SaaS Valuations: How to Understand Your Business’s Worth (and Get the Best Exit)

Learn how SaaS companies are valued and how to maximize your deal outcomes with industry-specific insights from a top SaaS M&A advisor.

When you’re deciding whether to work with a broker, one of your main considerations will probably be cost. Selling a business is a long and complex process, and the fees vary considerably depending on the size and type of business you run and the broker’s fee structure.

Still, knowing some industry averages and the breakdown of the types of fees you’ll see can be helpful.

At Axial, we have over 2,000 M&A advisors and business brokers in our network. This gives us detailed insight into what they charge. Every year, we put these insights together in a comprehensive list of broker fees in our annual fee guide.

In this post, we’ll use data from the fee guide to:

When you’re ready to find a broker or M&A advisor, it can be difficult to know if you’re choosing the best options for your business.

At Axial, we curate introductions of relevant M&A advisors to business owners looking to exit their business. With over 2,000 M&A advisors/brokers in our network and 14 years of insights, we recommend 3–5 M&A advisors who can help you sell your business with confidence and ease. These recommendations are tailored to your specific business needs and goals.

All advisors in our network are evaluated on their past deal experience, ability to attract buyers and close deals, professionalism, and reputation. You can start the process here.

Brokers use different pricing methods to determine their final fees, often working on a case-by-case basis. This means it’s impossible to provide an exact cost without understanding your business and the individual broker you’re considering.

However, we can bring some transparency to the process by explaining the different types of fees you might encounter when working with a broker, using real data from our network surveys to examine potential cost ranges.

Note: In this article, we use the terms “broker” and “M&A advisor” interchangeably. Professionals in both roles can reach out to buyers and negotiate a deal on your behalf, though they typically serve different types of businesses. For more detailed explanations of these titles and how their roles overlap, refer to this post: Business Broker vs. M&A Advisor.

A retainer fee is the amount you pay to have a broker work on your business sale. It can also be referred to as “work fee” or “engagement fee.”

