Introducing Axial’s Business Valuation Calculator – Find Out How Much Your Business Is Worth

The number one question our exit consultants hear from business owners is: “How much is my business worth?” To help…

Click here to subscribe to Exit Ready, the Axial newsletter that distills the best content, tips, and guides designed to educate exit-minded business owners running $5-$100M businesses.

When the time comes to sell, business owners want the process to be quick and efficient.

With 14 years of experience in small business M&A, we’ve learned that every step is crucial. You must plan the transition, understand your business’s value, create compelling marketing materials, and identify the right buyers to advance to the due diligence stage.

To ensure you don’t run into any roadblocks midway through the sale, you have to be prepared for both expected questions and unexpected buyer requests.

In this article, we outline the essential steps for selling a business, laying out how to enhance your success rate. We also cover a less commonly mentioned aspect: the role of an M&A advisor.

We’ll explain how an advisor can expedite the process, secure the best deal, and take a lot of work off your plate, especially since you need to focus on good business performance while getting ready to sell.

Note: Our experience on this topic comes from streamlining the exit preparation process for over 10,000 business owners annually for 14+ years with the largest network of pre-vetted M&A advisors and capital providers. You can learn more about Axial and how we can help you prepare to sell your business by clicking here or reading more below.

Before we get into the steps to selling a business, we think it’s important to confirm with yourself that you’re serious about selling. This may seem unnecessary, but many business owners approach this process with a “let’s see what we can get” mindset, which doesn’t bode well for success.

The process of selling a business is time consuming, stressful, and intense. Buyers will scrutinize every piece of your business. If you’re not bought in, your will power to continue will wane. Owners must make sure they’re fully committed to actually selling their business before initiating any dialogue with potential advisors or buyers.

So, let us be clear: if you’re thinking, “I’ll sell if the right offer comes along,” or you just “want to see what’s out there,” your chances of success are low.

Buyers want to work with motivated owners and have ways of gauging your motivation. For instance, they’ll often ask about the reason for the sale. If the owner doesn’t have a compelling answer, we’ve seen buyers walk away to avoid investing time in due diligence only to have the owner get cold feet midway through the deal.

In contrast, here are some common motivations for selling a business that we frequently see among serious owners. This list isn’t exhaustive, and other legitimate reasons may also apply, but these are the most typical:

Finally, consider the issue of company valuation and expected sale price. Price can obviously be a big motivator to sell. As we said above, many owners go into the process thinking that if the price is right, they’d sell. So our advice here is to know your number.

Specifically, we’ve found that for most owners, this number isn’t just about business valuation; it also reflects what they need to fund the next stage of their personal life. For many, this could mean retirement, but it might also include funding other life events like their children’s education, a home purchase, or investing in another business.

So before starting the selling process (detailed below), consult with your accountant, tax advisor, wealth manager, spouse, and family. This will help you determine an initial estimate of your financial needs for the next phase of your life.

While every exit is unique, here are the steps we’ve seen most business owners take that put them in a great position to sell quickly.

One of the key concerns for buyers is who will take over the owner’s responsibilities after they leave. Buyers need to assess how profitable the business will be under new ownership, and they’re aware that business owners often juggle multiple roles.

Replacing an owner who handles several operational roles, including sales, while getting paid a single manager-level salary can be costly. Experienced buyers will account for this, knowing that the cost to fill those roles could be substantial unless the new owner and remaining leadership team can effectively take on these duties.

It’s also possible that a business owner has unique skills and connections that make them difficult or impossible to replace. A common example is an owner who brings in many leads and customers through their personal network. In such cases, the company may struggle to maintain the same lead flow or even retain existing clients without those connections.

Your transition plan addresses buyers’ concerns by detailing how the business will operate smoothly without you. Specify who currently handles each role, including your own responsibilities as the owner. Then, outline options or scenarios for filling those roles post-sale. A common approach is to transfer your duties to your leadership team. However, if you don’t have one, you’ll need to identify the right employees to take over your roles and ensure they are equipped with your knowledge and existing relationships.

After creating your transition plan, the next step is to ensure that your business is operationally ready to withstand the questions in the due diligence process.

