Industry Report: Artificial Intelligence Q3 2025 [Solganick & Co.]

Key Report Highlights AI M&A Momentum Accelerates with Record Investment ActivityThe artificial intelligence market is projected to hit $758 billion…

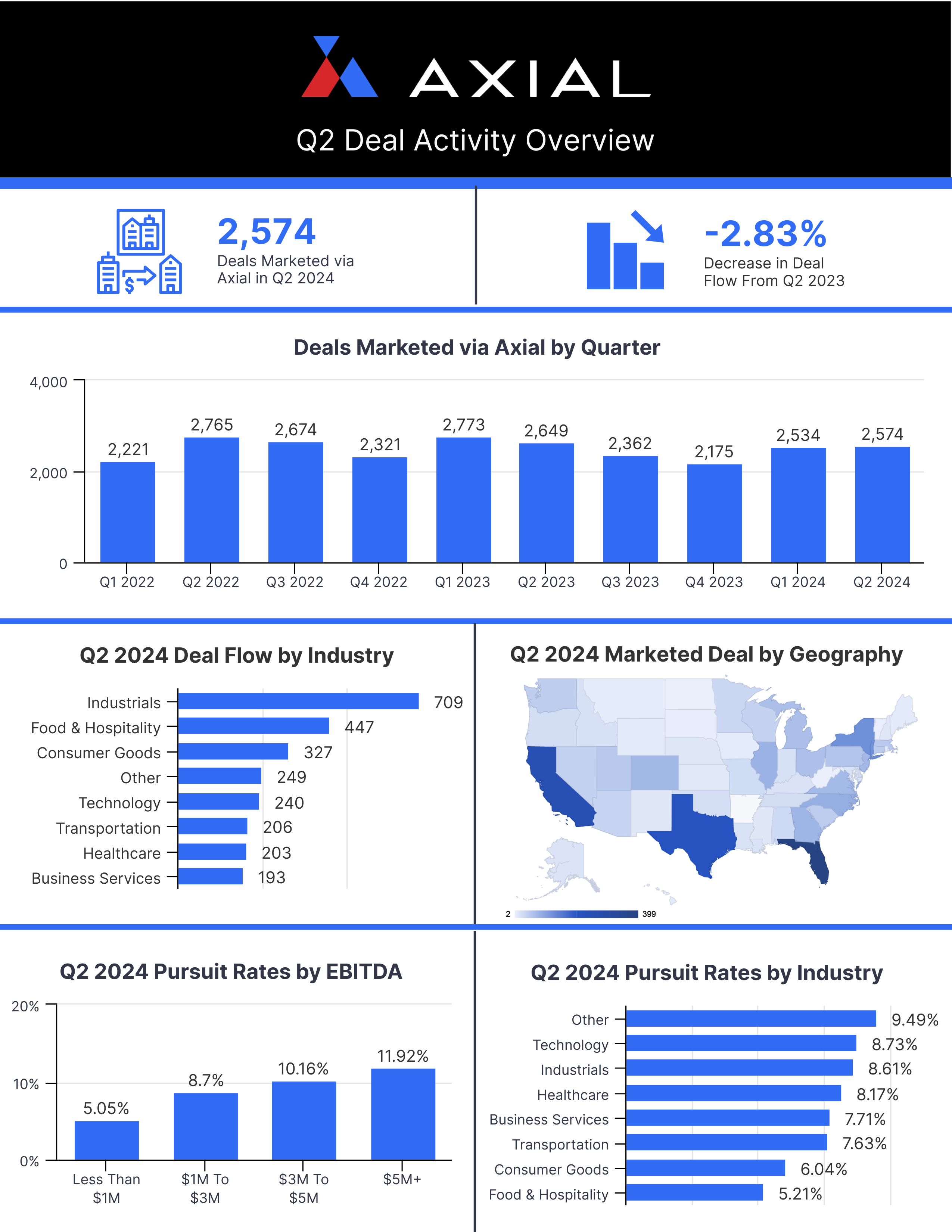

Welcome to the Q2 2024 issue of The SMB M&A Pipeline. This quarterly series surfaces a top-of-the-funnel breakdown of the deal activity on Axial’s platform. The aggregated metrics include quarterly deal volumes, financial and geographic characteristics, and pursuit rates, sorted by industry category.

