The Winning M&A Advisor [Volume 1, Issue 9]

Welcome to the latest issue of The Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

Business owners often underestimate the complexity of selling a business, overlooking the many steps and finer details involved. At Axial, we have 14 years experience in the small business mergers and acquisitions landscape. This includes extensive conversations with business owners and M&A advisors or brokers about what defines a successful exit and the obstacles that can prevent it. With this experience, we’ve put together a business exit timeline.

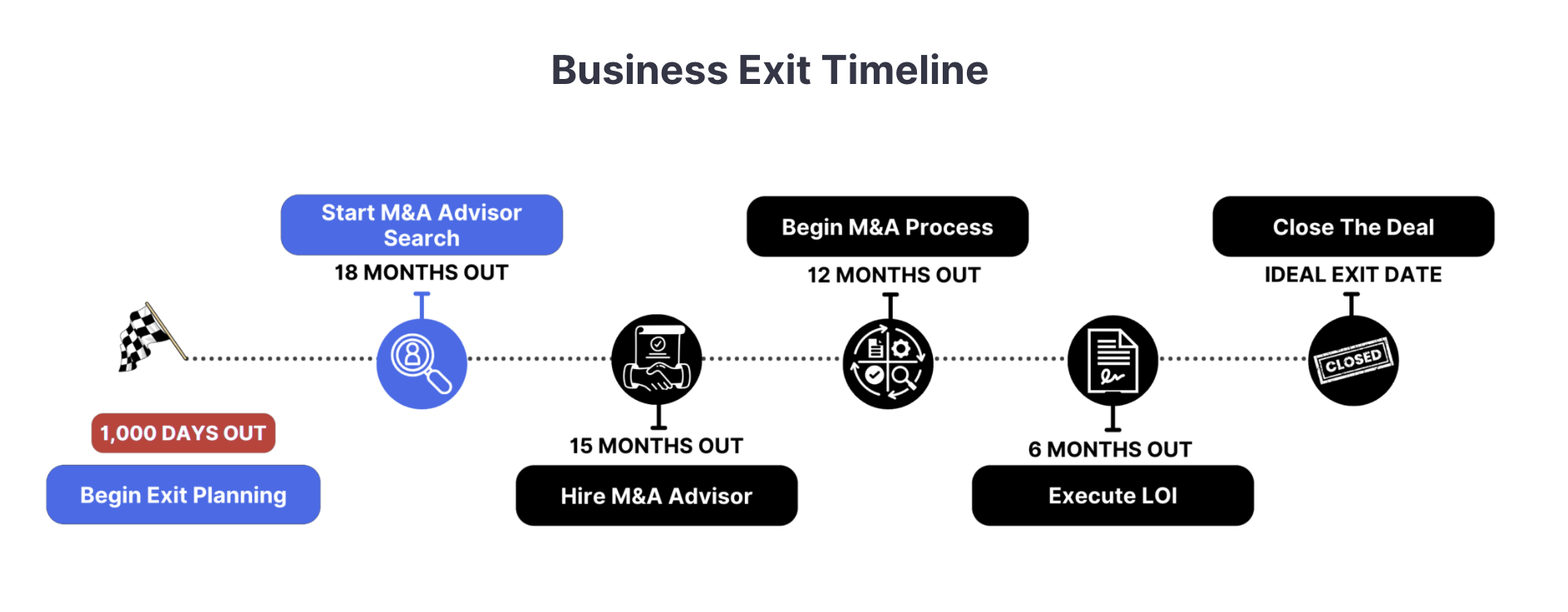

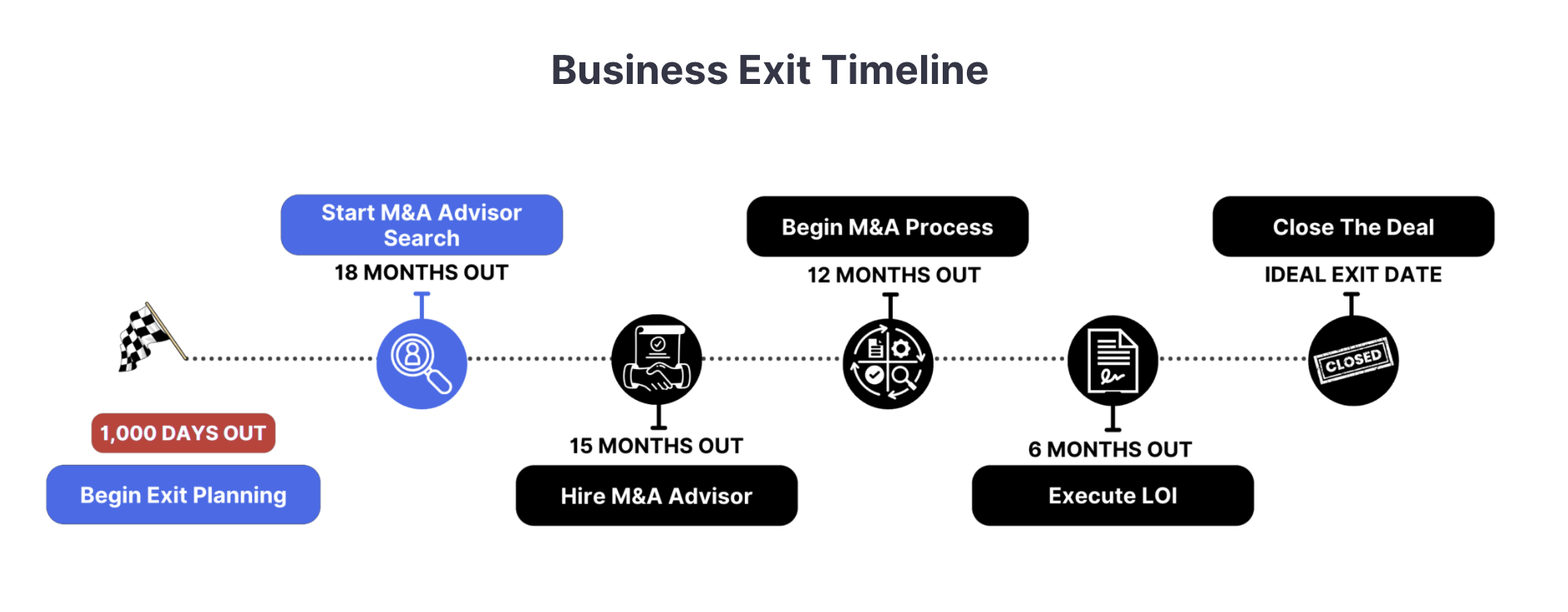

From exit planning to closing the deal, the process typically takes around three years. It starts with exit planning (which you can initiate as the business owner), followed by searching for and hiring an M&A advisor, beginning the M&A process, moving interested buyers through the funnel, and finally closing the deal.

Understanding this timeline helps prevent a failed exit and lets you determine the best time to start the process. Figure out your ideal exit date, then work backwards to decide when to begin.

We’ve created this checklist to guide you through the process of selling your business.

2. Begin Looking for an M&A Advisor

3. Hire the Best M&A Advisor for Your Business

5. Evaluate and Respond to Letters of Intent

6. Finalize the Sale and Close the Deal

Exit planning is the critical first step in selling your business, yet it’s often overlooked or considered something to tackle later, after obtaining a valuation or finding an interested buyer.

But that mindset is misguided. First, exit planning lays the foundation for a successful sale. The work you do here — particularly in streamlining operations and creating a transition plan — addresses issues that could negatively impact your valuation or reduce buyer appeal.

Secondly, selling your business requires full commitment. This phase helps you verify your readiness to sell. The process is intense and involves business and market analysis, creating legal documents, preparing marketing materials, and negotiations.

