The SMB M&A Pipeline: Q4 2024

Welcome to the Q4 2024 issue of The SMB M&A Pipeline, the quarterly series that surfaces a top-of-the-funnel breakdown of…

The debate preceding the approval of a $1 trillion infrastructure package in 2021 reinvigorated a wider conversation about private investment in industrials and manufacturing. Over the past several years, firms had already committed massive sums of capital to infrastructure funds to chase the sector’s steady cash flows and to secure exposure to its modest risk profile. But elevated levels of dealmaking across the lower middle market largely failed to materialize—until recently.

Last year, industrials and manufacturing deals brought to market in the US via Axial’s platform jumped by a third over results for 2020. And through the first quarter of 2022, new transactions expanded by an additional point compared to the same period the year before—despite mounting macroeconomic headwinds.

This development has the LMM’s industrials and manufacturing sector poised for something of a renaissance in investment going forward—a renaissance that many anticipated since restoring American industrial and manufacturing preeminence garnered headlines after President Donald Trump promised to introduce a $500 billion infrastructure bill during his 2016 campaign.

“We will build gleaming new roads, bridges, highways, railways, and waterways all across our land,” then-candidate Trump said. “And we will do it with American heart, and American hands, and American grit.”

But the recent change in fortune for investment activity across the industrials and manufacturing space has emerged in no small part to address unprecedented supply chain disruptions in the wake of the COVID-19 pandemic. This disruption has created inventory shortages and a tight labor market, among other challenges facing investors and operators alike. Although these conditions represent very real tests of the sector’s resilience, they also represent significant private investment opportunities.

“A key question for buyers doing due diligence is plans for automating facilities and factories,” Keith Dee, president, Osage Advisors, remarked during a recent Axial hosted roundtable. “Some of the businesses Osage are advising have even begun running their machines in the dark (meaning with no supervision). A lot of times, part of the reason sellers are selling their businesses is because they need the help automating them and so add-ons are most favorable in that scenario.”

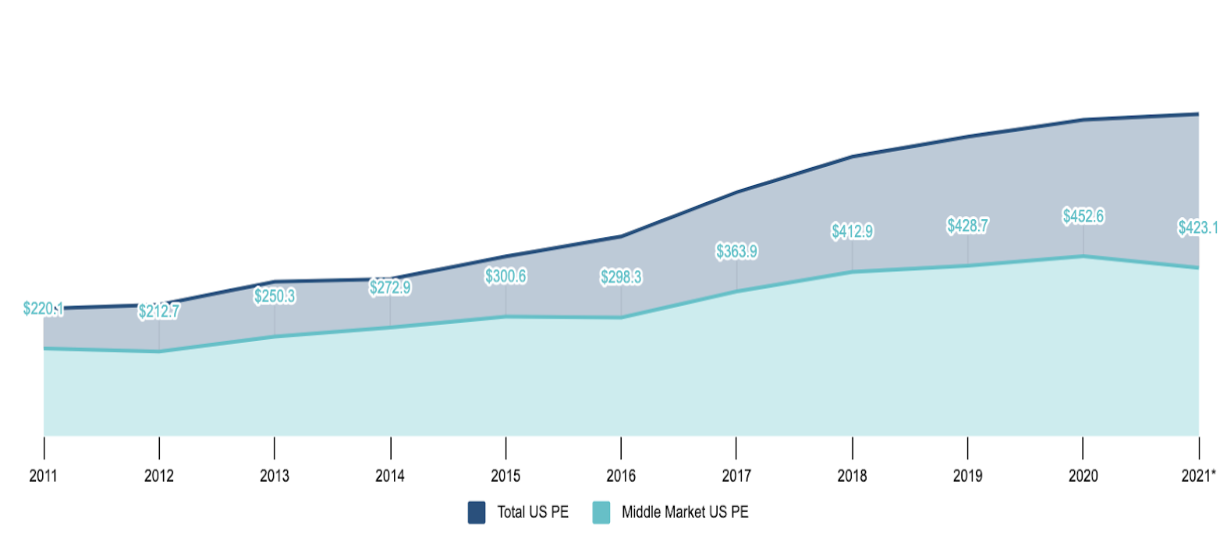

Dee’s comment highlights a pair of longstanding and significant trends in the space. The first concerns funding for innovation. According to a recent report from PitchBook, PE firms targeting infrastructure investments raised $120.7 billion globally in 2021. As recently as 2017, the sector’s prospects helped firms to secure just $77.1 billion in aggregate commitments. That represents a 56.6% increase in capital available for industrials and manufacturing investment over the span of only four years.

