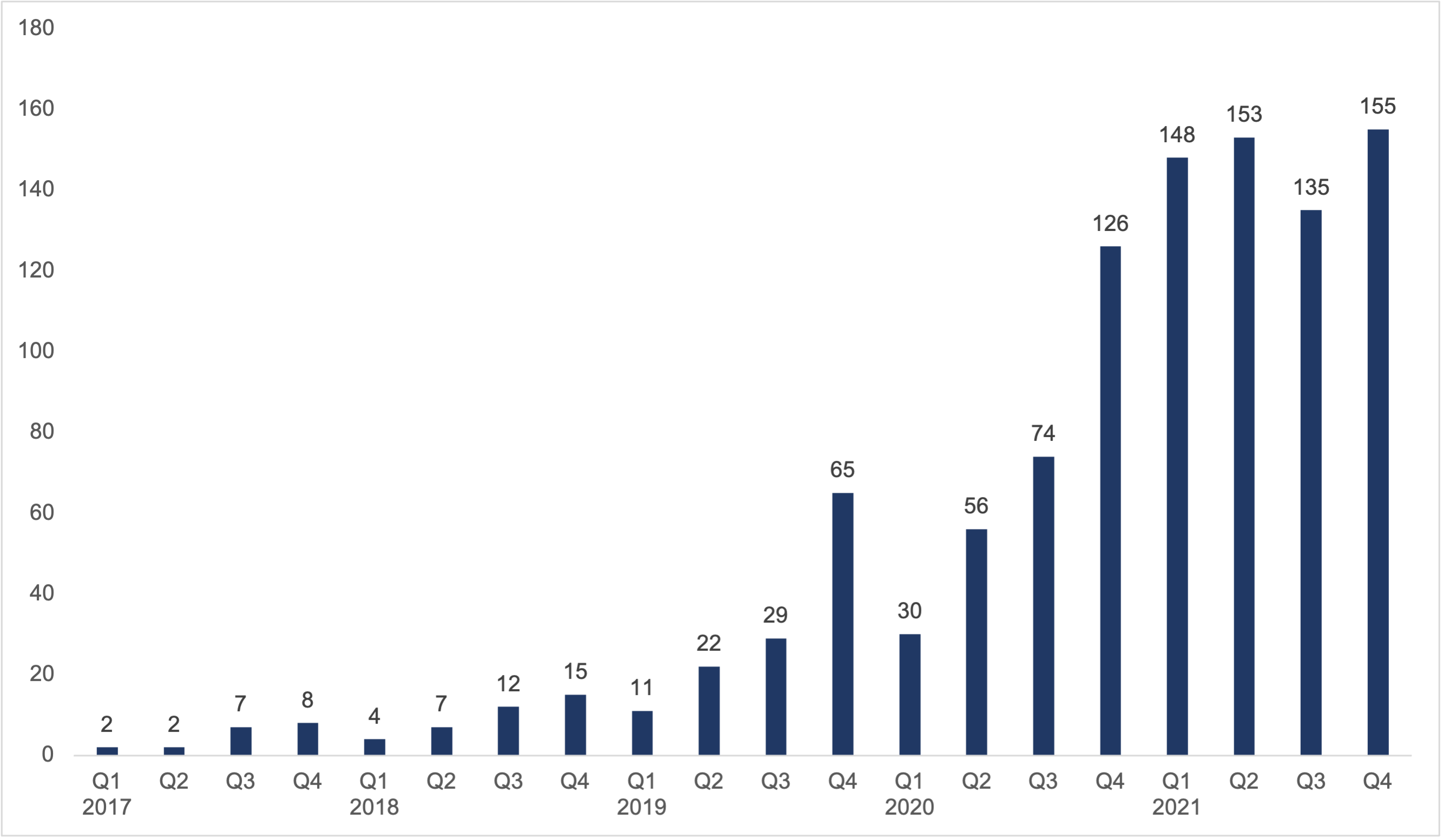

Rather, the development parallels the rapid increase in the importance of ESG to executives at the world’s largest companies. Their discussion of ESG’s impact on the enterprise accelerated starting in 2020 as COVID-19 began spreading globally in Q1, civil unrest over social inequity erupted in Q2, and predictions from climate models grew increasingly dire throughout the year.

A quick regression analysis of these data points reveals a solid R-squared value of 0.815, meaning 81.5% of the variation in the output—elevated levels of ESG discussion—is largely explained by the input. In this case, the proximate input is mounting pressure from investors to take more responsibility for improving the enterprise’s impact on the environment across operations while also tackling an array of social issues and bettering corporate governance.

