Advisor Industry Awards: The Top 12 Deals of 2024

Axial first introduced quarterly League Tables in 2019 to recognize the top Investment Banks and M&A Advisory Firms on Axial…

Advisors, Business Owners, Buyers, CFOs

Tags

As a business owner, engaging an investment banker is one of the first steps you’ll take on the road to an M&A transaction or capital raise.

A recent study found that investment bankers added value for 100% of sellers. But even if you know engaging a banker is a good idea, navigating the world of investment banking fees can be difficult. However, an increased purchase price can make the fee of partnering with an investment bank more than worth it. As the study notes, “Final transaction fees vary widely from firm to firm but are typically based on the size of the transaction and the services provided. Retainer fees paid by the client are sometimes deducted from the final transaction fee that is paid at closing.”

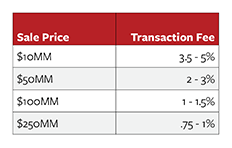

According to the report, in a full auction process, fees likely fall into these ranges:

What should sellers know about investment banking fees when approaching a transaction? We asked four bankers to weigh in:

“While very important, investment banking fees should be the last criteria in selecting an advisor. Difficult and subjective though it may be, your initial focus should be on evaluating what specific – and differentiating – strategies, experience, and characteristics the firm brings to the project that will generate premiums above that which you could realize on your own. In the end, it’s the net-premium (net of banker fees) that should be the determining factor.”

“While very important, investment banking fees should be the last criteria in selecting an advisor. Difficult and subjective though it may be, your initial focus should be on evaluating what specific – and differentiating – strategies, experience, and characteristics the firm brings to the project that will generate premiums above that which you could realize on your own. In the end, it’s the net-premium (net of banker fees) that should be the determining factor.”

– Dexter Braff, The Braff Group

“A seller should make sure that the fee structure properly aligns incentives with the investment bank (IB) they are partnering with. Properly aligned incentives will typically help garner an increased valuation in the market. The upfront work required for IBs in the pre-marketing stages is significant and in most instances, a one-time or even monthly retainer payments do not adequately cover the amount of work effort involved from start to finish. Depending on the transaction, we will sometimes offset our retainer payment(s) against our success fee to further align our interests with a sell-side client.”

“A seller should make sure that the fee structure properly aligns incentives with the investment bank (IB) they are partnering with. Properly aligned incentives will typically help garner an increased valuation in the market. The upfront work required for IBs in the pre-marketing stages is significant and in most instances, a one-time or even monthly retainer payments do not adequately cover the amount of work effort involved from start to finish. Depending on the transaction, we will sometimes offset our retainer payment(s) against our success fee to further align our interests with a sell-side client.”

– Michael Lamm, Corporate Advisory Solutions, LLC

“Ensure the fee structure and the incentives for the advisor are aligned with what you, the client, want to accomplish. For example, if you are selling your Company, your goal is to negotiate the highest price possible. M&A advisors typically receive a portion of the total sale proceeds as their fee, and having a tiered fee structure (with the advisors receiving a higher portion of the transaction as sale proceeds move above a certain threshold) encourages advisors to work harder to receive the best price for their client.”

“Ensure the fee structure and the incentives for the advisor are aligned with what you, the client, want to accomplish. For example, if you are selling your Company, your goal is to negotiate the highest price possible. M&A advisors typically receive a portion of the total sale proceeds as their fee, and having a tiered fee structure (with the advisors receiving a higher portion of the transaction as sale proceeds move above a certain threshold) encourages advisors to work harder to receive the best price for their client.”

– Josh Beck, Ravinia Capital

“A bank should be willing to work with the business owner to make the payment structure and schedule flexible. It could be anything from a monthly retainer, to a sign-on fee, to a success fee based on the valuation or timeline. No matter what, conversations about fee structures should center around how the bank intends to earn payment for the work they do on the deal. Because of that, business owners should expect that the person negotiating the fee be directly involved with executing on the deal.”

“A bank should be willing to work with the business owner to make the payment structure and schedule flexible. It could be anything from a monthly retainer, to a sign-on fee, to a success fee based on the valuation or timeline. No matter what, conversations about fee structures should center around how the bank intends to earn payment for the work they do on the deal. Because of that, business owners should expect that the person negotiating the fee be directly involved with executing on the deal.”

– Tony Giordano, BKD Corporate Finance