The Advisor Finder Report: Q4 2025

Welcome to the Q4 2025 issue of The Advisor Finder Report, a quarterly publication that surfaces the activity occurring on…

Tags

When you’re trying to value a company for sale, you’ll encounter three primary business valuation methods: discounted cash flow, comparable companies, and precedent transactions.

However, merely knowing these methods isn’t enough for an accurate valuation that reflects your business’s worth. An accurate valuation provides a clear understanding of your company’s true value — what potential buyers can see and agree upon. This insight helps you decide whether it’s the right time to sell your business or if you should focus on increasing its value before going to market.

Nuances like that are why we created this guide, which covers:

If you’ve thought about working with an M&A advisor to help you value and sell your business but are unsure if you need one, learn more about the benefits of working with an advisor.

There is no one-size-fits-all approach to business valuation. Each method examines your company’s value from a different perspective. Generally, M&A advisors and business valuation experts use all three methods to triangulate an accurate valuation range, ensuring you don’t undersell or oversell your business.

Here are the three most commonly used methods:

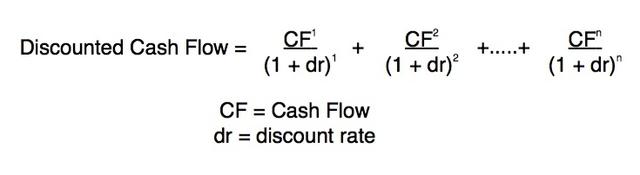

Summary: DCF determines intrinsic value by comparing present value to investment cost. This method estimates value based on future projections.

Discounted Cash Flow (DCF) is a method used to estimate the value of a business based on its expected future cash flows. It involves forecasting the profits your business will generate and then “discounting” those cash flows back to their present value using a discount rate. The discount rate reflects the risk and predictability of your business’ future profits while adjusting for inflation, indicating how much future profits are worth today. The sum of these discounted cash flows provides one approach to valuing the business.

To conduct a DCF analysis, you must select a long-term growth rate. This growth rate can sometimes be challenged by potential buyers because it relies on the assumptions you make.

To effectively back up your assumptions — and defend your growth rate and overall valuation — it’s best to base your growth rate on:

A good advisor can establish the appropriate assumptive growth rate and defend it more effectively based on their experience in your industry. Their experience allows them to understand the nuances surrounding historical performance, market conditions, company-specific factors, and macroeconomic factors. You can also use our free business valuation calculator. This calculator uses industry-specific DCF methodology preferred by leading M&A advisors to give you an idea of your business value.

But a DCF analysis is just one method an advisor will use to properly value your business. DCF analysis doesn’t consider current buyer demand or market sentiment. To incorporate these conditions, you should also consider company comparables (below).

Summary: Comparable company analysis estimates value based on what the market is willing to pay for businesses similar to yours.

Comparable company analysis (Comps) finds your company’s market value by comparing its financial metrics and valuation multiples to similar businesses that are publicly traded. To find a comparable company, you’ll look at industry, size, growth, geography, capital structure (how much debt a business has), and a business’s lifecycle stage (whether the business is a startup, in its growth phase, or has reached maturity).

However, for small businesses, conducting a comparable company analysis can be complicated. Large publicly traded companies may not serve as suitable references due to significant size differences. If you just compare your business with a larger one, you’re going to get an inaccurate valuation.

To solve this, a skilled M&A advisor will analyze comparable (albeit larger) companies and adjust their valuations to account for the differences in size, bridging the gap between their value and that of your business.

Summary: Precedent transaction analysis determines your implied transactional value by examining recent past transactions and actual purchase prices to estimate value.

Precedent transaction analysis uses the prices paid for similar companies in completed past sales to value a business. This approach fundamentally differs from analyzing stock prices and trading values. When examining completed sales, you’re often observing higher prices, as these figures include the additional amounts buyers are willing to pay during the bidding process for the business.

The advantage of using precedent transaction analysis is that it relies on real-world exit valuations of previously sold companies, providing concrete data that enhances certainty in negotiations. However, gathering this information for small businesses can be difficult because transaction details are often private. Recency is also key, as outdated transactions don’t reflect current market conditions.

Working with advisors who can draw on their insider knowledge of former clients’ deals is an effective way to leverage recent transactions figures.

When conducting a valuation, you want to know how to use each method. This alone can be challenging — if not impossible — for business owners, as they may not have the resources or experience to put together the data needed for conducting a company valuation.

There are plenty of mistakes business owners can make when trying to value their own company, including:

1. Having unrealistic expectations.

Business owners can struggle to see an objective view of their business’s value, whether through emotional biases or operational blind spots.