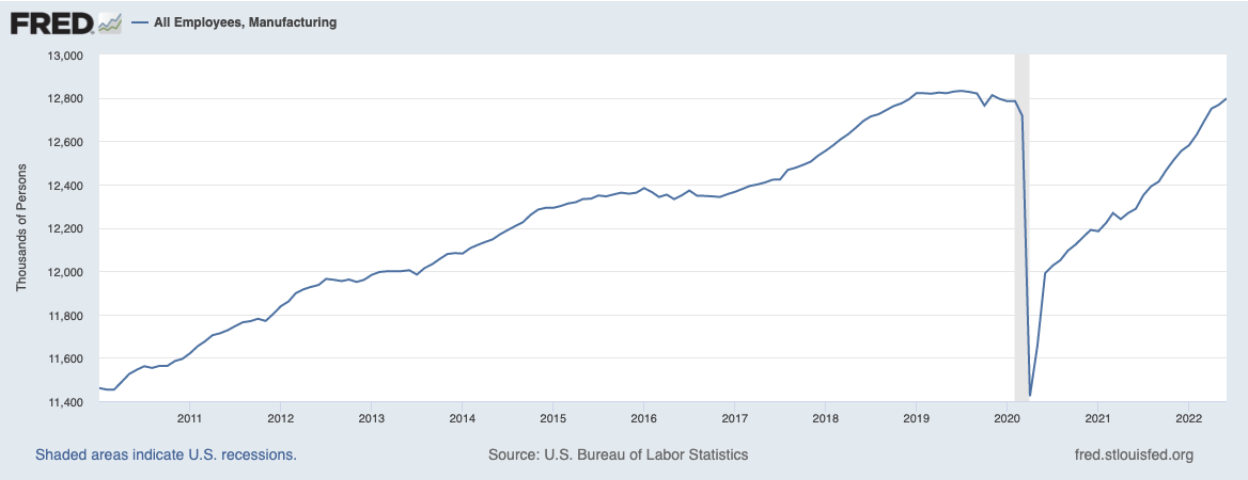

The second development concerns labor. The recent rebound in deal activity in industrials and manufacturing follows more than a decade during which job growth actually started to accelerate across this bluest of blue-collar sectors. As my colleague, Dani Forman, observed in his recent review of the top 50 LMM investors and advisors serving the space, “Manufacturing employment started rising in 2010 after a 30-year decline. And the disruptions in the global supply chain have redoubled interest in domestic production.” That has actually helped employment in this space recover rapidly in response to the pandemic:

Despite the recent rebound, though, labor remains an issue going forward. “Companies are bringing in large quantities of inventory but have no labor to manufacture and ship any of the products that they manufacture,” Bill Overbay, managing director with Stone Road Partners, remarked during Axial’s recent roundtable. “These activities are occurring across the globe and are creating a flywheel effect, which hinders the recovery of the supply chain.”

Fortunately, an essential ingredient to completing transactions such as add-ons to automate more of the supply chain remains the same: levels of dry powder in the US middle-market sit near all-time highs.

In 2021, capital overhang across the US middle market represented some 58% of the total

