The Top 50 Lower Middle Market Technology Investors & M&A Advisors [2026]

Axial is happy to release its 2026 publication of the Top 50 Lower Middle Market Technology Investors and M&A Advisors,…

Anticipating the future is a major part of any private equity professional’s job responsibilities. How will a potential portfolio company perform given shifting market and industry conditions? How will customers react to changes in product offerings? When is the right time to sell?

In today’s tech-enabled world, this responsibility has only become more pronounced. Today, technology has the ability “to upend entire industries with a speed and magnitude that can be blinding,” cautions Bain & Company in their 2020 Global Private Equity Report, released earlier this month. And while an average person may hear “disruptive innovation” and think only of behemoths like Amazon and Airbnb, the average private equity investor knows that technology is poised to upend nearly every industry out there, at every level of the market.

“No portfolio company or target is immune to disruption. Change may come sooner or it may come later, but it will come eventually, shifting profit pools, altering customer preferences, bending cost curves and reshaping how companies compete,” notes Bain. Plus, these disruptions are happening at a faster pace than ever before — today the average time from tipping point to 80% of maximum adoption of a new technology is about 8 years, compared to 18 years in the mid-20th century, according to the report.

Here are three ways Bain recommends updating your due diligence process to stay ahead of the disruption curve.

Rather than looking at today’s status quo and trying to project future changes, frame your analysis around the future — think 10-20 years from now. Think first about what Bain calls the “raw customer need,” as this never changes, and consider what types of disruptions, from what kinds of technologies, could better address this need. Netflix is a prime example of this kind of thinking, notes Bain: “From its founding, Netflix plumbed the raw customer need (‘I want to be entertained right now!’) and figured out how to satisfy it much more compellingly” using streaming technology vs. an in-store experience.

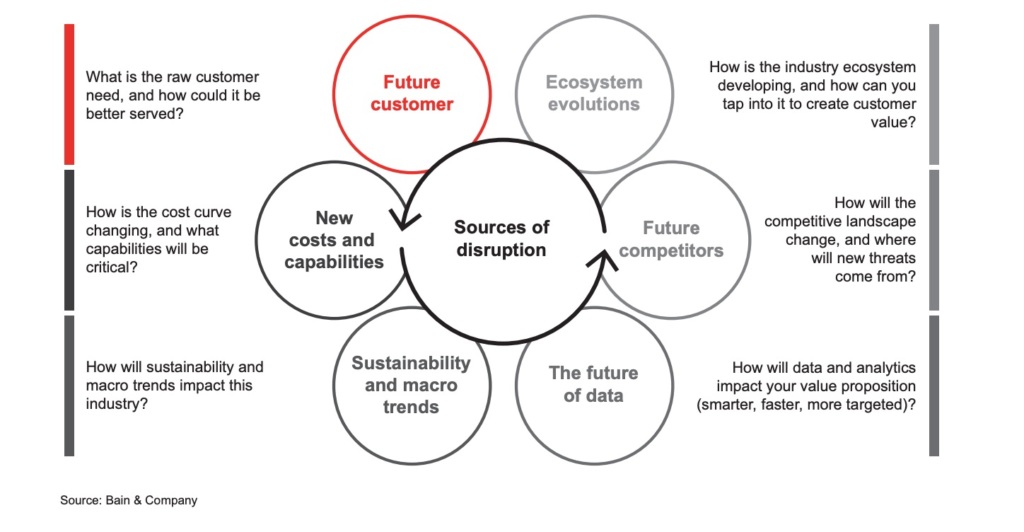

The report recommends asking six key questions as part of this analysis:

In addition to these questions, consider the idea of disruption from a more qualitative angle as well. D’Arcy Coolican, partner at VC firm Andreessen Horowitz, argues that another essential characteristic of a successful business is “product zeitgeist fit (PZF): when a product resonates with the mood of the time.” The disruptors of the future, Coolican argues, will have a certain je ne sais pas characterized by passionate employees devoted to building the product; dedicated customers in spite of any early product flaws (proving an emotional and not just functional connection); people’s eagerness to evangelize the product widely; and a certain sense of skepticism among the mainstream (as contrasted to the passion of the early adopters). When trying to predict a future market or other macro trends, then, it’s important to take into account not only quantitative factors like costs and capabilities, but also consider what types of disruptive innovations might evoke this level of passion in customers and those adjacent to the industry.

Because venture capitalists tend to invest in earlier stage companies than private equity, keeping tabs on VC spending in your target space can help track potential disruptions. “Often, the persistence of VC investment highlights a technology or business model that the broader market simply can’t get its head around — at first anyway,” says Bain. Analyzing VC investment in the space during due diligence (through online databases, press releases, and other market intelligence) “tells you how much venture capitalists and smart CEOs are betting against the status quo, while providing valuable clues about specific innovations,” says Bain.

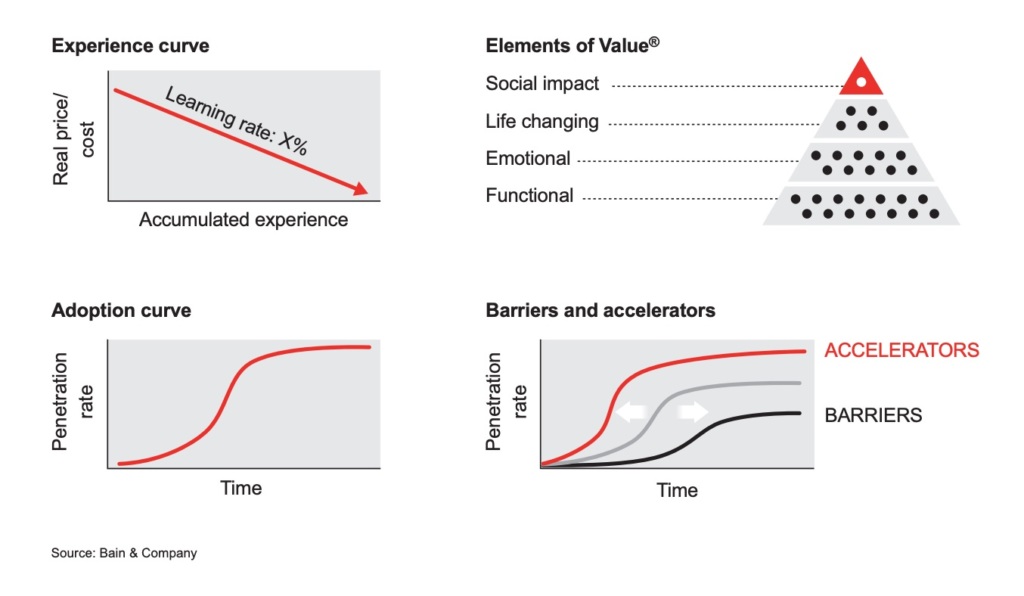

Given their typical hold periods, private equity investors must consider not only what disruptions are likely to come down the pike in a given industry, but when exactly that disruption is likely to take hold. Will the tipping point come right as you’re trying to sell your (suddenly woefully outdated) portfolio company? Bain recommends using four concrete tools to arrive at a quantitative answer to such questions:

While disruptive innovations may seem sudden to the untrained eye, savvy investors dedicate time to looking for them far in the future. Part of the due diligence process when evaluating any target company should include analyzing future disruption — where it’s coming from, when it’s likely to happen, and how it might impact the value of the business. At some level these questions are inherently unknowable. But as Bain points out, “there are structured, practical ways to gain real confidence about what’s ahead, enabling PE firms to model and rationally evaluate the risks and opportunities born of disruption.”

For more, read Bain & Co’s Global Private Equity Report 2020.