The Top 50 Lower Middle Market Technology Investors & M&A Advisors [2025]

Technology remains a steady presence in the lower middle market, representing ~13% of deals brought to market via Axial over…

Axial is excited to release our Q2 2024 Lower Middle Market Investment Banking League Tables.

To assemble this list, we reviewed the deal-making activities of 404 investment banks and advisory firms that met the qualifications to be considered for league tables last quarter.

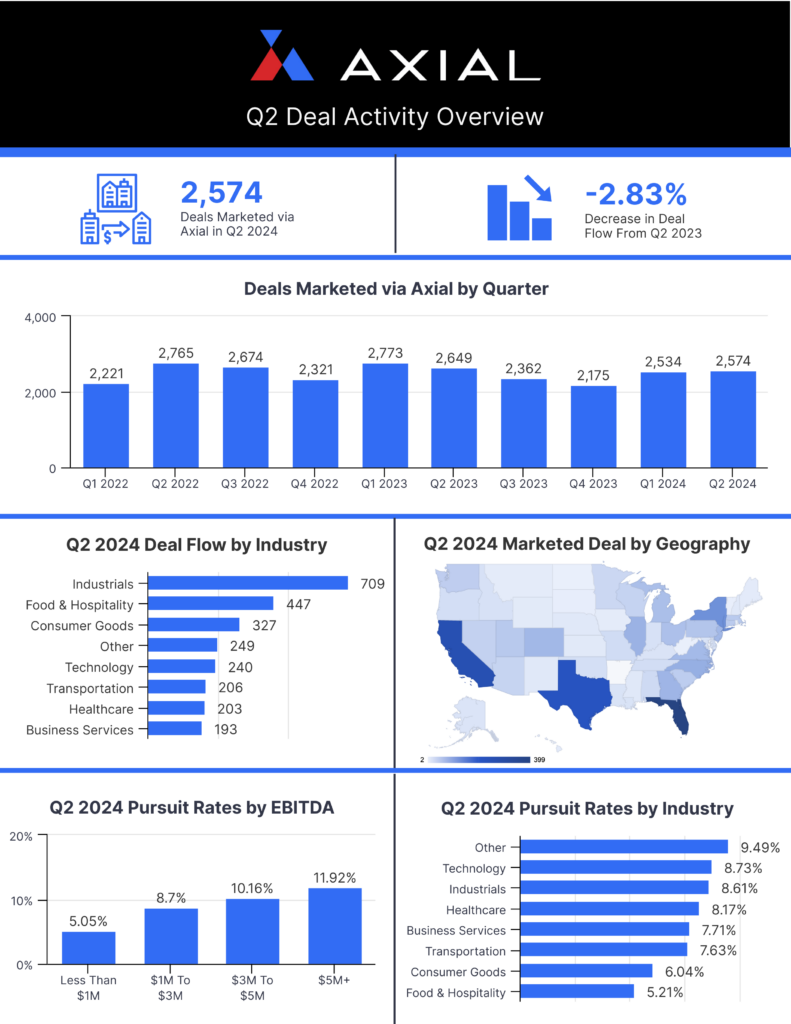

In Q2 of this year, the sell-side membership marketed 2,574 deals on the Axial platform. This is the third consecutive quarter of deal growth for our members, though last quarter’s numbers are still slightly lower (by 75 deals) than those of Q2 2023. Staying on trend, we saw the most deals come to market in the industrials category, with a heavy geographic focus on Florida, Texas, and California.

See below for an overview of last quarter’s deal activity. If you’re interested in diving deeper, check out Axial’s SMB M&A Pipeline series, which surfaces a top-of-the-funnel breakdown of the deal activity, sorted by industry category.

Axial’s league table ranking methodology (detailed methodology available in the footnotes) is driven largely by four factors:

Congratulations to each of these investment banks and M&A advisory firms for their dealmaking achievements in Q2!