As no less a figure than AQR’s Cliff Asness recently remarked, “Like in other forms of ESG investment there are really two approaches: one is engagement on impact with a company. […] But most of the ESG world is still about portfolio decisions: choosing not to own or to own less than you normally would have of the offenders, for want of a better word.”

But there’s an ultimate cause at work here as well. The recent upsurge of pressure from investors started with the wider public—the stakeholders, not just the shareholders—and it emerged much, much earlier than the historic events of 2020.

“Consumers have long had a high level of awareness and sensitivity to doing the right things for our planet and are receptive to doing the right thing with the right support in place,” Patricia Stensrud, MD with Avalon Net Worth, has observed. “In the end, you cannot be long-term successful without serving investors and consumers alike in the near term.”

These forces have, in tandem and over time, helped the consensus around ESG to narrow significantly. However, as most dealmakers across the lower middle market know, achieving consensus is just the beginning. Measuring impact remains paramount. The result has been a transition for dealmakers in recent years from leveraging ESG to screen out Asness’s “offenders” to supporting impact investment decisions across the portfolio.

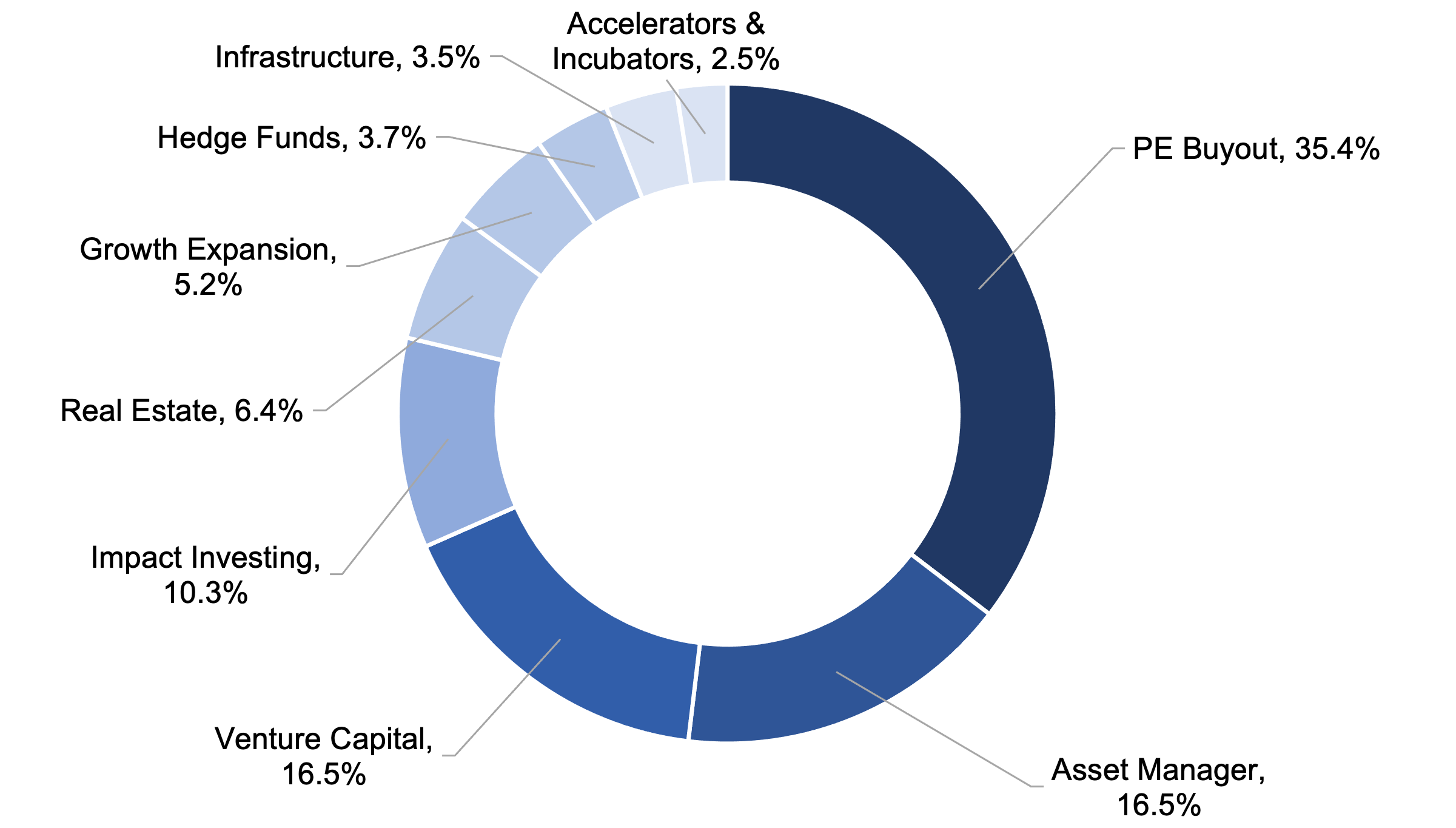

“We see a rapidly growing interest in/focus on impact and sustainable investing,” observe Lindsay Adam Weiss, Robert Fedrock, and Karen Fisman, executives involved with ESG initiatives at Toronto-based Origin Merchant Partners. “We are finding that ‘ESG’ is often used synonymously with this type of investment. There is certainly growing interest in ESG-centric investment/acquisition opportunities across the size spectrum—from VCs to lower mid-market and mid-market investors, to investors at the largest end of the market, with many strategics (corporations) establishing their own impact-focused venture funds.”

Meanwhile, recent regulatory moves by the SEC seeking to formalize ESG standards for private market compliance would codify investor sentiment in this way. In a statement released in late May, the SEC declared that investor demand for ESG information will require taking “an all-agency approach.” Although formalizing ESG reporting standards for compliance will no doubt put additional pressure on firms across the private markets to implement or improve programs, significant challenges continue to dog the “surprisingly complex issue” of ESG measurement, as a recent piece from the Kenan Institute of Private Enterprise recently put it. These ESG data can help to assess risk, reward, and management effectiveness overall. But methodologies and implications of results for investors can vary considerably, not least by industry.

