Axial’s 2025 Independent Sponsor Report

Independent Sponsors continue to strengthen their position in the lower middle market M&A landscape. Over the last 12 months, Independent…

Tags

If you look at the stock market, these are tough times for technology companies trying to raise capital. The Nasdaq 100 technology sector is down 20% since mid-November. And some highflyers have fallen far further.

Little of this turmoil, however, is reaching small and midsize technology companies. Bankers and investors focused on the lower middle market expect a brisk pace of acquisitions of technology companies in 2022, with capital readily available to fund them.

The current strong market is really a continuation of the trends in 2021, when smaller technology companies were acquired at a record pace, often with record-breaking valuations.

An analysis of deal activity on the Axial platform shows that the number of technology companies marketed for sale increased by 56% in 2021. That’s after a modest increase of 7% in 2020, despite the drag from Covid.

The pandemic, in fact, spurred a flood of investment to support the shift to shopping at home. The fastest growing sector within technology on the platform was retail technology, where the volume of deals increased by 132% YoY. The second fastest growing subsector within technology was the services space.

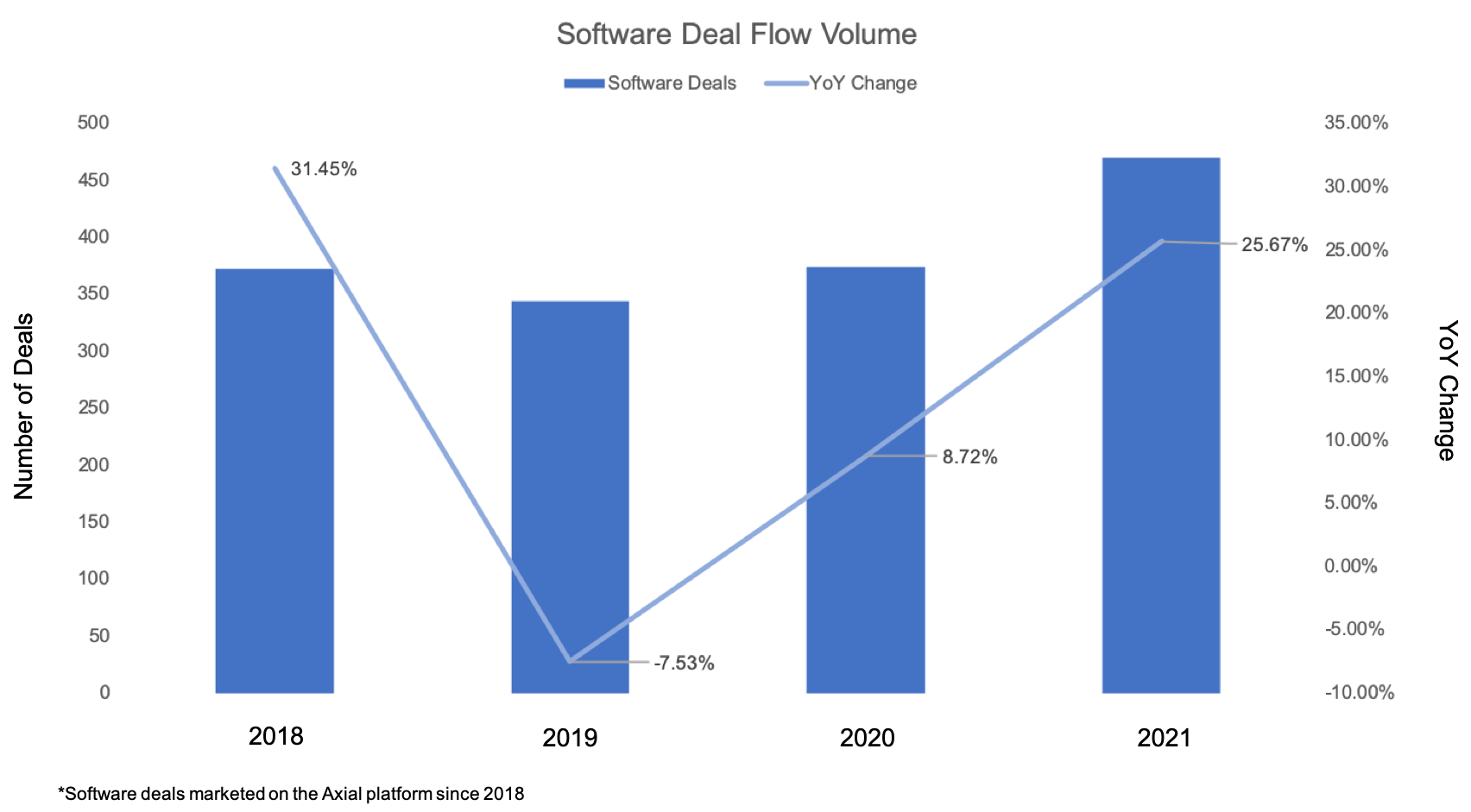

The largest category of technology deals, however, continues to be software companies, representing a bit more than two-fifths of all sell-side technology-related activity on the platform. Software deals increased a healthy 26% in 2021.

