The Winning M&A Advisor [Volume 1, Issue 9]

Welcome to the latest issue of The Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

When determining how much you can sell your business for, we recommend focusing on two key areas:

Both of these steps should be done with an M&A advisor who has recent experience in selling businesses like yours. With their expertise, advisors can triangulate the most accurate valuation range and identify factors affecting your business’s value. The right advisor will have a deep understanding of your business size, industry and target buyers, allowing them to guide you effectively.

One of the biggest mistakes a business can make is partnering with an M&A advisor without relevant experience. This can cause plenty of issues, including not getting the best price for your business. At Axial, we have a network of over 2,000 advisors and extensive data on what kind of deals they’ve recently worked on. Using that data, we can recommend 3–5 advisors that are a good fit for your business. You can start the process here.

There are two common ways to get an accurate business valuation: working with a valuation expert/analyst or working with an M&A advisor.

If exiting your business on a specific timeline is your main goal, working with an M&A advisor is essential. They will assess your business’s worth and guide you through the entire M&A process — from buyer targeting to evaluating Letters of Intent, negotiations, and closing the deal.

M&A advisors can leverage data from closed deals to help determine the value of your business. You can learn more about how an advisor can assist with your business exit here.

If you’re not yet ready to engage an M&A advisor, you can get a certified valuation from an accredited valuation specialist. If you choose this route, look for an analyst with one of these certifications:

We recommend working with either an M&A advisor or a certified valuation analyst to get your valuation. There are many misconceptions about business valuations, including the idea that you can simply find an industry-standard multiple and multiply it by your EBITDA or SDE (seller’s discretionary earnings). This isn’t accurate; using this method provides only a quick estimate, not a thorough and precise valuation.

Both M&A advisors and certified valuation analysts will help you obtain an accurate and precise valuation. M&A advisors, specifically, can offer a valuation while considering your intent to sell the business.

No matter which path you choose to obtain a valuation, the next step is preparing your financials.

Many small and mid-sized businesses don’t manage their financials in a way that’s valuation-ready. For example, some companies operate on a cash-in, cash-out basis from quarter to quarter. While this works for day-to-day operations, it doesn’t provide an accurate foundation for a business valuation.

To get a reliable valuation, you’ll need to follow standard accounting practices that are widely accepted. Without them, common mistakes — like incorrectly calculating EBITDA or failing to determine the working capital tied up in operations — can skew your valuation.

Specifically, you’ll need three audited financial statements:

While there are no real shortcuts to selling a business, having these audited financials in place early can streamline the process and help you sell more quickly. They’re often one of the first things professionals on your deal team will ask to see.

To value your company for sale, your M&A advisor will use the information you’ve gathered to complete three analyses, which will help determine your business’s valuation range. They will also need data from similar businesses, so it’s best to work with someone who has recent experience in your industry. This way, they can leverage data from other businesses they’ve represented.

Here are the three valuation methods that will be used to determine your range:

Discounted cash flow (DCF) analysis values your business based on expected future cash flows. You forecast the profits your business is projected to generate and discount these cash flows to their present value using a discount rate. This rate accounts for the risk and predictability of future profits, adjusts for inflation, and indicates the present value of those profits. The sum of these discounted cash flows helps determine your business’s value.

The valuation hinges on the long-term growth assumptions you make, which is why an advisor’s expertise is invaluable. This figure should be backed by evidence, such as historical performance, market conditions, macroeconomic factors, and industry insights.

If you’re too conservative, you may undervalue your business. However, overestimating growth or ignoring potential challenges could lead buyers to challenge your valuation later. Both scenarios could result in a lower sale price or even derail the sale completely.

You can use our business valuation calculator to get a DCF analysis. Our calculator uses an industry-specific methodology to ascertain your company’s value. It won’t be the final valuation range, as it doesn’t factor in the methods we cover below, but it will provide with a good idea of your business’s worth.

Comparable Company Analysis (CCA), also known as your business’s “comps”, values your company by comparing it to similar businesses.

This involves identifying publicly traded companies with similarities, such as:

Conducting a CCA for small businesses, however, can be challenging because the data set often includes larger, publicly traded companies, making direct comparisons difficult. Advisors address this issue by analyzing the data and adjusting valuations to account for size differences.

To complete your CCA, an advisor will need access to:

Determining the right comparables and understanding your EBITDA multiple requires significant expertise, as these multiples can vary widely based on factors like business size, location, and industry.

Precedent transaction analysis (PTA) values your business based on recent transactions between buyers and companies similar to yours. This analysis relies on real, completed sales, which often include additional amounts that buyers paid during the bidding process, resulting in higher prices.

Similar to a comparable company analysis, gathering this information can be challenging, which is why working with the right advisor is crucial. Transaction details are generally private, and relying on sales from too long ago can lead to outdated data that doesn’t reflect current market conditions. However, an M&A advisor can access the right data from past clients to provide an accurate analysis.

Your M&A advisor can also help you understand which factors can affect your valuation. This insight allows you to determine if it’s worth making changes to increase your potential sale price.

Here are some common factors that can impact your company’s value:

An M&A advisor can identify which of these factors apply to your business. They can also provide realistic expectations of how much impact these factors will have on your company’s value. With this insight, you can confidently decide what changes to make (if any) before going to market.

How you target buyers can impact your final sale price. There are two main processes for targeting buyers when selling a business:

It’s important to remember that different processes suit different types of businesses. An auction process doesn’t always guarantee a higher price than a limited process; the best approach depends on your business and the buyers you’re targeting.