All deal data is fully anonymized to protect the confidentiality of these transactions.

“Pursuit rate” measures the rate at which Axial’s buyside members register interest in a deal that an Axial sell-side member has invited them to consider. If NDAs, IOIs, and LOIs reflect the deepening progression of interest among acquirers on a given deal, the pursuit rate is one step higher in the funnel than the signed NDA. It offers insight into the forward deal pipeline and the initial interest level of prospective Axial buyside members.

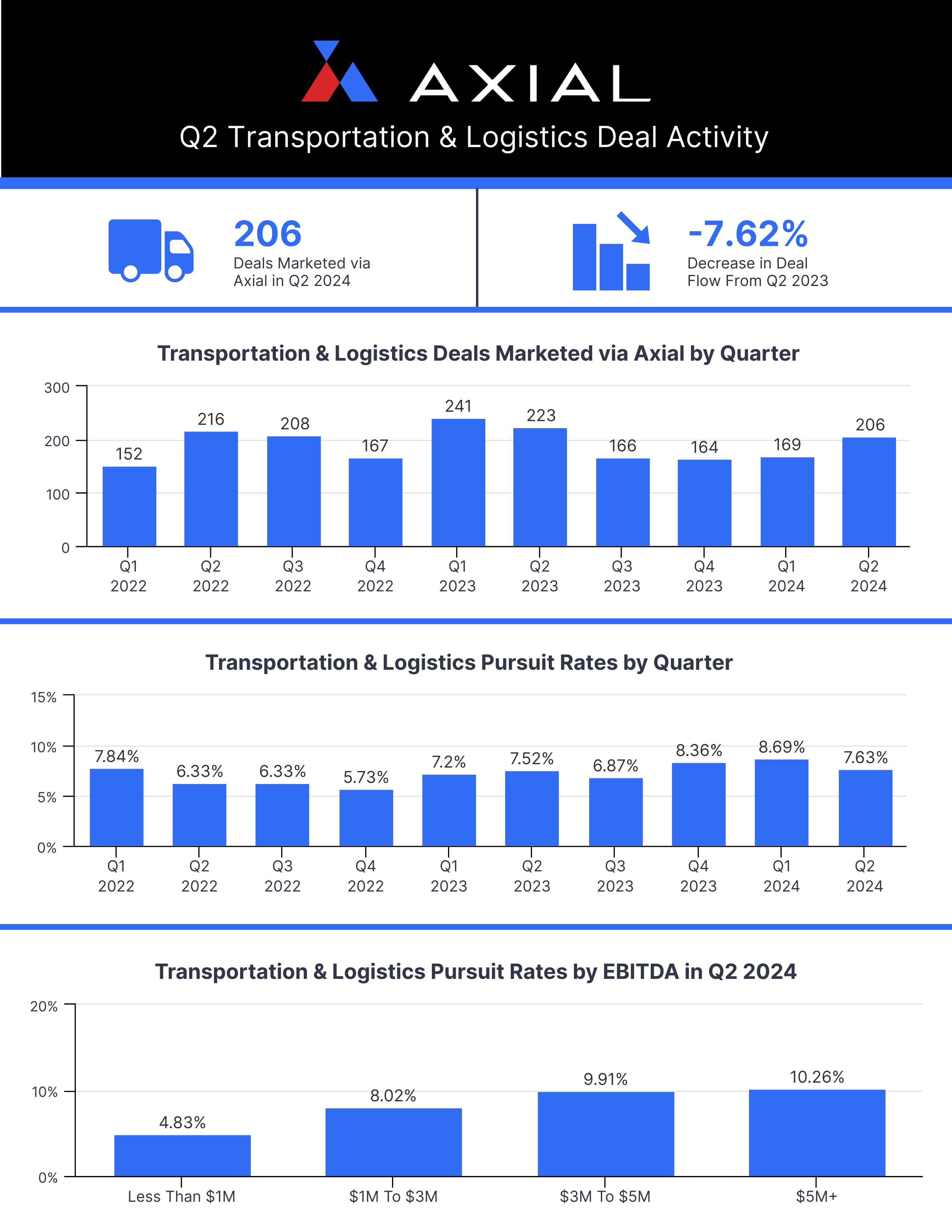

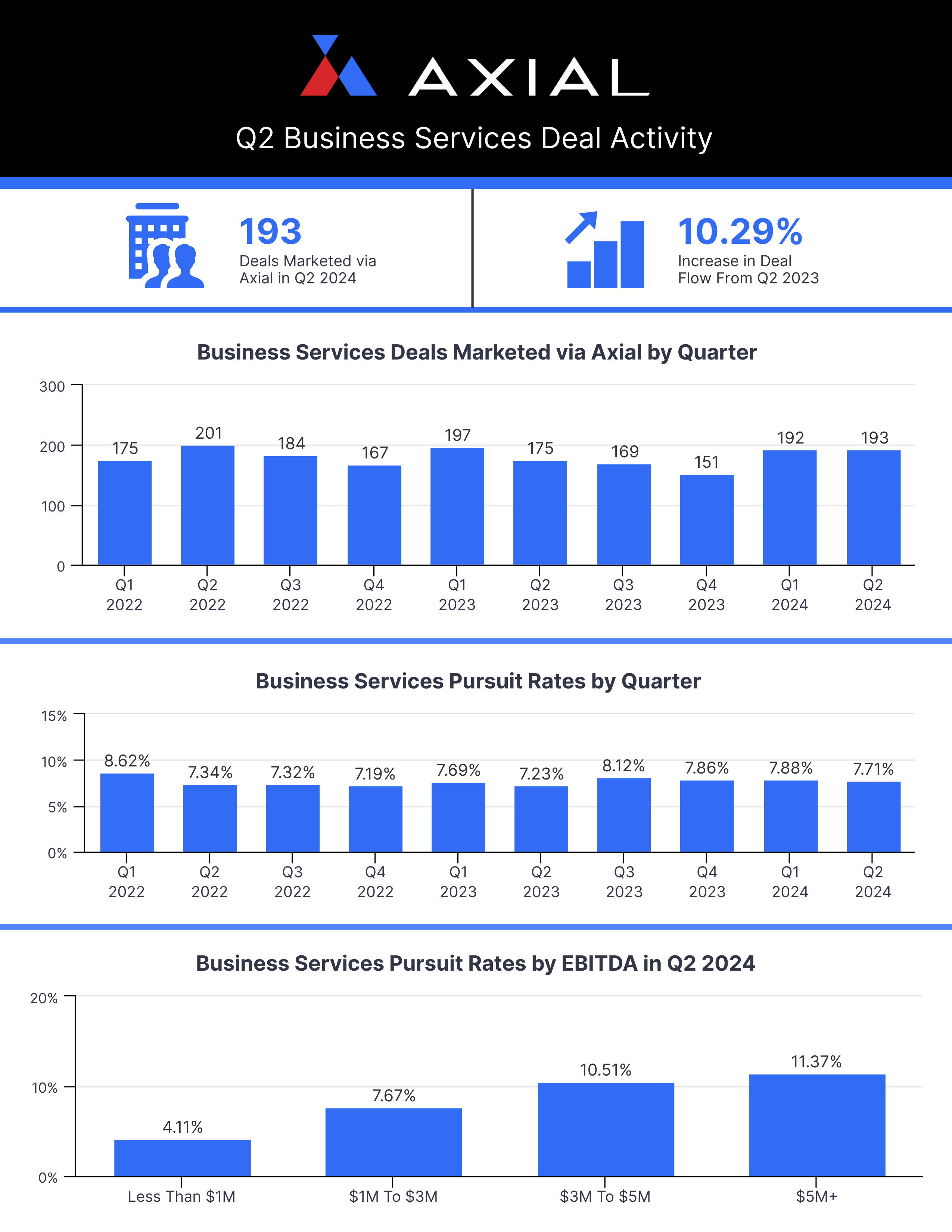

We saw 2,574 deals come to market in Q2, a 2.83% decrease compared to the same time period last year. Business Services and Industrials were the only sectors with YoY deal flow increases (see table below). Food & Hospitality had the most significant decrease, at 13.71%.

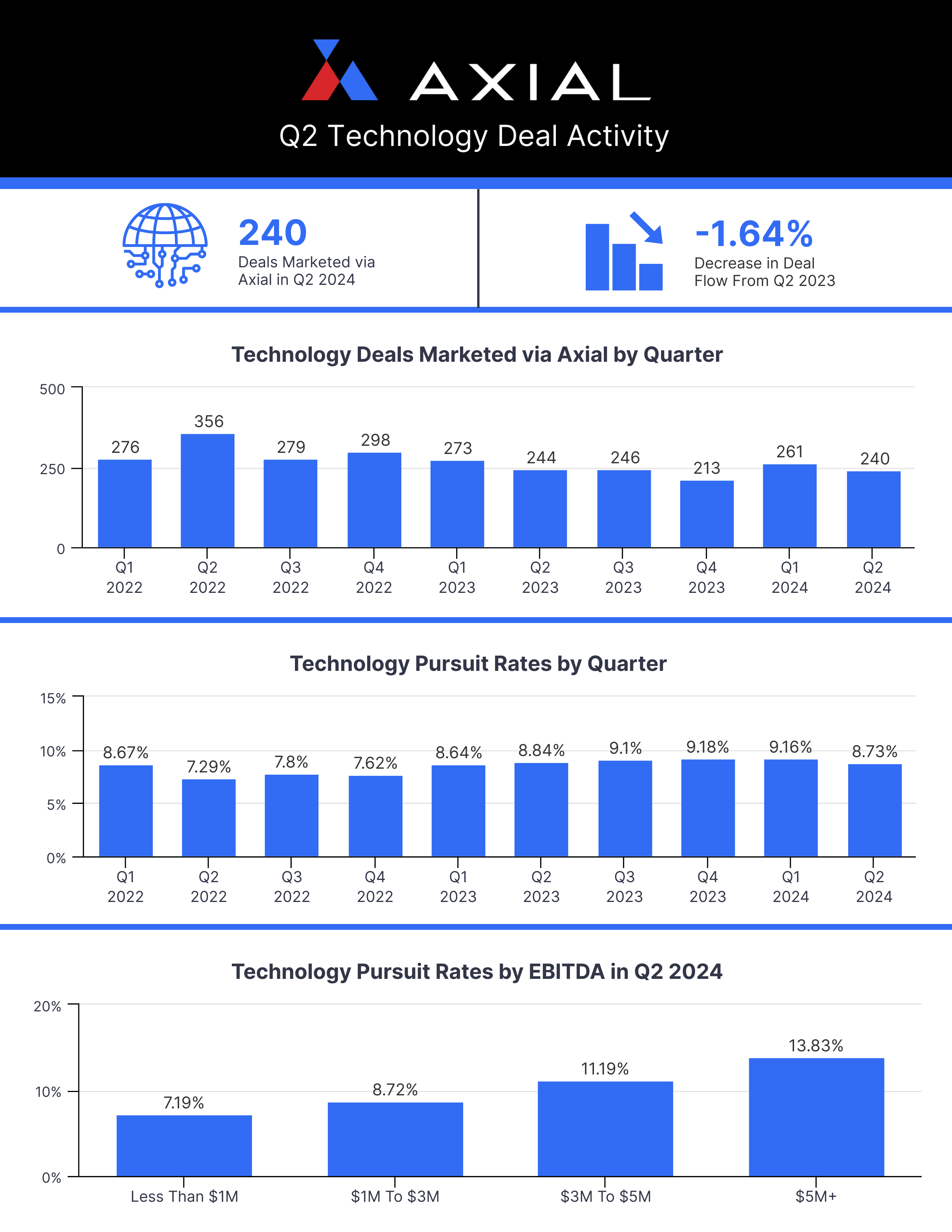

Despite ranking in the middle of the pack for deal volume (4th), Technology ranked 1st for pursuit rate in Q2. Healthcare and Business Services exhibited inverse trends, with Healthcare ranking 6th in deal volume and 3rd in pursuit rate and Business Services ranking 7th in deal volume and 4th in pursuit rate.

Below are industry-specific and overall deal activity tearsheets that lay out a complete breakdown of deal activity in Q2 on Axial. Feel free to share and incorporate the data into your materials as you see fit.

Want to receive articles like this directly to your inbox? Enter your email address below to subscribe to Middle Market Review.