Accordingly, the rest of this report will focus on lower middle market software companies. We’ve identified 50 of the top private equity investors and M&A advisors that have a specialty in software deals (see the methodology section below for our criteria).

Click here to see the full list

We also talked with experts at six of these top firms to explore the many forces driving software deals in the past year and what they expect in the future. Some of these conversations are excerpts from a roundtable that we recently hosted, which can be accessed here.

Like this report? It’s part of a quarterly series (click here for the 2021 Healthcare Top 50, here for the 2021 Business Services Top 50, and here for the 2021 Industrials Top 50). Email us at editor@axial.net if you have questions, ideas, or additions.

The experts say the bullish market for software companies reflects the rapid expansion of software and products built on it.

“Software continues to eat the world,” Neudecker says, quoting a memorable 2011 line by Marc Andreessen, the Netscape founder turned venture capitalist. “Software is filling smaller and smaller niches and helping smaller and smaller main street businesses modernize themselves.”

Indeed, there is a world of technology companies far from the pressure cooker of Silicon Valley.

“Everyone talks about the next unicorn,” Solganick says, “but the majority of deals are smaller founder-backed companies.”

Those main-street software companies are now attracting private equity investors who traditionally ceded the technology sector to the more risk-tolerant venture capitalists.

“Private equity firms that were doing other industry ecosystems all of a sudden were doing software,” he said. This influx of capital pushed valuations to a record level. Solganick calculates the average revenue multiple for private software firms in 2021 was 7.3x, up from 5.6x in 2020.

Meanwhile, large businesses in every industry are looking to embed software and data analysis into their products, and they are often buying specialized mid-sized technology companies to do it.

“John Deere is making more money selling data than selling heavy equipment,” Burgess says. Many companies are acquiring software companies to embed new expertise in their traditional businesses. “Everyone is looking for a way to get into the customers’ wallets. So the incumbents are looking for small companies that will let them do something big.”

Another force keeping up the prices of smaller companies is the talent shortage.

There’s a very narrow skillset around building software and technology revenues,” Burgess adds. “A lot of M&A is focused around building teams instantly. They will pay a lot for the folks they want.”

Still, the lower middle market is vast, and many investors with distinctive strategies are finding attractive acquisitions.

“A lot of what we see is overpriced, but that hasn’t been a problem for us,” Kozinsky says. Enduring Ventures is looking for returns from steady cash flow rather than a dramatic exit. “We try to buy great businesses at great prices and hold them forever.”

Sometimes, it buys companies abandoned by their venture capitalists after they didn’t reach escape velocity. It also finds opportunities in overlooked corners of the software industry. Recently, for example, Enduring purchased control of Ed Mehlman and Associates, which provides software to help retailers audit invoices from suppliers. (The investors found the company on the Axial platform.)