| Rank | Firm | HQ |

|---|---|---|

| 1 | Woodbridge International | CT |

| 2 | Peakstone Group |

IL |

| 3 | Bentley Associates | NY |

| 4 | New Direction Partners |

PA |

| 5 | Cross Keys Capital | FL |

| 6 | FOCUS Investment Banking |

VA |

| 7 | Axiom Acquisition |

TX |

| 8 | SDR Ventures |

CO |

| 9 | MidCap Advisors | NY |

| 10 | Exit The Family Business, LLC | MA |

| 11 | Plethora Businesses | CA |

| 12 | Transact Capital Partners |

VA |

| 13 | Protegrity Advisors | NY |

| 14 | Ad Astra Equity Advisors | MO |

| 15 | Vesticor Advisors | MI |

| 16 | Northbound Group | WI |

| 17 | Brentwood Growth |

NJ |

| 18 | Solganick & Co. | CA |

| 19 | Groce, Rose & Moore, LLC | SC |

| 20 | True North M&A | AK |

| 21 | Venture North Group | AK |

| 22 | Capital Canada Limited | ON |

| 23 | Cornhusker Capital | NE |

| 24 | TREP Advisors | FL |

| 25 | BlackRose Group |

LA |

| Firm | HQ |

|---|---|

| Meritage Partners, Inc. |

CA |

| Touchstone Advisors |

CT |

| Pont | TX |

| SGCM Advisors | DC |

| Tsalach Corporate Finance |

IL |

| Firm | HQ |

|---|---|

| Eisen Fox & Company |

WI |

| Janas Associates | CA |

| Sun Mergers & Acquisitions | NJ |

| Founder M&A | TX |

| Sterling Point Advisors | VA |

| Firm | HQ |

|---|---|

| Lakeside Acquisitions | IL |

| SB Liftoff | VA |

| DealGen Partners | MA |

| Gratia Equity Partners | TX |

| JTW Advisors | FL |

| Firm | HQ |

|---|---|

| IT ExchangeNet |

OH |

| Stump & Company | NC |

| Hughes Klaiber |

NY |

| American HealthCare Capital | CA |

| EBB Group |

TX |

![]() – 1 closed deal on Axial |

– 1 closed deal on Axial | ![]() – 2 or more closed deals on Axial

– 2 or more closed deals on Axial

“Woodbridge International has been closing lower-middle-market M&A deals for 30 years. We closed 32 deals in 2022 in various industries, including manufacturing, distribution, e-commerce, logistics, consulting and healthcare; generating $619 million in liquidity for our clients.

We do ground-breaking, confidential global client marketing. We create powerful marketing videos showcasing our client’s companies. We have an innovative 150-day timeline-driven auction that establishes a closing date upfront, and all clients attend a 2-day virtual, Management Meeting Training Program. We are a technology-driven, fully virtual firm.

That’s why Woodbridge International is well-positioned to dominate the highly fragmented, underserved lower middle market.”

Visit Woodbridge International’s Profile

“The Peakstone Group is an investment bank that specializes in mergers and acquisitions advisory and capital raising for middle market clients. Our team is comprised of senior investment banking professionals and operating executives, all of whom have decades of experience and have executed hundreds of transactions totaling billions of dollars.”

Visit Peakstone Group’s Profile

![]()

“Bentley is comprised of senior level investment bankers providing a full array of services to middle market and growth companies. Founded in 1990, our senior level investment bankers joined Bentley over the years from such firms as Bear Stearns, Donaldson, Lufkin & Jenrette, Lehman Brothers, Merrill Lynch, Nomura Securities, PaineWebber, Prudential Securities, Salomon Brothers, Schroders, Bankers Trust, Chase, Citicorp and J.P. Morgan. As a result, our investment banking capabilities are comparable to almost any major Wall Street firm. With 27 senior level investment bankers, Bentley has assembled the “critical mass” of experienced professionals to meet the needs of our clients. Our investment bankers, typically with 15-25 years of experience, have executed a wide variety of transactions. Our clients are in many diverse industries, both domestically and internationally. In 2008 Bentley professionals worked with over 50 clients. As a result, our investment banking capabilities are comparable to any major Wall Street firm, with one exception — their higher overhead costs often preclude them from devoting their senior level talent to anything other than large, prestigious clients and transactions. Because of this key difference, mid-sized companies can expect superior results from Bentley.”

Visit Bentley Associates’ Profile

“New Direction Partners provides advisory services in investment banking, valuation, financial advisory and management consulting. Our partners have unparalleled experience, with involvement in over 200 sales and mergers since 1979. We specialize in providing services to the printing, packaging and allied graphic arts industries with an emphasis on mergers and acquisitions..”

Visit New Direction Partners’ Profile

![]()

“Cross Keys Capital has offices in Fort Lauderdale, Florida, and Chicago, Illinois. With a team of more than 20 professionals, we provide our clients with a full suite of investment banking advisory services including sell-side and buy-side M&A, recapitalizations, restructurings, and capital raising. At the onset, we perform comprehensive diligence and analyses on our clients to identify key deal factors, including the quality of the management team, the stability and track record of the business, the strength and testing of the company’s financial profile, and its competitive positioning.”