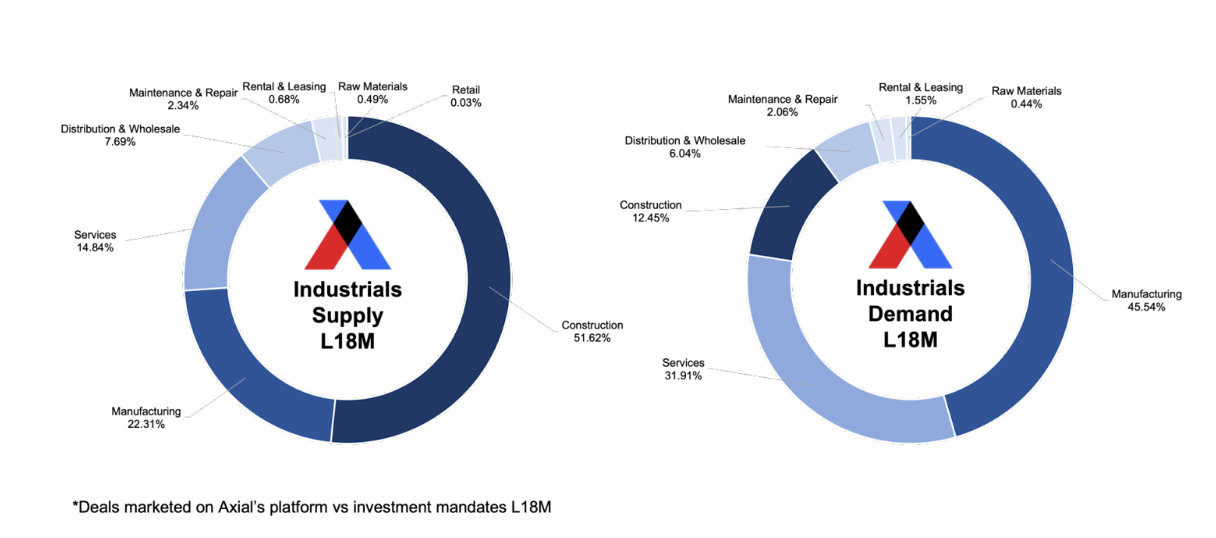

Where funding has led, deal activity has followed of late. Again, investment across the industrials and manufacturing sector jumped considerably over just the past 18 months—a trend unlikely to alter anytime soon. But before tucking into the numbers further, a necessary caveat: deal activity conducted and tracked via Axial does not represent a comprehensive record of all LMM transactions. Rather, with thousands of active members using the platform, Axial’s dataset captures the drivers of dealmaking in this vibrant corner of the private capital markets.

Leading with the most activity from sellers over the past 18 months has been construction, followed by manufacturing and industrial services. Although construction captured about half of activity over the past five years, buyer interest has failed to follow with as much vigor recently.

Rather, the most significant demand on the Axial platform has emerged from investors targeting manufacturing companies. This demand represents nearly half, at some 45% of overall interest, of the buy-side for the last 18 months. Industrial services followed at a third for buyers, while construction deals piqued just 12% of interest overall.

Construction dominates supply while manufacturing leads demand

But the industrials and manufacturing sector still faces substantial near-term challenges that private equity firms are seeking to address.

“Sellers are reading the same news and doing the same industry research as IOP is doing and so they understand the changes,” Philip Fioravante, operating principal at Industrial Opportunity Partners remarked during Axial’s recent roundtable. “IOP is spending a little bit of extra time on the diligence piece including labor shortages and how businesses are dealing with it, human resources and their interaction with the company, customer due diligence to understand how different customers behave and may grow or shrink in the future, and whether or not the business will experience organic growth or will need inorganic growth through an add-on.”

Finally, inflation and interest rate increases are also putting pressure on the sector, as they raise the cost of doing business. All the same, private equity in particular is showing an increased interest in the industrials and manufacturing sector as businesses adapt to various disruptions. In particular, PE firms are interested in businesses that are able to capitalize on the shift to digital manufacturing, as well as those that are investing in automation and robotics to improve efficiency and productivity.

Thanks to their investment and operational expertise, PE firms have been able to provide the resources and support that companies need to weather the current disruption and emerge stronger in several core ways:

1) Streamline their operations: In order to cope with the impact of the pandemic, many industrials and manufacturing companies have had to streamline their operations. Private equity firms have been helping companies to identify ways to optimize their operations, improve efficiency, and reduce costs.

2) Improve their supply chains: One of the biggest challenges facing industrials and manufacturing companies is the need to improve their supply chains. Financial sponsors have been working with companies to identify and implement changes that will improve the efficiency and reliability of their supply chains.

3) Invest in new technologies: In order to remain competitive, industrials and manufacturing companies must continue to invest in new technologies. PE firms have been helping companies in this sector to identify and invest in the technologies that will enable them to stay ahead of the competition.

As a result, the LMM industrials and manufacturing sector remains strong and competitive in the face of current challenges. It also remains a significant investment opportunity as it adapts through disruption.