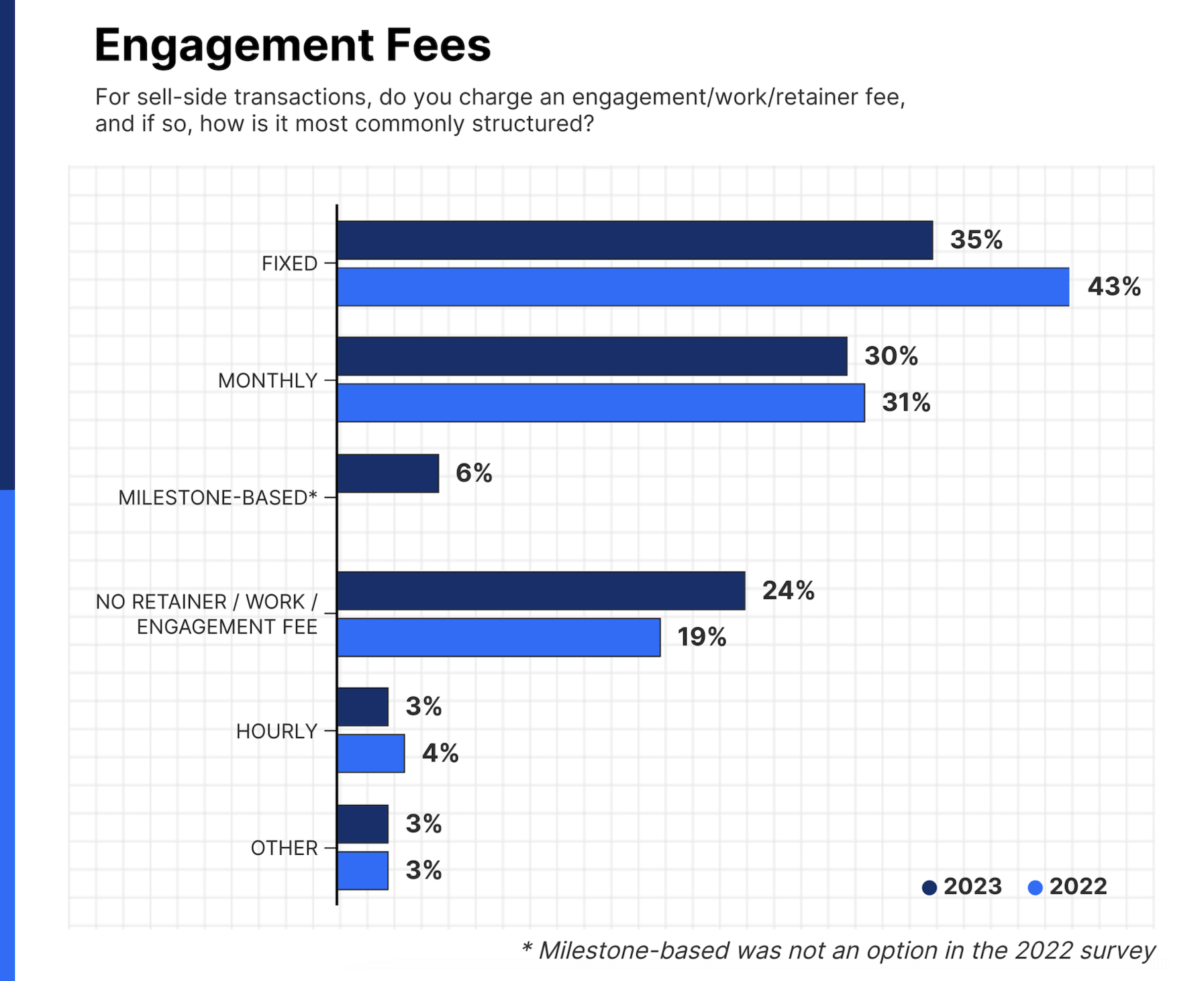

Brokers may charge their retainer fee:

Currently, the fixed model is the most widely used, with 35% of brokers asking for a one-time retainer fee. In most cases, they’ll then subtract the retainer from the success fee when the deal closes. For example, if your success fee would have been $200k, but you paid a $20k retainer at the start of the engagement, your final success fee would be $180k.

In addition to knowing how you’ll be charged, it’s important to know how high that fee could be. This is where the costs become more difficult to predict, as the range of these fixed retainer fees is quite wide.

For example, our data shows the cost of one-time, upfront retainers tends to vary by the size of the firm. Firms with 20 or fewer employees typically charge $15k or less, while larger firms with more than 20 employees tend to charge over $25k as a fixed retainer.

Overall:

However, the price doesn’t have to be sky high. Only 6% of firms that work with fixed fees set them at $51k or higher, and 16% charge less than $5k as a lump sum.

There are also an equal number of brokers who use another pricing structure to spread the retainer fee over the length of the engagement. In total, 36% of brokers use a monthly or milestone-based fee structure.

In terms of monthly costs, these figures should give you an idea of what you’re looking at with a monthly retainer:

And at the lower end of the spectrum, 19% of the advisors and brokers we work with set their monthly retainer at less than $5k.

Another type of retainer is the milestone-based model, which is less common, with only 6% of advisors and brokers using a milestone-based structure.

With this model, instead of a monthly fee, payment is made based on completion of specific milestones.

For example, a broker might bill their client for $10k at the beginning of the engagement, then $10k after they create the CIM (Confidential Information Memorandum), and a final $10k after the LOI (Letter of Intent) is executed with a potential buyer.

Finally, 24% of brokerage/advisory firms don’t use a retainer fee at all. For these firms, their entire income comes from their success fee when they close the deal.

The success fee is the commission brokers earn when they close a business sale. Most brokers will use a success fee structure alongside their retainer fee.

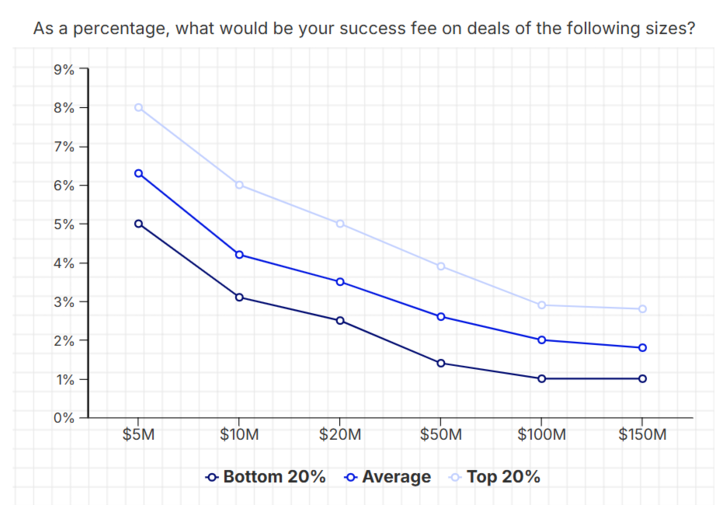

Success fees are generally higher for smaller deals. This is because smaller deals require the same amount of work as larger ones when it comes to preparation, marketing, due diligence, negotiations, and closing the deal. Achieving profitability while charging a smaller success fee on such deals can be challenging, which is why brokers charge a higher fee percentage when working with smaller businesses.