To successfully execute this step, business owners should:

Understanding your valuation is one of the most important details of selling. Owners often go into the process with a number already in their heads. Checking that number against a realistic range is best done as early as possible so owners can decide if they still want to sell their business at a valuation that may be different than what they’d been thinking.

Having a defensible valuation also helps back up your sale price when negotiating with buyers.

There are three widely accepted methods for valuing a business:

You can read more about these valuation methods in our article on valuing your business.

As mentioned earlier, doing an initial evaluation yourself can provide a general idea, but it can be challenging without professional help. For instance, comparing your small business to large publicly traded companies often yields inaccurate results, and while private transaction data is more valuable, it isn’t easy to access.

When you’re serious about valuing your business, we recommend having an organization officially certify its value. This typically costs between $5k and $10k, and if you work with an investment banker or M&A advisor (more on the benefits of working with them below), this service is often included in their package.

When you begin conversations with prospective buyers, one of the first steps will be to send them standard marketing materials describing your business. So it’s important to have that ready before you start promoting your business for sale.

Creating compelling materials helps you craft a persuasive narrative for prospective buyers, highlighting why they should be interested in acquiring your business.

The three standard documents exchanged during the initial stages of the sale are:

Note: When creating these documents, a single story may not appeal to all buyer types. For example, a private equity firm may have completely different motivations for buying your business than a competitor making a strategic acquisition.

Hiring an M&A advisor who has extensive experience building these materials can help ensure that you are telling the right story to the right buyer. Some advisors might be a better fit for your business than others, so it’s important to ask for samples to get familiar with their work.

After creating the materials listed above, the next step is getting your business in front of prospective buyers. This is typically done in one of three ways:

Differentiating between the serious, motivated buyers and tire kickers can help business owners avoid wasting time. Here’s a brief overview of how to screen buyers:

Ensuring buyer motivation and compatibility in vision helps safeguard the legacy and values you’ve built. Since M&A advisors handle this frequently, they have a robust process for quickly screening out unfit buyers to ensure that you don’t elongate the process. (We’ll discuss how M&A advisory firms assist with this and more below.)

Negotiating and closing the sale is the final step that business owners need to complete. Once you’ve shared your marketing materials with potential buyers and screened out those who aren’t a fit, you’ll likely spend more time evaluating the ones that remain.

At this stage, buyers will want to speak with business owners over the phone, visit the company in person, meet the team, and tour the facilities to get a clear picture of the business. Through your conversations, you’ll want to dig deeper into the values of each prospective buyer to see if they are in line with the values you have laid out at your company.

Beyond cultural fit, there are four crucial sub-steps to be mindful of:

Overall, the above steps are time-consuming and difficult to get right, especially while you’re still busy running the business. In the section below, we discuss how an M&A advisor can make the process easier and increase the chances of success for most small business owners.

Most business owners aren’t experts in selling a business — many are selling a business for the first time. They’re also busy running their business. As a result, executing the above steps well while running their business is difficult. We’ve found that owners working with an advisor or investment banker are far more successful than those trying to manage the process themselves.

M&A advisors specialize in these transactions and help owners avoid mistakes that could delay or derail the sale. These advisors assist with preparation steps, handle valuation, prepare marketing materials, approach motivated buyers, and negotiate competitive prices and terms.

Here are the most impactful ways an M&A advisor assists in selling a business:

M&A advisors are unbiased third parties who help manage the sale process by counteracting emotional biases that could hinder a smooth transaction.

Business owners may be more emotionally invested than they think. For example, it’s common for business owners to come in with an assumption of the company’s expected value because of the effort they’ve poured into it. If that doesn’t match what the market will pay, the chances of closing on a deal are low.

Good advisors will give you an honest, third-party assessment of what your business is worth and can explain in detail why the valuation is what it is, including finding relevant comparable transactions. This helps owners make informed and impartial decisions during the sale of their business.

Professional advisors, like those we pair businesses with, have valuable networks to connect business owners to high-quality buyers. When you find an M&A advisor through Axial, many proactively reach out to potential buyers for you, rather than just waiting passively on listing sites.