Visit Cross Keys Capital’s Profile

“With more than three decades of experience, FOCUS Investment Banking is a trusted name in M&A advisory services with a nationwide footprint and a global reach. Headquartered in the Washington, DC metro area, FOCUS also has corporate offices in Atlanta and the Los Angeles metro area. Its team of 35+ senior bankers is supported by more than a dozen analysts, senior advisors and support staff. Each FOCUS banker maintains a core practice in one of the 12 industry verticals comprising the firm’s current areas of specialization, keeping FOCUS abreast of developments in today’s rapidly changing market environments.”

Visit FOCUS Investment Banking’s Profile

“Axiom Acquisition Group is a Texas-based, privately-owned firm specializing in Mergers and Acquisitions for Texas-based businesses. With over 70 years of combined experience and $4 Billion in transaction volume, we have the experience and expertise to deliver incredible results for sellers and buyers.”

Visit Axiom Acquisition’s Profile

“SDR Ventures is a Denver-based investment banking firm serving private business owners in the lower middle market, including companies with values up to $300 million. The SDR Ventures approach of ‘thinking like owners’ helps businesses maximize their value. Whether owners are looking to sell a business, buy a business or raise debt or equity, SDR is committed to helping them succeed.”

“MidCap Advisors, a middle market investment bank headquartered in New York, specializing in mergers and acquisitions, corporate finance, capital raises, ownership transition planning, business valuations, and negotiation support services for companies generating $5 million to $250 million in revenues. A business owner’s definition of success is multi-faceted. For some, it is selling a business for maximum value. For others, it is effecting a smooth ownership transition to key employees or family members. And for others, the question has not been fully answered yet. That’s why our experienced and knowledgeable advisors created and adopted a 360 degree approach to help business owners identify and accomplish all of their goals. MidCap Advisors also represents corporations, private equity firms and investors who are seeking to grow through acquisition. We can help formulate acquisition strategies, identify prospective acquisition targets, initiate contact, assist in negotiating terms of an acquisition, and help obtain acquisition financing when necessary.”

Visit MidCap Advisors’ Profile

“We represent sell side lower middle market businesses with a 2 tiered fee structure: 1) A performance based value creation fee and 2) a subsidized fee of a successful exiting transaction. Experience shows 76% of successful lower end lower middle market businesses are not prepared to sell. They were built to create a great lifestyle, not built to sell. Our engagement focuses first on staging the business for a successful sale, then bring them to market. This differentiates us from most M&A firms, who’s sole purpose and interests are generally aligned for a sale in the shortest time possible. This may or may not be in the best interests of the owner.”

Visit Exit The Family Business, LLC’s Profile

“Plethora Businesses is a leading M&A firm specializing in business sales, mergers, acquisitions and valuations for privately owned businesses.

We uphold the highest standards in confidentiality. Remaining confidential ensures that your relationships with employees, buyers, investors, and vendors remain intact. We develop a confidential business review of your company specifically tailored for qualified buyers. We have a network of thousands of highly qualified potential buyers, including high net worth individuals, corporate buyers, investment groups, private equity groups, and strategic buyers. We work to align your business with the buyer uniquely positioned to carry on the legacy you have created. We negotiate deal terms to ensure that you receive the value earned and deserved for your business. And because of our experience, we foresee potential roadblocks to a successful transaction, allowing us to proactively plan and avoid transaction issues and delays.”

Visit Plethora Businesses’ Profile

“Transact Capital and subsidiary, Transact Capital Securities, represent business owners in the confidential sales of their business. Founded in 2001, our firm’s 17 experienced professionals specialize in selling privately-owned, mid-tier businesses throughout the U.S with enterprise values of up to $150MM. We have cultivated a reputation for providing our clients with a team of extremely smart, truthful, deal-savvy, close-oriented professionals with a bias for action and an overwhelming concern for our client’s well-being.”

Visit Transact Capital Partners’ Profile

![]()

“Protegrity Advisors is a leading regional M&A advisory firm serving multiple business sectors in the lower middle market ($5 million to $100 million in revenue). Our deal team members have all completed business divestitures, acquisitions and finance transactions as CEOs, General Counsel, and senior business executives. We employ a lean business model that makes our fee structure significantly more competitive than traditional M&A advisory firms. Currently our clients are primarily located in New York City, New Jersey, Connecticut, and on Long Island; however, our access to private equity, corporate and strategic buyers as well as acquisition opportunities extends across the United States and internationally.”

Visit Protegrity Advisors‘ Profile

“AAE is a boutique merger and acquisition advisory firm located in the Kansas City area. We offer M&A advisory services as sell-side advisors. We guide business owners through strategic planning, marketing, and closing of a deal to transition their company. Ad Astra has successfully closed a combined $500 million of transaction value.

