The Top 50 Lower Middle Market Technology Investors & M&A Advisors [2025]

Technology remains a steady presence in the lower middle market, representing ~13% of deals brought to market via Axial over…

“When everyone is looking for gold, it’s a good time to be in the pick and shovel business.” (Mark Twain)

Metaphorically speaking, a company is said to be in the picks and shovels business if they are providing derivative goods and services in support of entities engaged in some primary activity. Using the gold mining analogy, the idea is that while perhaps less glamorous, it may be a similarly lucrative yet less painful existence to simply hand out the tools than to be the ones tasked with using them. I contend that we are amidst a golden age (or will be very soon) for service providers to the PE community, and we’re starting to see transaction activity (i.e. funds investing in their own service providers) that supports this claim.

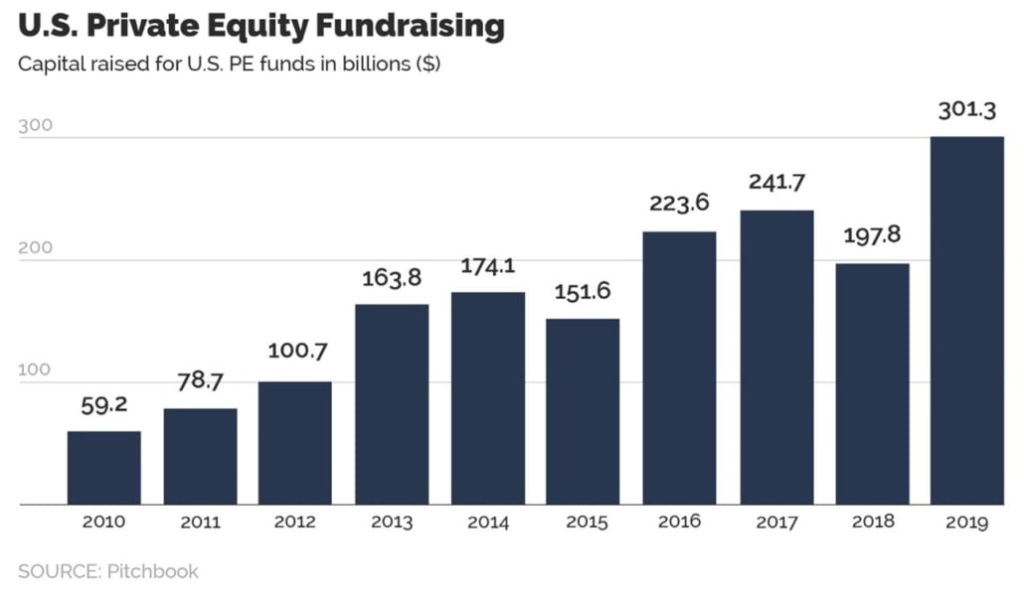

In the U.S., private equity firms have an estimated $900 billion of unspent capital that needs to find a home. The mandate to invest this money wisely and in a timely fashion is what drove funds to lace back up in the second half of 2020 and get creative about how to get deals done when the world seemed like it was ending. And, as long as returns in the broader PE space remain attractive relative to other alternatives, capital will continue to flow into the system, fueling an ongoing gold rush dynamic. The chart below illustrates the generally increasing fundraising trend for U.S.-based PE firms which has been the primary driver of elevated competition (2020 omitted for obvious reasons).