Determining a serious buyer can be challenging when you’ve never sold a business. M&A advisors specialize in screening buyers and ensure you engage only with motivated candidates who check all your boxes — including access to capital, cultural fit, and what they intend to do with your business.

M&A advisors are experienced in negotiating deals and handling tough valuation discussions. For instance, we recently worked with an owner who was expecting a 7x multiple but received 9x profit thanks to the guidance of an M&A advisor we introduced.

This extensive experience helps ensure that owners don’t undervalue their company or engage with low-quality buyers, ultimately securing the best possible price. In fact, studies show that M&A advisors generate anywhere from a 6% to 25% higher purchase price.

Most advisors take a 2% to 5% success fee if the business sells, meaning if they help you sell your business when you otherwise wouldn’t have or help you get a 6%–25% higher price, it’s worth working with them on just a financial basis, not to mention the time and stress savings.

Selling a business can be nearly a full-time job, and business owners must run their companies simultaneously. M&A advisors handle the sale process, allowing you to focus on your business.

Drafting documents, finding and negotiating with buyers, and developing a transition plan while managing daily operations can be overwhelming. This complexity increases the risk of mistakes, which can prolong the sale process. This could also affect the company’s worth.

If an owner is busy preparing the sale of their business, they could run the business poorly, which could impact value. Hiring an M&A advisor enables them to focus on the organization so the quality of the business stays consistent.

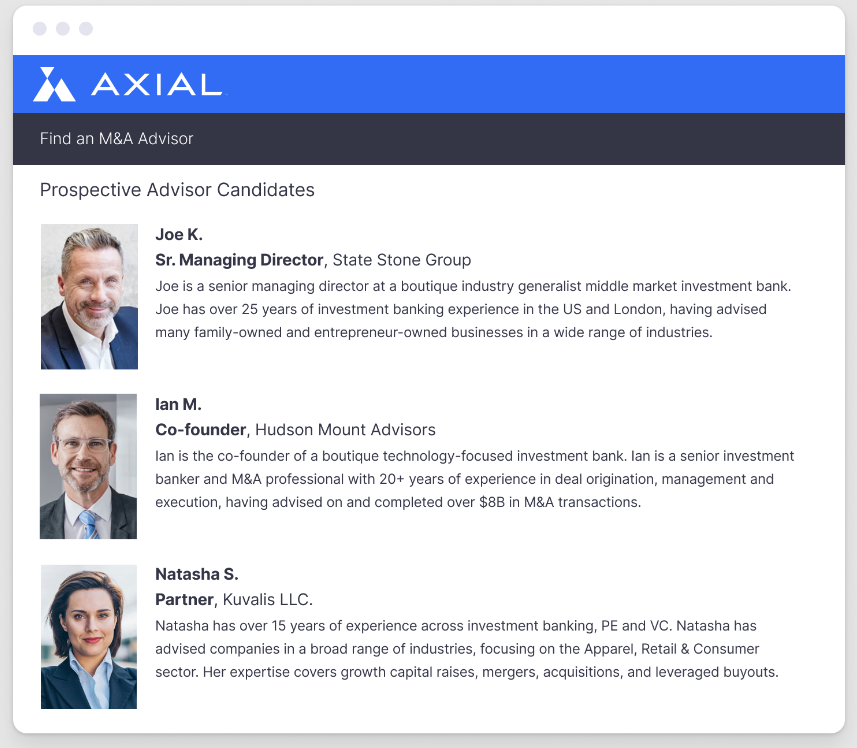

An experienced M&A advisor helps you sell your business quickly and smoothly, and Axial can help you find one. Axial’s Advisor Finder program guides business owners through the complicated process of identifying and vetting the right M&A advisor.

We start with a survey and a brief exit consultation to understand your business, priorities, and transaction goals. Then, we shortlist the best candidates for you from our pool of over 2,000 advisors, choosing advisors with as much experience as possible in your field.

Throughout this process, your information and identity stays 100% private until you choose to connect with the 3–5 advisors you’d like to interview.

Selling your business is challenging enough already. Join Axial, and we’ll match you with the best advisor based on 14 years of insights, completing the transaction as smoothly as possible.