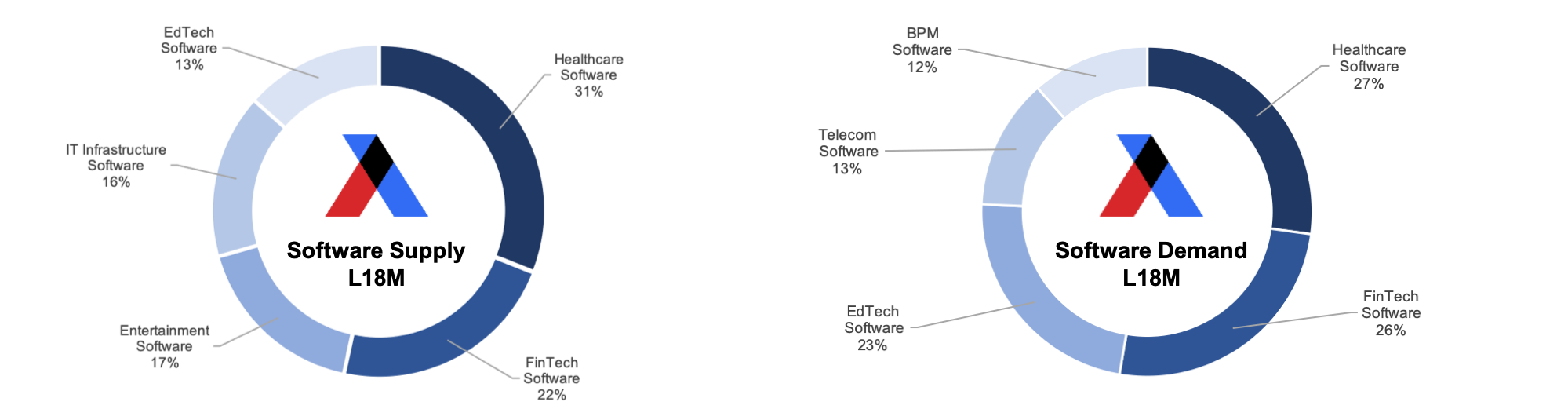

The Axial platform enables companies to be marketed for sale, and it also allows potential buyers to express interest in specific types of deals. This allows us to look at potential differences between supply and demand in the lower middle market.

The biggest gap was for technology companies that sell to consumers rather than businesses. Specifically, 27% of sell-side activity was for consumer software and online services, while only 8 percent of the buy-side activity was.

Within enterprise software and cloud services, buyers had a distinct preference for companies that specialize in a vertical industry, especially healthcare or financial services. They were less interested in platforms that perform a specific function like marketing or human resources. On the sell side, there was a more even split between vertical and horizontal software companies, although healthcare and fintech companies were also the top subsectors.

Looking forward, the bankers and investors see several sectors that have attracted a lot of attention in Silicon Valley, growing in the lower middle market as well.

Top among them is data—collecting, analyzing, selling, and protecting it.

“Companies are overwhelmed by the sheer quantity of data they are interacting with on a daily basis across different devices and platforms,” Norley says. “There have been some big exits in this space, but we’re not interested in the companies with massive capitalization. What interests us is how businesses of any size manage their touchpoints with the digital world.”

Another growth area is managed services companies. These don’t just deliver software from the cloud; they also include consulting and engineering so a company can outsource an entire function—from cybersecurity to human resources.

To be sure, the path to long-term growth may take a detour if the tech pullback in the public markets continues, interest rates rise, or the economy is roiled by the fallout from war in Europe or another surprise from the coronavirus.

So far, the only impact has been for private companies that have been hoping to go public.

“Two years ago, if we had a company with $50 million in revenue, was performing well and had good analyst support, they’d be pretty excited about filing an S1 or doing a SPAC deal,” Burgess says. “That’s off the table now. There is a lot of skepticism around the guys on the periphery trying to access the public markets right now.”

For most of the lower middle market, valuations have remained at record levels, but they may have stopped rising.

“There’s a light conversation around whether we’ve reached peak valuations,” Solganick says. “Some people say they may come down a little, but nobody expects a crash tomorrow.”

Indeed, the hint that the good times might end is prompting a wave of fear-of-missing-out bidding.

“The multiples are through the roof,” Gowisnock says. “Many of the players that haven’t been able to get in the space are becoming more aggressive so they can get into the technology market.”

There’s been a similar rush to provide debt financing for software deals as banks and other new lenders enter the market. That’s why nobody in the market appears concerned by the Federal Reserve’s signals that it will raise interest rates several times this year, the advisors and investors said.

“With all the competition to provide debt for these deals, rates are so low that even if they go up a point or two, they are basically nothing,” Neudecker says.

Some advisors, however, suggest that the spigot of cheap cash will eventually close, as it always does. And the speed and severity of the liquidity crunch may well be a surprise.

“There’s no real talk about how tightening credit markets will hit PE valuations yet,” Burgess warns. “Time to sprint, guys, because it will come.”

For now, the market for software and other technology companies in the lower middle market remains strong. Healthcare and financial technology are the most active sectors, with a lot of interest in any company connected to the collection and analysis of data. While valuations have stopped increasing they are stable.

To conclude, we’re excited to present Axial’s 2022 Top 50 software private equity investors and M&A advisors, whose work both advising and partnering with software business owners deserve recognition.

Axial’s Top 50 software list was generated based on a weighted formula leveraging private transaction data from the Axial platform. Metrics in the formula include the number of software deals brought to market via Axial (sell-side), how much interest those deals generated from Axial’s buy-side member base (sell-side), the number of specific software-focused investment mandates created in the platform (buy-side), and the number of software deals that progressed through the deal funnel achieving an IOI, an executed LOI, or successfully consummated transaction (buy- & sell-side).