Discuss with your advisor to determine the right approach based on your business and goals.

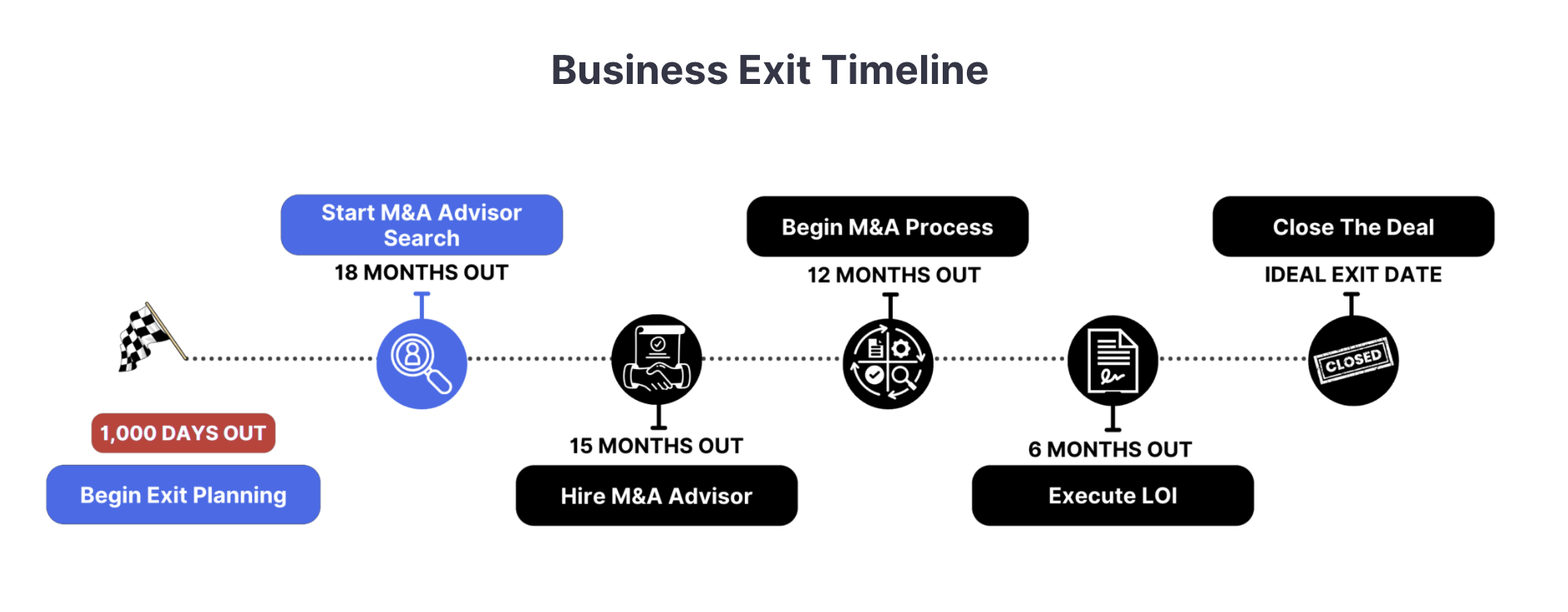

At Axial, we’ve developed a business exit timeline based on our experience in small business mergers and acquisitions and insights from over 2,000 M&A advisors in our network. Generally speaking, from the moment you get serious about selling your business, you have about 1,000 days until exit.

Depending on your current stage, you might just be starting (Exit Planning) or ready to engage an M&A advisor.

Here’s a breakdown of each step:

1. Begin Exit Planning

At this stage, you’re reaffirming your motivations and involving your family in decision-making. Honest conversations about how selling your business will affect family dynamics and finances are crucial. You’ll also streamline operations and establish a leadership handover plan, which is key to ensuring the rest of the process goes smoothly.

2. Start M&A Advisor Search

We’ve spoken at length about the importance of finding the right M&A advisor to help you value and sell your business. Many business owners turn to Google or ask fellow business owners for referrals, but the key is finding the right advisor with the right experience.

At Axial, we connect you with 3–5 of the best M&A advisors who have experience selling businesses like yours. We leverage our network of thousands of firms to shortlist top candidates based on their relevant deal experience, down the funnel success, and overall professionalism and reputation.

3. Hire an M&A Advisor

After we’ve handpicked 3–5 M&A advisors for your consideration, it’s time to choose one.

At Axial, you’ll work with an Exit Consultant to evaluate each advisor’s fit and conduct thorough interviews. We also provide resources, including a guide for negotiating engagement terms.

4. Begin M&A Process

After you engage an M&A advisor, the M&A process begins. Your advisor will conduct valuation analyses to determine your business’s potential sale price. Using this information, they will create marketing materials to target specific buyers.

Your advisor will then manage interest from potential buyers, which includes responding to inquiries, evaluating Indications of Interest (IOI), and verifying that buyers are serious and financially capable of making an acquisition.

5. Execute LOI

Once you’ve identified an interested buyer to proceed with, a Letter of Intent (LOI) will be signed to formalize the agreement. The LOI outlines the roadmap for due diligence, negotiations, and closing the deal.

It’s important to note that LOIs include an exclusivity clause. This means that for a set period, typically around 90–120 days, you, as a business owner, cannot engage with other potential buyers. This signals to the buyer that you’re serious about closing the deal.

6. Close the Deal

The final step involves negotiating and structuring the deal. Your M&A advisor will continue to manage the process, providing expert guidance, while you make the final decisions on what to accept or reject.

If you’re just starting the process of selling your business and want more information, we recommend these resources: