Introducing Axial’s Business Valuation Calculator – Find Out How Much Your Business Is Worth

The number one question our exit consultants hear from business owners is: “How much is my business worth?” To help…

For business owners looking to transact, it is important to have an understanding of the critical documents within an M&A process. If you’ve hired an M&A advisor, this understanding helps you collaborate with them, and responsibly oversee their work. If you’re unrepresented, a deep understanding of these documents is even more important.

Today, we dive into the Indication of Interest (IOI).

As the M&A process progresses down the funnel and the potential buyer pool narrows, many buyers will provide an indication of interest (IOI). This document expresses the buyer’s genuine interest in acquiring or investing in the target company.

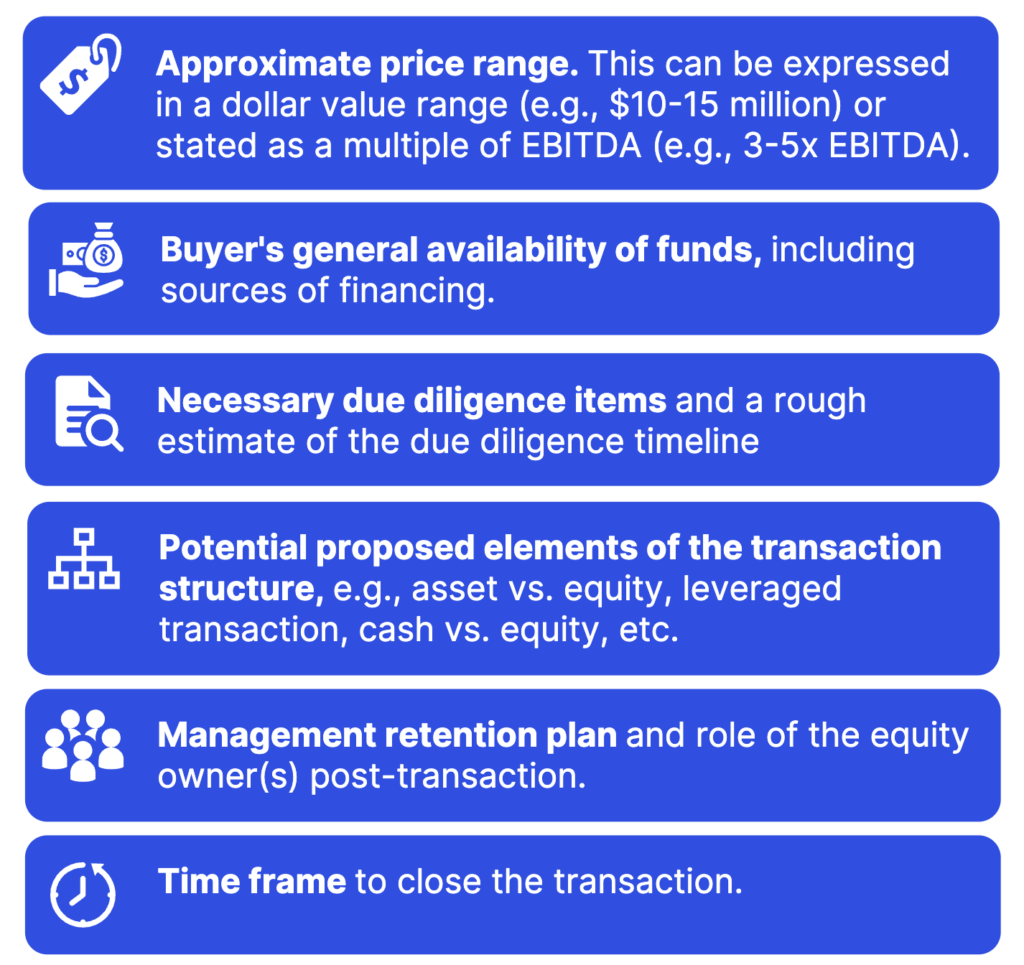

The IOI is a formal document that outlines the buyer’s initial offer. It sets the stage for further negotiations. In this article, we’ll highlight the key elements of the IOI, why it is important, how it differs from a letter of intent (LOI), and how to gauge the effectiveness of a process using IOIs.

An IOI is the very first written offer for a company. It is typically based on limited information – the buyer likely hasn’t visited the company yet or conducted any serious due diligence.

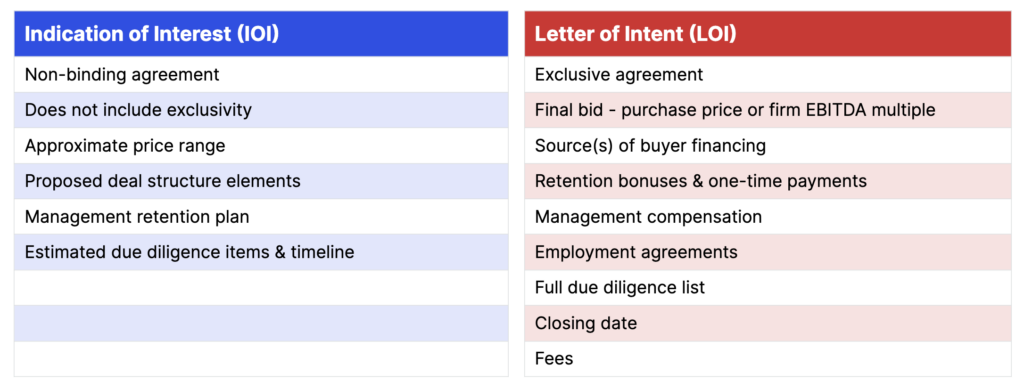

Many business owners new to the M&A process may confuse the IOI with a Letter of Intent (LOI). These documents, while similar in purpose, are quite different. While the IOI is used to express the buyer’s initial offer and initiate the M&A process, the LOI is used to formalize the deal and serve as a roadmap for further negotiations. Below are the key details in each document:

We often get the question from M&A advisors and business owners, “Is the number of IOIs I’ve received on this business ‘good’? How does it compare to similar businesses?

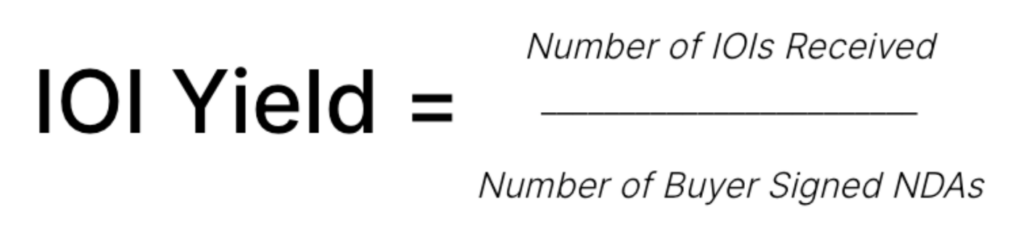

At Axial, we answer this question by tracking a metric we call “IOI yield.” We see the best M&A advisors track a similar metric, but the majority do not.

IOI Yield is a way to gauge how well you, or your M&A advisor, is converting somewhat interested buyers into seriously interested buyers that truly understand the value of your business.

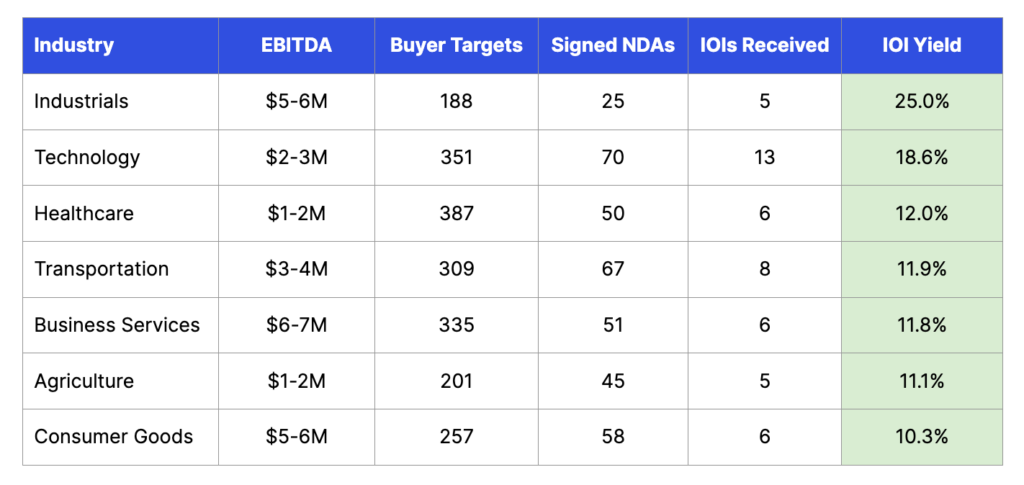

Here is a table with a few examples of deals that have been marketed via Axial:

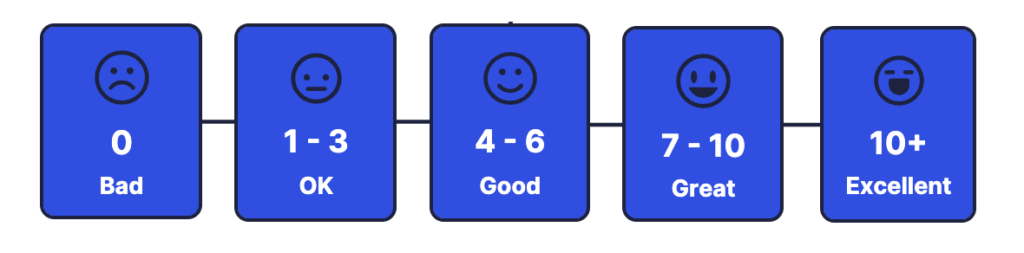

To answer the question in terms of total number of IOIs received, the spectrum may look something like this:

One critical note – these are merely quantitative methods of assessing process effectiveness, and these metrics come alongside a host of caveats and nuances. They may not apply if you are running a process with a handful of parties you already know are interested, or if you have an esoteric or distressed business.

Quality of an IOI, and the buyer behind it, is equally as important as quantity. At the end of the day, all you need is a single serious buyer that is the right partner for the business and is willing to purchase the business at a fair price.

If you’re looking to find the best buyer and maximum price for your business, you can’t go wrong if you launch your process by asking the question, “how can we generate the most IOIs from serious buyers with the right price expectations and outlook on the business?”