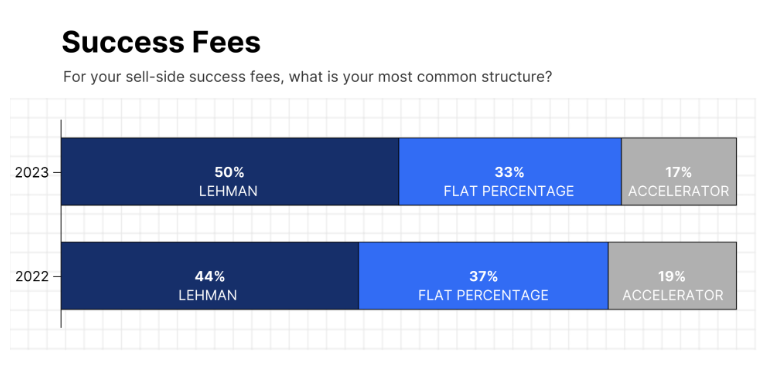

To calculate their success fees, 50% of brokers use the Lehman Formula.

The Lehman Formula fee structure bases the fee on the value of the transaction in a 5-4-3-2-1 structure. Put simply, the broker’s success fee is the equivalent of 5% on the first $1m, 4% on the second, 3% on the third, 2% on the fourth, and 1% on anything above the first $4m in purchase price.

Although Lehman is the most common structure, 33% of M&A advisors/brokers use a flat percentage instead. For example, they might charge 5% of the purchase price, so their success fee would be $125k if the business sold for $2.5m, rising to $150k if they sold it for $3m.

Finally, a smaller number of M&A advisors/brokers use an accelerator structure, where the fee increases the larger the deal. It’s worth noting that flat fees and accelerator fees seem to be declining in popularity, but 17% still use the accelerator formula.

To see how an accelerator formula could look in practice, here are a few examples:

Both of these examples of the accelerator model illustrate how important the thresholds are when you’re discussing the fee structure with a broker.

In the second example, the broker is strongly incentivized to sell the business for a higher price, as their success fee increases sharply if they sell the business for over $5m.

Another key consideration is that a broker’s success fee is likely to be flexible. Brokers typically work with clients on a case-by-case basis. Even if they used the Lehman formula on one deal, they might find a flat fee better suits another company.

Our contact at Momentum Advisory Partners explained this in their own words:

“Our fee structure at Momentum Advisory Partners is not rigidly formulaic. We assess each deal’s scale and potential market value to determine a suitable dollar fee. This is then translated into a percentage, assuming the market performs as anticipated. As our track record of successful transactions grows, we gain confidence in justifying higher percentages.”

Now, let’s examine how brokers might set their engagement and success fees. There are several factors in play here.

A broker’s engagement and success fees are balanced to protect the broker. For example, it’s common for the retainer fee to be based on the projected deal size (and therefore, the success fee). As Joe Milam of HST Capital puts it:

“Our retainer fees are based on a percentage of our projected success fee. As the success fee increases, the retainer decreases.”

Let’s put this into real terms by looking at the different success fees based on deal size.

Based on our latest data, if a company sells for $10m, the average success fee would be just over 4% of the purchase price, or around $400k. But, if the company sold for $20m, the average success fee would drop to 3%, and the broker would take home $600k. The purchase price would double, but the success fee would not.

Unless the broker you’re working with is new to M&A, they’ve likely gone through some trial and error to set their fees. The percentages, thresholds, and relationship between the retainer and success fee is based on experience of what they think the market can bear.

Put simply, brokers will charge the highest fees they can without losing a client.

As they set their fees, brokers also try to match their competition — both in terms of what they charge and the structure they choose.

For example, some brokers charge upfront fees, while others will only charge after the first milestone or even when the deal closes. In this case, brokers will only be able to raise their upfront fees so high before they start to lose out to competitors who don’t ask for them at all.

Although it’s not strictly part of their fee, many brokers will include a minimum fee requirement in their contract, which they also decide based on experience, market pressures, and similar recent transactions. The minimum fee requirement is there to protect the broker if their client accepts an offer for less than they initially discussed.

In our experience, minimum fees requirements are standard in the middle market. John Carvalho from Divestopedia told us:

“Minimum success fee amounts are usually established in smaller transactions to set the watermark value expectation between the advisor and client for what is acceptable. The minimum fee also protects the M&A advisor from engaging a client who subsequently accepts a deal that is much lower than initially contemplated.”

Finally, if a client has a buyer lined up (for example, if someone made them an unsolicited offer for their business, and they went to a broker to find out if a more lucrative deal would be possible), a broker might include two different fees in their contract. They would charge a lower amount if the business owner closed the deal with the unsolicited buyer, and a higher amount if that deal fell through and they needed to put in the work to find a new buyer.

Brokers set their fees based on the size of the business, their needs, their client’s needs, what the market can bear, and a host of other factors.

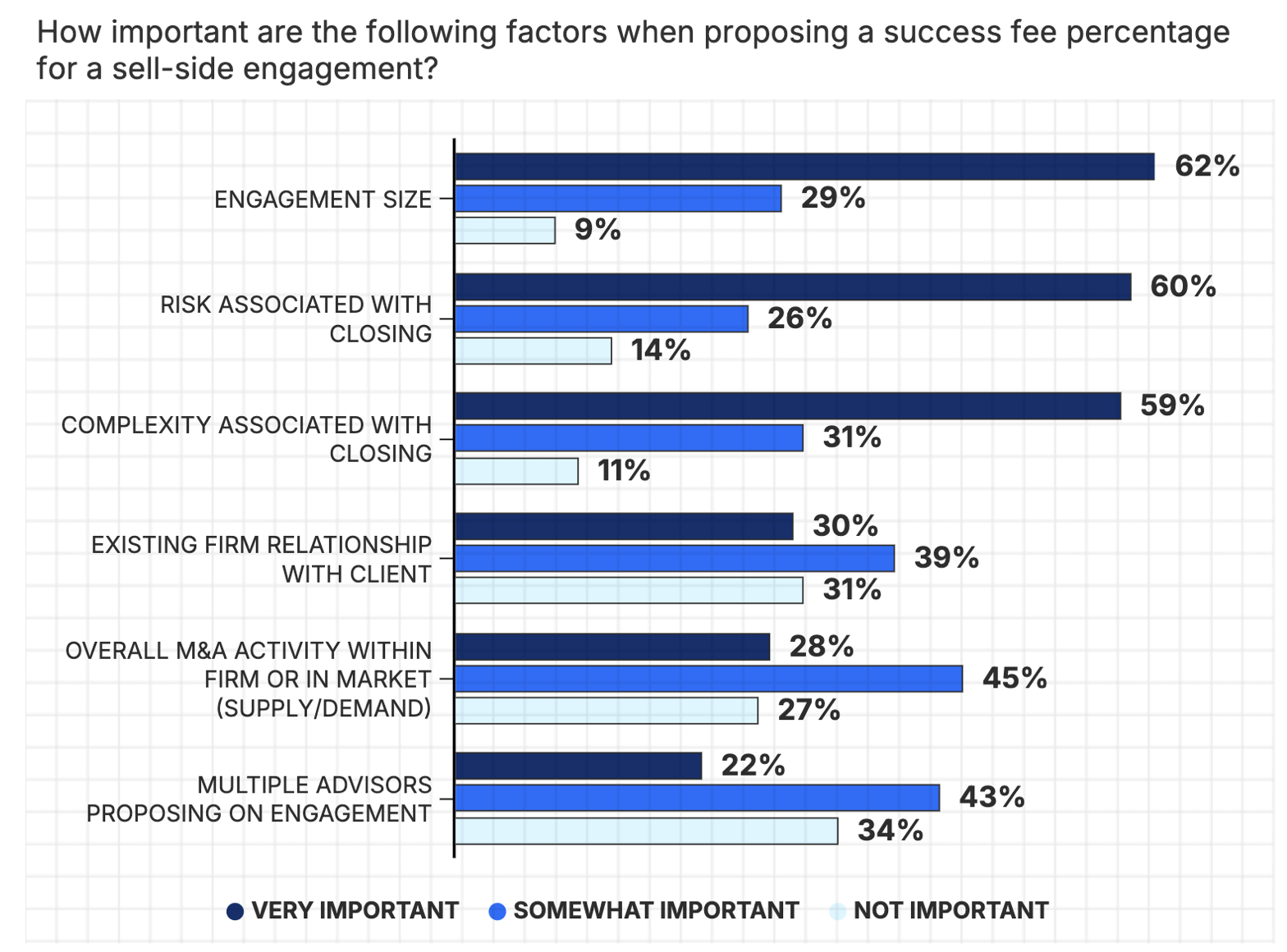

Although the size of the engagement (that is, the projected price for the business) is still the most important factor for the majority of M&A advisors/brokers, our research shows the risk involved in the transaction is an increasingly important consideration.

In our latest fee guide, 60% of M&A advisors/brokers listed riskiness as a very important factor, up from a distant third place in the previous year. This illustrates how much brokers structure their fees to protect themselves — especially in a complex and uncertain economic climate.

Part of the reason it’s so hard to predict what a broker will charge is that they’re considering all of the factors listed in the graph above. For example:

It’s also worth noting that 38% of brokers increased their fees in 2023 because of the rising costs of running their own businesses. Looking ahead, this economic uncertainty means brokers are likely to lean even further into fee models that reduce their reliance on success fees — at least as much as they can without losing out to other brokers going after the same business.

Whatever fee a broker quotes, it’s crucial to clarify terms like the retainer schedule, minimum success fee, and percentage split before they begin reaching out to buyers on your behalf. A good broker will be able to break their contract clearly and keep the fees transparent throughout the engagement.

Brokers charge a fee, but it’s usually well worth it. When you use a broker to sell your business, you get:

These benefits are a direct result of the broker’s guidance, experience, network, and outside perspective — all things the majority of business owners simply don’t have.

When considering whether to enlist a broker, it’s important to recognize how complex and involved the processes of valuing a business, preparing it for sale, and negotiating with buyers are.

To understand how brokers navigate these complex processes, let’s look at the skills they bring to the table in more detail.

An accurate valuation of your business is crucial to understand what prospective buyers might be willing to pay for it. Valuation involves some incredibly detailed calculations and analysis. These include some areas that business owners tend to overlook, such as:

Either due to inexperience or emotional attachment, business owners will often make mistakes in valuing their business. This can cause problems later, when the valuation has to stand up during negotiations with interested buyers.

In contrast, brokers take all these factors into account, and triangulate them with three different analyses of your business’ value. Together, these calculations give you a detailed valuation range to consider.

Brokers generally calculate:

We discuss these calculations in more detail in our post on valuing a business for sale.

A broker will also take the time to explain the sources of their valuation estimates, helping you make informed decisions about how to prepare your business for sale. For example, their valuation could reveal areas where you could increase your business’s value, or it could suggest that waiting another year to sell might be best, especially if an upcoming regulatory change could impact your business’s attractiveness.

When you have a business to sell, one of the main challenges is to get it in front of qualified, interested buyers. This is where a broker — and specifically, their network — comes in.

Brokers build their buyer networks through years of closing deals. Experienced brokers have a deep understanding of their buyer network’s interests and extensive knowledge of past acquisitions. This means they know the best firms to market your business to and the most effective way to approach them.

Brokers can take one of two approaches to marketing your business:

The right approach largely depends on your business size. Brokers typically use a non-targeted strategy for smaller businesses and shift to a targeted approach for larger ones, as buyer demand becomes stronger and more focused as business size increases.

Whatever the method, a broker can do a much better job of finding vetted buyers than business owners can on their own. The best brokers also know how to market your business towards buyers. This means creating marketing materials that highlight the aspects of your business that potential buyers find most attractive, like demand, local economic relevance, growth synergies, etc.

Working with a broker can help you preserve your confidentiality.

First, if you self-represent, potential buyers will immediately know which business is for sale, as it will be tied to your name.

Second, engaging with buyers during the outreach stage requires balancing the promotion of your business and showing its value while preserving confidentiality. This can be an incredibly difficult line for business owners to tread.

When you work with a broker, you have someone experienced in navigating this balance. Plus, if you choose a broker with expertise in your industry (which we strongly recommend), they will know exactly what information to reveal early on to capture the interest of potential buyers.

Brokers understand what to include in documents like investment teasers, NDAs and CIMs during the initial stages of a sale. They use these documents to pique buyers’ interest while still protecting sensitive data. They can also tailor this information to specific buyer types and know the right moment to send each document to maintain momentum in your business sale.

Selling a business is almost a full-time job. We’ve found that business owners who self-represent spend 20–30 hours per week managing the sale, all while continuing to operate their business.