For example, owners commonly forget to factor in the work they do to keep their business running. When you sell your business, the new owners will have to hire people to replace you. That cuts into their profits. Not factoring in those future costs can lead to an inaccurate picture of your company’s future profits, affecting its true value to potential buyers.

2. Consulting inaccurate financials or drawing incorrect conclusions from them.

Plenty of small businesses don’t have a CFO, and even if they did, their financials can still be inaccurate or hard to cipher through. Some businesses are used to keeping “cash in, cash out” financial records to help them operate from quarter to quarter. But it’s a different ballgame to use those same records to sell your business. Now, you need to look at those financials through the eyes of a buyer. You’ll need to adhere to standard accounting practices that are widely accepted and reliable.

Without standard accounting practices, we see owners make common mistakes like incorrectly calculating EBITDA or not being able to determine the working capital that is tied up in day-to-day operations. Mistakes like these skew your valuation.

3. Failing to use multiple valuation methods to triangulate the most accurate valuation.

Each method has its limitations on what it can tell you about your business’s value, so you want to use all three. (And not just pick the valuation method that yields the highest results.)

There’s also the issue of not conducting your analysis correctly. You need to be able to speak about the assumptions that you made as part of your analysis. You need access to relevant and recent data. You need to be able to compare your business to larger businesses, and add in a discount rate to get a more accurate comparison. These are non-trivial tasks that can be difficult, if not impossible, for a business to do on their own.

Finally, it’s critical to know which factors can change the value of your company, even as you enter negotiations.

By knowing what changes your value, you can strategically plan to improve your business in key areas to get a better offer.

Generally, your company’s value is impacted by several factors, including:

Working with an M&A advisor can help you identify opportunities for quick wins to improve your valuation. This lets you address key areas of your business, and strengthen your company’s value before marketing it to potential buyers.

In our 14 years of experience, we’ve found that owners who self-represent have a 60% lower chance of closing a deal. This challenge is even greater for first-time sellers without experience in mergers and acquisitions.

On the other hand, M&A advisors are experts in handling deals and understanding the factors that drive a successful sale. This includes conducting the valuation, but also much more.

Specifically, M&A advisors will:

1. Achieve the Most Accurate Valuation for Your Business

Overvaluing can hinder closing, while undervaluing leaves money on the table. Advisors are experienced in all three valuation methods and leverage their market knowledge to help you target a realistic, best-case valuation.

Your valuation’s strength relies on your ability to defend it to prospective buyers. Valuing your business independently can lead to costly mistakes, such as miscalculating EBITDA or misinterpreting financial data. These errors can create a significant gap between your expected value and what buyers perceive as your business’s true worth. Working with an advisor ensures that the sale process stays on track and avoids these pitfalls.

2. Avoid Costly Mistakes That Diminish the Attractiveness of Your Business

A skilled advisor goes beyond conducting a valuation — they provide strategic guidance to enhance the value of your business in the eyes of potential buyers. This can involve suggesting actionable steps, such as developing a transition plan to mitigate key person risks, addressing regulatory issues, and determining the optimal timing for a sale.

For example, if several long-term contracts are set to expire in a few months, an advisor might suggest postponing buyer outreach until the renewals are confirmed. This helps eliminate uncertainty around future revenue, preventing potential buyers from using these pending renewals as leverage to lower their valuation of your business.

3. Create a Competitive Bidding Environment

A valuation is just the starting point — it doesn’t determine the final price of your business. Skilled advisors leverage their network of qualified buyers and craft tailored marketing materials that highlight the strengths and opportunities of your business.

By engaging multiple buyers and fostering competition, they can drive up offers and ultimately secure the best possible price for your business.

4. Manage Negotiations with Potential Buyers

A crucial part of closing a successful sale is handling negotiations effectively. Interested buyers will conduct their own valuations, aiming to secure your business at the most attractive price for them. Beyond that, they may present complex deal structures that can be challenging for business owners to navigate.

For instance, a buyer might offer a smaller upfront cash payout or a larger payout spread over several years, contingent on achieving certain performance milestones. Choosing the best deal in these instances can be difficult for you.

An experienced advisor can help you evaluate these offers objectively, leveraging their knowledge of your business and the market landscape to determine which deal structure is best for you. They also know where to push for more, where to stand firm, and where to compromise, ensuring you get the best possible outcome.

If working with an M&A advisor sounds like the right fit for valuing and selling your business, we can connect you with highly skilled advisors through our advisor network.

The advisors we recommend will have experience in your industry and a proven track record of down-funnel success, meaning they excel at securing bids and closing deals.