As Stensrud has argued, “Metrics without measurement are meaningless, and it takes appropriate tools and significant manpower to get it right—defining and establishing standards is going to take some time. At the same time, sector specifics remain a challenge. While fossil fuels are maybe an obvious target for decarbonization measurement, their relevance and measurement for other industries may be more obscure.”

Indeed, “E,” “S,” and “G” can themselves vary in relevance and materiality across sectors and business models. These nuances have already informed investor interests in ESG opportunities across the private markets coming into 2022.

“If everyone tried to do good, despite slightly different definitions, the aggregate event would be positive,” Sasha Grutman, partner at Middlemarch Partners, has argued. “The problem is that everyone is trying to standardize around a series of metrics to facilitate comparisons, and it’s very difficult. It’s also open to gaming or greenwashing. And there’s a lot of good that doesn’t lend itself to easy measurement.”

A study published last year by The Martec Group and Goby, an ESG platform for PE firms, found that, despite the challenges, recent developments have been “very positive for ESG-related solutions as general interest in ESG goals and data has spiked in the past 12-18 months and is not expected to slow.” The study concludes that the demand for management solutions, specifically ESG software, will continue to accelerate as LPs focus on ESG and other similar initiatives with GPs.

But ESG software’s no silver bullet, not least for the LMM. On their own, small funds—like small businesses—can lack the resources required to collect and analyze key performance indicators. In this environment, PE firms, direct lenders, and the like can provide more than capital. Strong partnerships with investors can provide LMM operators with strategies to improve the process of monitoring, measuring, and analyzing ESG data as well as support reporting capabilities.

These practical challenges on the ground for LMM companies can slow the implementation of ESG initiatives, however. As Martec and Goby’s study found, ESG initiatives are less urgent compared to other considerations across the LMM. All the same, those surveyed still acknowledge that ESG’s importance to investment opportunities across the LMM will continue to increase in the near term.

