The Winning LOI [Vol. 4, Issue 4, No. 56]

Welcome to the latest issue of The Winning LOI, the Axial newsletter that anonymously reveals small business M&A valuation data…

Welcome to the latest issue of The Winning LOI, the Axial newsletter that anonymously reveals small business M&A valuation data and certain key deal terms associated with winning LOIs.

Sign up to receive the Winning LOI newsletter here.

Sponsorship inquiries: [email protected]

Issue #18 examines the EBITDA multiple and financing terms for a commercial printing business. The 5+ year-old company runs a fully remote operation, specializing in event printing services, including custom cards, envelopes, indoor and outdoor signage, and custom samples – all of which are ordered and fulfilled through their online eCommerce channel.

The commercial printing deal went to market confidentially via Axial in Q2 of 2022 and spent 171 official days in market. The deal went on to close 95 days after the winning LOI was executed.

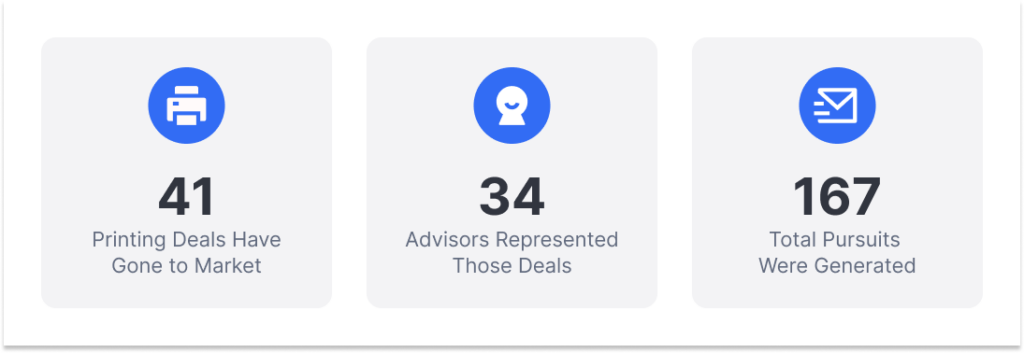

We took a deeper dive into the M&A deal activity for Commercial Printing Services on the Axial platform. Here’s a snapshot of the last 12 months.

Looking to exit your business?

See below for Winning LOI #18’s anonymized data ⬇️

| The Deal | |

|---|---|

| Deal Type | Change of Control |

| Revenue Range (TTM) | $6M - $6.5M |

| EBITDA Range (TTM) | $1.75M - $2M |

| EBITDA Margin Range | 25% - 30% |

| Key Industries | Business Services |

| In-Market Date | Q3 2022 |

| Axial Deal Data | |

|---|---|

| Recommendations* | 147 |

| Recipients* | 147 |

| # of Pursuits* | 17 |

| Deal Pursuit Rate* | 11.56% |

| Winning LOI Pursuit to LOI Executed | 171 Days |

| Winning LOI Executed to Deal Closed | 95 Days |

| The LOI | |

|---|---|

| Total Enterprise Value Range | $12M - $12.5M |

| EBITDA Multiple Range (TTM) | 6.75x - 7x |

| Exclusivity | 45 Days |

| Structure | |

| ➡️ Cash | 74% of TEV |

| ➡️ Rollover Equity | 10% of TEV |

| ➡️ Seller Note | 16% of TEV |

| ➡️ Earnout | ❌ |

| Noteworthy Elements of the LOI | Management Options: Based on the multiple of invested capital ("MOIC") realized by Buyer, senior and mid-level management shall be eligible for management options for up to an additional 10-20% of Company's fully diluted common units at the Strike Price subject to a sliding schedule. |

| Axial Sell-Side Member Data | |

|---|---|

| Member Type | M&A Advisory Firm |

| Total Deals Marketed on Axial | 12 |

| Average Annual Deals Marketed | 2 |

| Average Revenue of Deals | $7,992,091 |

| Average EBITDA of Deals | $1,145,364 |

| Axial Buyside Member Data | |

|---|---|

| Member Type | Private Equity |

| Number of Acquisitions | 1 |

| Buyside Pursuit Rate* | 7.23% |

| Buyer Responsiveness Rate* | 77.34% |

*Buyside Recommendation: Axial sell-side members receive a matching set of buyside members for every deal they manage via Axial. A buyside recommendation refers to a specific buyside Axial member who matches a particular deal.

*Recipient: A recipient is a buyside member who has been granted access by an Axial sell-side member to review a particular deal.

*Pursuit: Axial buyside members express initial interest in a deal by clicking “Pursue”, after which they can access and sign the NDA.

*Deal Pursuit Rate: The deal “Pursuit Rate” is defined as the number of times a particular deal is pursued by unique buyside members (i.e. the buyer shows explicit interest in exploring the deal) divided by the total number of buy-side firms invited to evaluate the deal

*Buyside Pursuit Rate: The buyside “Pursuit Rate” is defined as the number of deals pursued by a particular buyer throughout an entire Axial membership term, divided by the total number of deals sourced during the same timeframe.

*Buyside Responsiveness Rate: The buyside “Responsiveness Rate” is defined as the rate at which a member responds to teaser shares within 5 days. The calculation initiates when a member has a minimum of 10 teasers and is calculated based on the member’s last 100 teasers received.

Disclosures: All data presented in The Winning LOI is anonymized to respect and protect the confidentiality of Axial members and their transactions. Data is provided to Axial by Axial members in accordance with the Axial Member Terms of Service. Axial has endeavored to present data accurately, but Axial does not and cannot fully verify the accuracy of the presented information. Information contained in The Winning LOI is for informational purposes only, and does not represent investment advice or recommendations of any kind.