Even when you work with an M&A advisor (something we strongly recommend), you’re still involved in the process. The more committed you are, the more likely you are to put in the effort needed to close the deal. The exit planning phase focuses on clarifying your motivations, securing emotional buy-in, and setting the stage for your business to thrive without you.

Exit planning can be broken down into four key parts:

Understanding your motivations is essential for committing to the exit planning process. Clearly defining your reasons for selling helps set your goals, including how aggressively you want to approach the sale.

Individuals have varying reasons for selling, but here are some common ones we see among business owners: retirement, death, significant personal events (such as divorce or relocation), health issues, family obligations, a change in passion, or funding other life events. While you don’t need to fit into one of these categories, it’s important that your commitment reflects strong emotional buy-in.

A great way to solidify your commitment is by deciding when you want your business sold and setting a firm exit date. We’ve found that having a clear deadline is highly effective in building the focus and momentum needed to successfully sell your business.

Selling a business isn’t just a financial transaction; it’s a life-changing event that affects your personal life. Start having open discussions with those that are going to be most affected by this change. Make sure everyone understands the timeline and what to expect logistically and financially.

Talk with your family about adjustments to daily routines and roles, i.e., how much more free time you may have now that you’re not running a business. Address any concerns about how their individual careers may shift following the sale. Acknowledge the emotional aspects of this transition, as it can help everyone feel more at ease during the process.