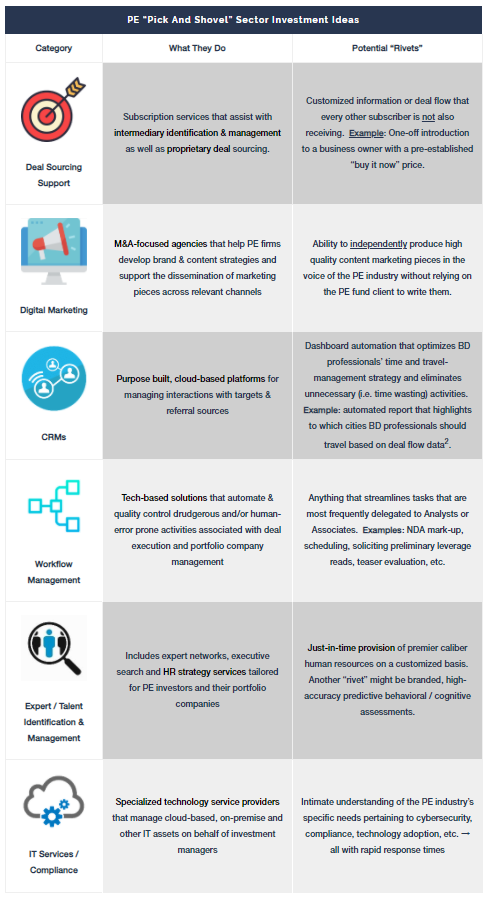

In response to increasingly crowded auction processes and rising valuations, PE firms started pulling out all the stops. This resulted in the rise of the business development professional, CRM implementation, sector specialization, growing marketing budgets and a host of other behaviors that made PE firms start to look like real businesses. As a peer in the PE industry lamented to me not long ago, “This is starting to feel like work.” Therein emerged the opportunity for service providers to ride to the rescue with solutions that made workstreams more accurate, efficient, automated, and generally palliative to the plight of the investment professional. And, to the delight of those offering their wares to the private equity community, they discovered a clientele that was fragmented, seeking tech-enablement, amenable to recurring revenue-denominated relationships and not especially price sensitive. This dynamic creates a fertile backdrop for the PE industry to begin foraging for picks and shovels businesses as investment candidates within its own ecosystem.

In response to increasingly crowded auction processes and rising valuations, PE firms started pulling out all the stops. This resulted in the rise of the business development professional, CRM implementation, sector specialization, growing marketing budgets and a host of other behaviors that made PE firms start to look like real businesses. As a peer in the PE industry lamented to me not long ago, “This is starting to feel like work.” Therein emerged the opportunity for service providers to ride to the rescue with solutions that made workstreams more accurate, efficient, automated, and generally palliative to the plight of the investment professional. And, to the delight of those offering their wares to the private equity community, they discovered a clientele that was fragmented, seeking tech-enablement, amenable to recurring revenue-denominated relationships and not especially price sensitive. This dynamic creates a fertile backdrop for the PE industry to begin foraging for picks and shovels businesses as investment candidates within its own ecosystem.

Read on for some examples of such businesses that I think will be primed for sustainable growth and, thus, investment by PE firms. But first, let’s learn about the OG1 pick and shovel magnate, Levi Strauss.

Around 1872, Levi received a letter from one of his customers, Jacob Davis, a Nevada tailor who had developed a technique for making denim pants using rivets at points of strain to make them last longer. Davis sought to patent his idea but needed a business partner to commercialize his products. Understanding the appeal of more durable workwear to support gold mining, Levi partnered with Davis, and a patent was issued to Jacob Davis and Li & Company on May 20, 1873. Consequently, blue jeans as we know them today were born.

In 2020, Levi Strauss & Co. generated approximately $4.5 billion in revenue with around 75% of that revenue generated from pants. The company’s brand remains one of the most recognizable in consumer products globally. Can you even imagine jeans without rivets on them now?

The private equity industry has long relied upon service providers to support the pursuit and execution of deals. You might say, for instance, that M&A attorneys or accountants represent classic pick and shovel disciplines, which would be true. However, my focus here is on the emerging class of, primarily, tech-enabled service providers cropping up to make PE firms better, faster, and stronger across their various workstreams. Note that for each sector example profiled below I’ve included an idea about what a potential “rivet” could be – in other words, what could or should these entities be providing PE firm clients that would lock them in as essential partners.

The PE industry itself remains a fabulous place to make a career and a living. It’s also true, though, that the amount of capital being managed, and the number of participants, has spawned an excellent opportunity for an array of service providers to serve a demanding yet high quality PE clientele. An opportunity so compelling, that PE firms themselves may increasingly recognize that investment opportunities in high margin, recurring revenue generating, high retention, strong organic growth potential, low customer concentration, tech-enabled services businesses have been hiding in plain sight.

As always, please get in touch if this piece inspired any reactions, and I encourage you to share, like and comment on LinkedIn.

_______

1Original gangster. This is hip hop parlance for someone credited with being the primary or founding influence on a given profession or discipline.

2Anything that eliminates the indiscriminate participation in M&A conferences would be a big win and an undeniable “rivet”.

This article was originally posted on ClearLight Partner’s blog

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle-market companies in a range of industry sectors. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value.

Visit ClearLight Partner’s Profile on Axial.

Disclaimer: The views and opinions expressed in this blog are solely of the author’s and do not necessarily reflect any ClearLight opinion, position, or policy.