How Coronavirus Is Impacting Lower Middle Market M&A Activity

Last week, Axial convened a virtual roundtable of members to review the impact of the coronavirus pandemic on lower middle…

Family offices have been a misunderstood entity. Ultra-wealthy family offices are misrepresented in the media and the misconceptions often lead to a negative view of the industry overall, as Axial previously reported.

To help investors and business people better understand this group, we put together some facts to show some of the characteristics of family offices.

A family office is the private office of a family of significant wealth. According to the 2017 UBS’ Global Family Office Report, the ideal candidates for establishing a single family structure are families with private wealth of more than $150m. A multi-family office may be created when multiple wealthy families share some common values or goals and want to consolidate and leverage resources. However, these families might not necessarily be related to each other.

The Global Family Office Report 2017 is based on a survey of senior staff from 262 family offices across the world between February and May 2017.

There are more than 5,300 family offices in operation around the globe as of 2016, of which around 2,200 of them are in North America, according to an investigation by Campden Research. A report from Ernst & Young says that there are at least 10,000 single family offices in existence globally and at least half of them were set up in the last 15 years.

To view a list of US family offices on Axial, please click here.

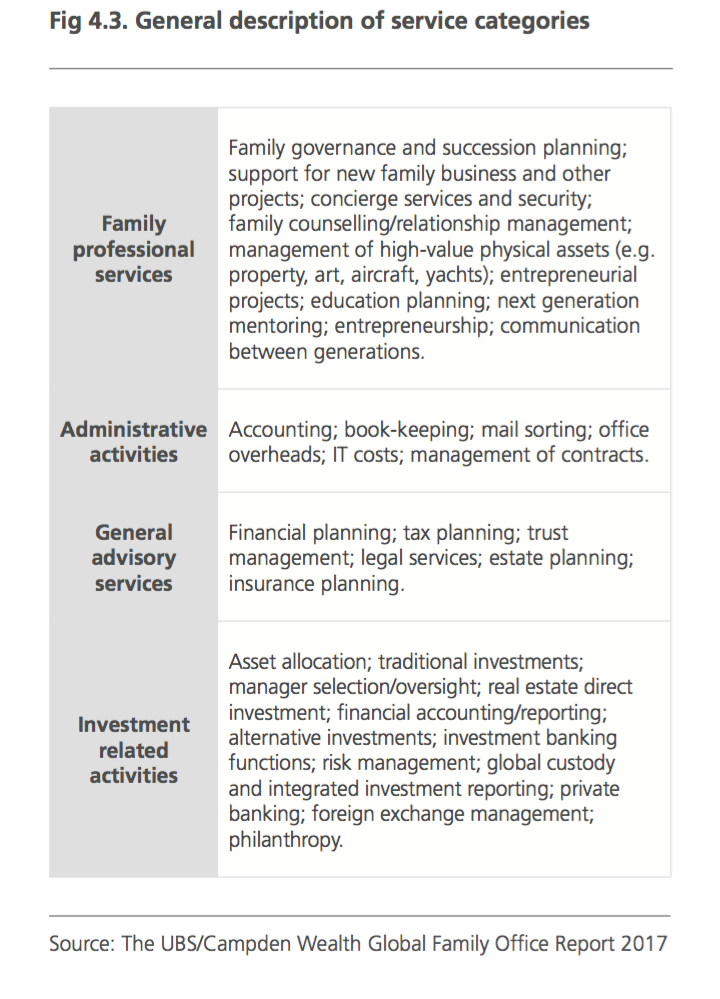

Investment management is at the heart of any family office. However, a mature family office also provides its members with services on:

The UBS Global Family Office Report 2017 also gives a general description of service categories.

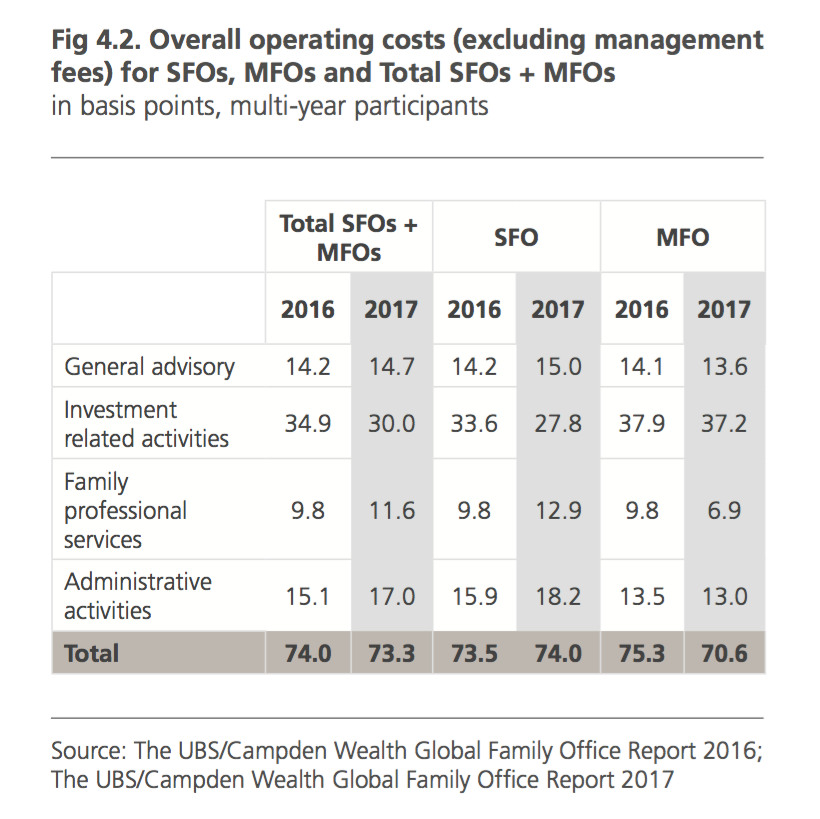

It is suggested that a full-service family office will cost a minimum of $1m a year to run, and it is usually much more, according to EY Family Office Guide. Family offices typically have operating costs of between 30 basis points (0.3%) and 120 basis points (1.2%) of Assets Under Management (AUM), and the cost is on the rise in recent years as a percentage of AUM.

According to the Global Family Office Report 2017, North America’s average operating costs, excluding external management fees, stand at 61.3 basis point (0.631%) of AUM.

The figure below shows the overall operating cost for single family offices, multi-family offices and the total of the two kinds.

According to EY Family Office Guide, family offices can often diversify their assets very broadly, much more than institutional investors can, due to the amount of assets under management. Family offices are also generally better able to think and invest on a more long-term basis, the report said, and they primarily pursue wealth preservation in to pass on assets to the next generations.

According to the EY report, family office investment strategies generally fall into three broad categories:

Family offices often use a mix of these strategies to diversify investment exposure and improve risk-adjusted returns. Family offices are a fan of alternative investments, such as horses, art, farmland, timberland and yachts and more, the report said.

Of all 262 global family offices UBS surveyed between February and May 2017, developed and developing-market equities accounted for 27.1% of the average family office portfolio, the highest proportion among all asset classes.

The figure below shows an average family office portfolio.

Click here to read more about family offices.