It’s important to put your company in the best possible light for potential buyers — and that starts early on in exit planning. Conduct a thorough assessment of your business processes, identifying both strengths and areas for improvement. Look for opportunities to cut costs and improve efficiency.

On the financial front, tidy up your company’s books. Resolve any outstanding tax issues, make sure your financial statements are accurate, and address any discrepancies. Confirm that any legal obligations or agreements (such as leases, contracts, supplier agreements) are settled and documented to avoid complications down the road.

A smooth leadership transition is key to maintaining your business’s value during and after the sale. This will be a significant factor later in the process when potential buyers are conducting a valuation of your company. They will assess whether your business can maintain its value after you relinquish control.

If buyers perceive that your exit as the business owner will have a significant negative effect on operations and profits, then they may lower their valuation or, if the risk is too great, walk away from the sale completely.

Start by coming up with a succession plan for leadership, choosing key personnel within your company who could step into these roles post-sale. Ensure they have the necessary training and expertise to run operations without you.

Also, focus on retaining high-performing employees who are critical to the business’s ongoing success. Maintaining as much business continuity as possible will help to minimize disruptions when the company transitions to new ownership.

For more information about creating a transition plan, download our guide:

CEO’s Guide to Business Transition Planning

After completing those four tasks, you can confidently proceed with the checklist.

When it comes to selling your business, working with a mergers and acquisitions (M&A) advisor is a game-changer. Survey from Axial customers show that advisors can save business owners 30+ hours a week of work. Plus, advisors can increase the final sale price, anywhere from 6% to 25%.

Advisors will:

This is why you should start looking for an M&A advisor early in the timeline — around 18 months before your ideal exit date — since they play a critical role in the process moving forward.

But often, business owners are at a loss on how to find the right advisor. They may:

At Axial, we’ve put together a resource center for business owners who want to exit their business. This includes guides on finding the right M&A advisor and questions to ask before hiring an advisor.

But you can greatly simplify your search by letting Axial find qualified M&A Advisors for you.

At Axial, we have a network of over 2,000 advisors. These advisors are evaluated by relevant deal experience (with priority given on deals they’ve marketed within the last 24 months), down funnel success (such as the numbers bids buyers have issued on an advisor’s deals within the Axial network), and professionalism and reputation.

To get started, you fill out a short form. We then pair you with an Exit Consultant who learns more about your business and your exit goals. We will take that information and hand-select the best advisors for you.

When we have our recommended advisors, we send you a list with insights on how to further evaluate your options and ultimately pick the best advisor.

With your research complete and potential advisors identified, it’s time to choose and hire an M&A advisor. This step should occur around 15 months before your proposed closing date, giving you and your advisor ample time to prepare for the sale.

At this stage of the checklist, you will:

Now that you’ve shortlisted potential advisors, you’ll conduct initial meetings or consultations. Use these opportunities to evaluate whether their expertise, approach, and personality align with your expectations and needs.

Your advisor should understand all aspects of selling a business and be able to provide strategic advice throughout the process. You’ll be working closely with this person during one of the most significant transactions of your life, so it’s crucial that you feel comfortable with them and confident in their abilities.

When you use Axial to find an advisor, your Exit Consultant guides you through the interview process. We also give you the resources needed so you can confidently select the right advisor for your business.

Prepare a list of questions for potential M&A advisors, focusing on their experience with previous deals, strategy, and negotiation tactics. Inquire about their approach to marketing your business, specifically whether they plan to go with a broad process (posting on public sites) or a selective process (privately reaching out to specific buyers). Understand the pros and cons of each approach and confirm that it aligns with your preferences for confidentiality and exposure.

Discuss their fee structure and assess their ability to handle complex transactions. Pay attention to their communication skills, particularly how they’d navigate difficult conversations with prospective buyers. This thorough vetting process will help you choose an advisor whose approach and expertise match your needs and goals for the sale.

Once you’ve chosen an advisor, they will provide an engagement letter for your review. This document outlines their responsibilities, fees (including any retainer, commission, or success fee tied to the final sale price), confidentiality agreements, expectations for regular updates, and the overall timeline for the sale. It should also include any performance milestones to keep the process on track.

Having these details in the engagement letter ensures that everyone is aligned and committed to moving forward efficiently. Take your time to read through it carefully to make sure it matches what you’re expecting.

With your M&A advisor on board, it’s time to dive into the formal process of preparing your business for sale. This phase typically begins about a year before your ideal closing date and involves:

Your M&A advisor will conduct a formal business valuation. The goal here is to value your company for sale.