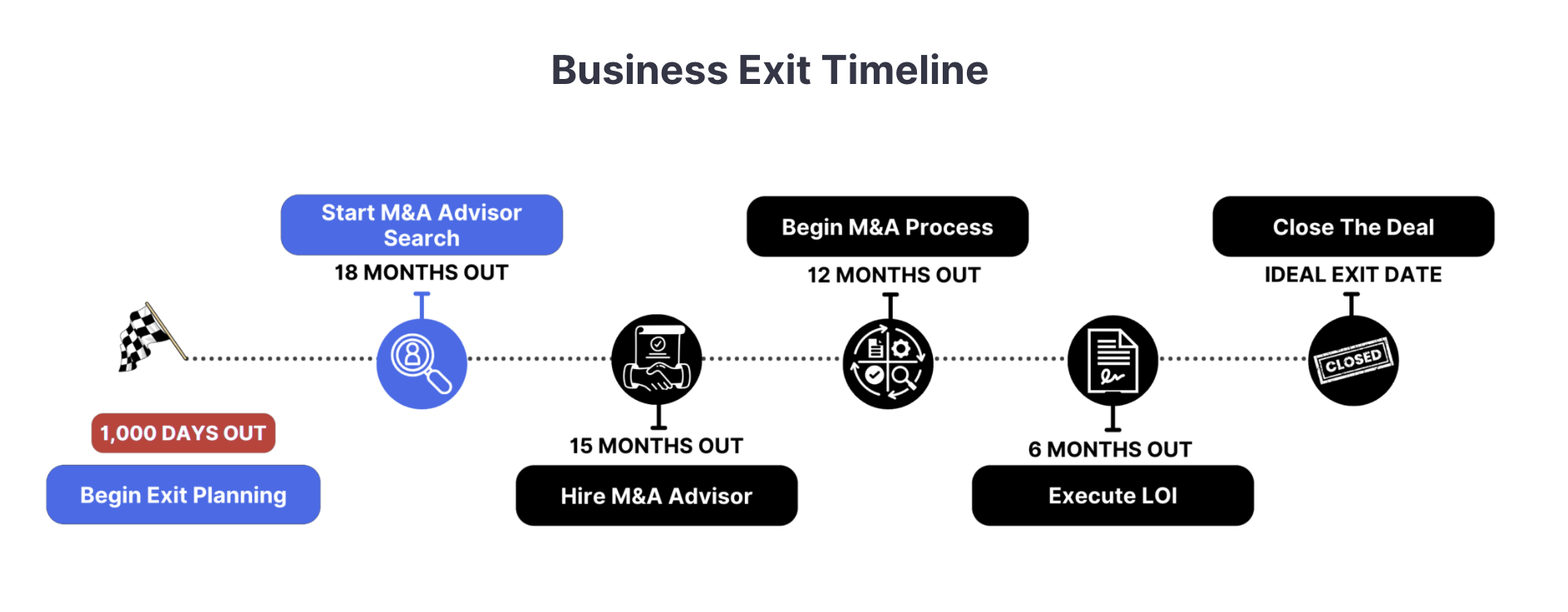

It’s also an incredibly long-winded process. Far from being a busy few weeks or months, an ideal business exit timeline starts 1,000 days before you hope to close the deal.

While preparing to exit your business, you need to keep daily operations running smoothly. Any sign of stagnation can be off-putting to potential buyers and reduce its value. One of the main advantages of working with a broker is regaining that 20–30 hours per week to devote to your business.

Brokers will prepare documents for you, screen potential buyers to find motivated candidates, research their backgrounds and sources of capital, prepare for meetings, and negotiate on your behalf. While you’ll have to manage the broker, you’ll have significantly more time to focus on running your business and far less stress as you prepare to exit.

Not all advisors are the same. Some simply connect you with prospective buyers, acting more as facilitators than managing the due diligence process. Others take a hands-on, strategic approach, guiding you through the entire selling process.

Finding the right partner makes all the difference for your exit, but many businesses don’t know where to start or how to evaluate their options.

This is where we can help. At Axial, we see 10,000+ North American businesses get marketed for sale every year, across nearly every industry, by more than 2,000 advisors and brokers. We leverage data from these businesses and the advisors who represent them to pinpoint the most suitable advisors for you.

When we evaluate advisors/brokers, we look at:

To get started, simply provide key information about your business, priorities, and transaction goals. We’ll then research our network of over 2,000 advisors and brokers and connect you with 3–5 firms that have experience with businesses like yours.

Your information and identity stay 100% confidential until you begin interviewing candidates.

Ready to take the next step? Start the process by answering a few questions about your business.