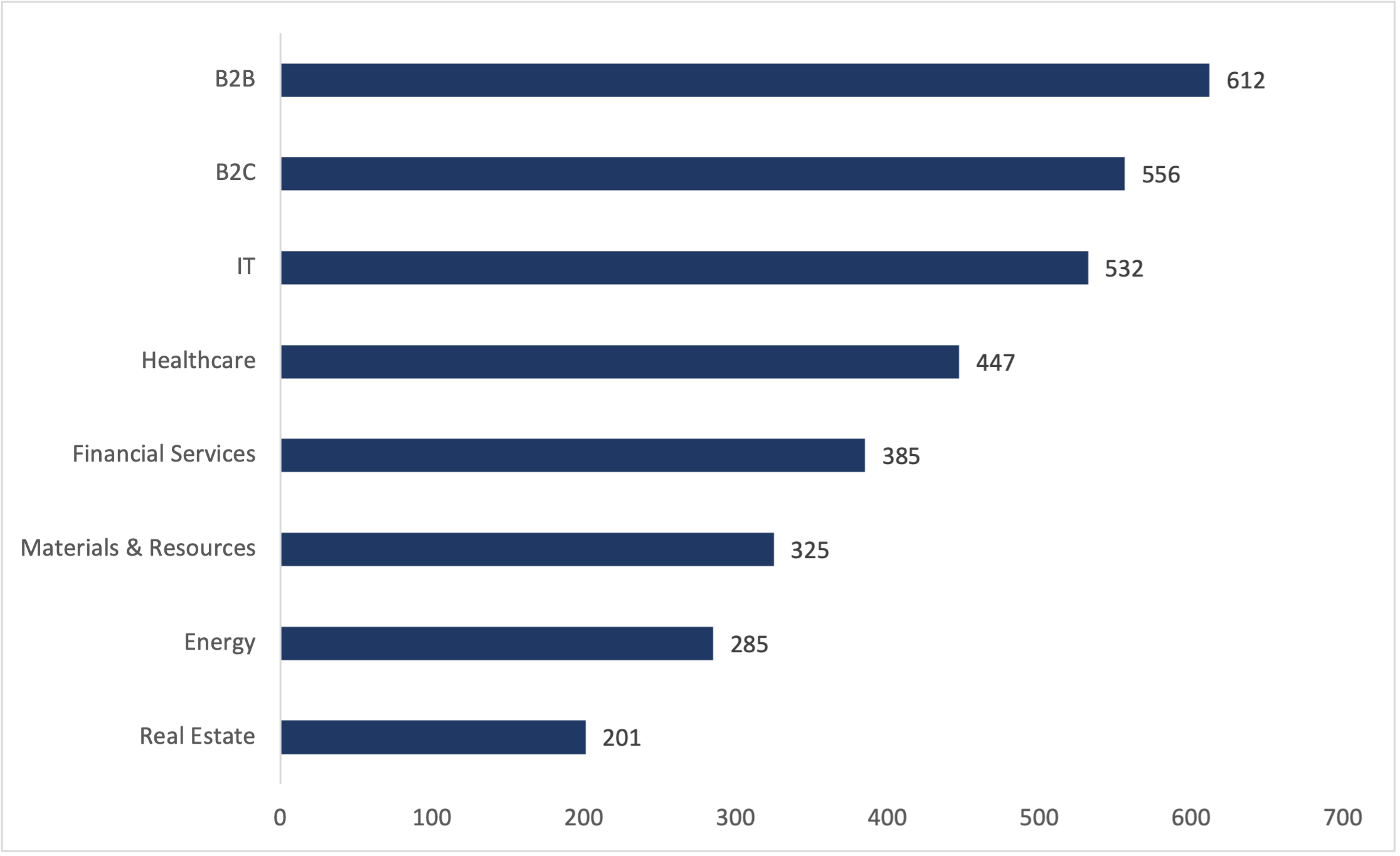

Currently, investment opportunities sought across the private markets reflect an environment more favorable to ESG investment opportunities in business and consumer services than in other sectors.

Business services lead all others at some 18.3% followed closely by consumer segments at 16.6% of responses. Since these sectors typically command an outsized share of investor interest and deal-making activity overall anyway, it does remain to be seen if the expansion of ESG initiatives across the LMM shores up this support or directs energy elsewhere going forward. It’s clear, though, that PE firms already have a significant mandate to pursue ESG investment opportunities across a wide range of verticals.

“It’s exciting to see the level of strategic and financial investor interest in these businesses,” Weiss, Fedrock, and Fisman have argued. “In the agtech space, companies are innovating to address the global food supply, improve carbon capture, and reduce greenhouse emissions. Recycling businesses are developing processes that support the circular economy. These are just select examples, and there are many more in the pipeline. Certainly, this is a great time for investors focused on ESG-centric companies, and for entrepreneurs building businesses in the space.”

Limited partners have played a significant role in pushing PE firms and asset managers to take on a more significant role in shaping ESG investment theses across verticals. And together these investors represent more than half of the buy-side in ESG. That’s not a trend that’s about to change—not now nor in the future. In response, big names like BlackRock and the companies on the S&P 500 have made moves that have garnered a greater share of ESG headlines in recent years. And they’ve also increased their signaling to outside investors of just how serious their initiatives are. Of course, saying and doing don’t always go hand-in-hand. But those doing a lot of the saying are also doing a lot of the doing, with investors largely rewarding them for their effort.

All the same, the corporate HQs of the S&P 500 and the communities potentially impacted by any softening in ESG performance are often worlds apart. Therefore, the LMM will continue to have a unique role to play across the growing ESG landscape, given its proximity to the very same natural and built communities in which they operate and in which they and their employees live—it’s no abstract concern at all. Rather, an LMM ecosystem characterized by strong ESG performance can improve local employment conditions, reduce waste, and support social services by expanding the tax base. For these reasons, if for no others, ESG’s importance to the future of the LMM looks secure.

As Grutman has found, “Businesses that do well by customers, that do well by non-customer stakeholders, generally do well long term. People just have more positive things to say about them to others.”