Advisors will use three different methods to do this:

To do these analyses, advisors will look at comparable companies and similarly closed businesses. They’ll also look at your financial records, which is why successfully completing your exit planning is key. If your financial records are in disarray at this stage, then this will slow down the process.

Throughout the valuation process, your advisor will explain their methodology and findings, helping you understand which factors most impact your valuation, such as growth rate, customer concentration, regulatory risks, and earnings predictability. This sets realistic expectations, identifies areas for improvement, and gives you actionable steps to potentially increase your business’s value before going to market. Your advisor’s expertise in this complex process is essential, positioning you strongly for the next stages of selling your business.

While you will have an ideal close date in mind, knowing your company’s valuation may influence your timeline. You might want to go to market sooner, or delay going to market until some key issues are resolved, and your company’s value can be increased.

Your M&A advisor will guide you in gathering all necessary documentation for due diligence, where potential buyers will be examining your business thoroughly.

This will include things like contracts, tax returns, leases, permits, employee agreements, and intellectual property records. Working with your advisor, you’ll review these documents to confirm that there are no unresolved regulatory matters or outstanding issues that could complicate the sale of your business.

Your M&A advisor will use their expertise and established networks to identify and screen a list of potential buyers.

Depending on your specific business, they will target buyers in one of two ways:

Together, you’ll review and refine the list, focusing on the right buyers — those who meet key criteria like strategic fit, financial capability, and the potential to add long-term value to your business.

Collaborating with your M&A advisor, you’ll create a professional marketing package that showcases your business’s strengths and future potential. This package will include a teaser, an NDA, and a CIM.

Using documents like the above, your advisor will help you highlight what makes your company an attractive opportunity for buyers, such as its market position, growth potential, and competitive advantages. This carefully crafted presentation is designed to capture the interest of potential buyers while protecting sensitive information, setting the stage for productive discussions with serious prospects.

As serious buyers emerge, they’ll submit Letters of Intent (LOIs). This is a critical point in the business sale process, as the LOI acts as an initial offer that reflects the buyer’s perception of a reasonable purchase price before they conduct a thorough evaluation of your business.

Most of the LOI process is handled by the M&A advisor, with your input. Together, you will:

Your advisor will carefully review each LOI, scrutinizing key details such as the purchase price, payment structure (upfront vs. deferred payments), transition periods, and any contingencies that could affect the sale. This thorough evaluation will also focus on whether the terms align with your financial goals and the long-term stability of your company post-sale. Your advisor will discuss all of this with you, highlighting which elements of each offer are most advantageous and which might pose challenges down the line.

Once you’ve reviewed the offers, your advisor will help you narrow down and identify the best LOI: the one that offers the most favorable terms and aligns with your priorities. This might involve some negotiation to refine details, but once the ideal LOI is selected, you’ll then execute it. At this stage, you will formally agree to the outlined terms, paving the way for further negotiations and due diligence as the sale moves forward.

As you approach the final stages of the M&A process, this is where the most critical negotiations and decisions take place. At this point, both parties are committed, but it’s essential to manage the final details carefully to avoid any last-minute complications or delays.

Key activities during this stage include:

During the buyer’s due diligence process, you’ll provide all requested data, making sure everything is accurate and up-to-date. Your M&A advisor will manage the information flow, keeping the process on track and avoiding unnecessary delays or miscommunications. They’ll also prepare you for any in-depth questions from the buyer and help organize site visits, which are typical at this stage.

Your advisor will take the lead in addressing the buyer’s detailed and nuanced questions about your business, providing clear responses on your behalf. They’ll clarify the inquiries for you, ensuring you understand the buyer’s concerns and objectives.

Your advisor will also manage the in-person site visits so that the process is efficient and professional during this critical stage.

Your advisor will negotiate the final terms of the sale, including the purchase price, earn-out clauses, and any post-sale commitments. Once negotiations are complete, you’ll work together to finalize and sign all sale agreements, including the purchase agreement and any additional contracts required to close the deal.

As part of the closing process, you’ll facilitate a smooth handover to the new owner, communicating clearly with your staff about the transition.

When you look over the checklist above, you’ll see a critical part of the entire process if partnering with an M&A advisor. It’s the first thing you do after you complete exit planning.

This makes sense when you look at the value an advisor brings to your sale, including:

But many business owners aren’t sure how to find an advisor, often relying on word-of-mouth recommendations or conducting their own research.

With Axial, you’re matched with experienced advisors tailored to your unique needs, providing guidance and connections that extend beyond typical networks. This support ensures a smooth, well-managed sale with tailored guidance as you navigate your business checklist — from finding and hiring an advisor to finalizing the deal. You’ll have peace of mind and confidence at every stage of the selling process.