Our team works with owners across the nation, of varying sizes, across several industries, with each owner having unique goals. We are well equipped to understand a business owner’s wants and needs, converting those goals into our unique deal process which becomes our roadmap to their ideal outcome.”

Visit Ad Astra Equity Advisors’ Profile

“Vesticor Advisors was founded on the principle that owner-operated companies in the lower middle market are unique and require specialized attention and advice when considering strategic investment and exit opportunities.

Vesticor Advisors provides M&A and capital raising advisory services exclusively to founder and owner-operated companies. We support clients with the expertise needed to build their business through growth acquisitions, optimize value in an exit or sale, transition ownership to family or management, divest non-core assets, or raise capital. After founding, building and exiting our own businesses, the partners at Vesticor came together under a shared vision: to build an M&A firm that helps other business owners achieve their dreams of growth, expansion, legacy and financial independence.”

Visit Vesticor Advisors’ Profile

“We offer an unrivaled blend of synergistic skills to help you maximize the value you receive from your business:

Our team is purpose-driven to get life changing results for our clients. Don’t do the biggest deal of your life alone!”

Visit Northbound Group’s Profile

“Brentwood Growth assists home service and facility management business owners wanting to sell all or part of their business. We assist in valuation, transaction structure, marketing the business, leveraging our network of institutional buyers and managing due diligence / legal process to close. Our fees are 100% performance based paid at close of transaction.”

Visit Brentwood Growth’s Profile

“Founded in 2009, Solganick & Co. is a data-driven investment bank and M&A advisory firm focused exclusively on software, healthcare IT, and tech-enabled services companies. Offices are located in Austin, Dallas, Los Angeles, and San Francisco. Our deal team has completed over $20 billion in M&A transactions to date.”

Visit Solganick & Co.’s Profile

“If you are looking to buy, sell, expand, consolidate, or simply need to understand your options and their effects, we can help. No matter your current business model, structure or financial condition, there are actions that you should and could be taking now. As an aspect of strategic management or investments, our team at Groce, Rose & Moore will assist you in selling – acquiring – growing – downsizing – understanding your company’s value, changing the nature of your business, competitive position and more. We not only have the knowledge and experience to get things done, but understand and care about your personal and business goals. We work with family offices, private equity firms, venture capitalists, angel investors, corporations and individuals.

We believe it’s our client approach that sets us apart from our competition. First and foremost we listen and then take that knowledge leveraged by our experience and vast contacts to create the right fit. We focus on what is important to you, your business and any shareholders. We also strive to conduct ourselves in a manner that makes certain everyone is treated fairly and equitably.

Visit Groce, Rose & Moore, LLC’s Profile

“True North Mergers & Acquisitions advisors serve business owners from across the country who want to sell companies that generate annual revenue between $5 million and $150 million.

The nationally-recognized team at True North Mergers & Acquisitions has access to an unmatched network of buyers and founders. We’ll help you secure a better, more profitable transaction for your transitioning business with a strategy that values your employees and customers, outlines exactly what your business is worth, and champions your legacy.”

Visit True North M&A’s Profile

“Venture North is firm based in Anchorage, Alaska that provides a full suite of services to our buy-side, sell-side and capital finding clients. We have successfully managed and handled engagements in a wide variety of industries and are recognized as a leader in assisting in the sale, or purchase of businesses. We do business throughout the US, but we have unmatched expertise in the Alaska market. Due to Alaska’s very low level of VC and PE activity, the returns tend to be higher and deal quality better than in other, more competitive markets.

Our team has more than 30 years of experience working in diverse industries, which has enabled us to build our services and solutions in strategy, consulting, mergers, acquisitions and capital finding that assist our clients in maximizing their potential.”

Visit Venture North Group’s Profile

“Capital Canada Limited is an independent investment banking firm providing expert, financial advice to corporations and entrepreneurs in Canada and abroad. With a focus in the private capital markets, Capital Canada brings to bear the application of innovative and independent financial skills, targeted towards the unique characteristics of its clients. Capital Canada recognizes that effective corporate finance requires evaluation of financial needs, an understanding of corporate goals, awareness of market attitudes, knowledge of funding sources, as well as an ability to develop the best financial structure for each client. For over 35 years, Capital Canada has built a reputation for performance with one clear goal: complete the best transaction for the client.”

Visit Capital Canada Limited’s Profile

“We are highly experienced Investment Bankers and Advisers focusing on the lower end of the middle market. Our sweet spot is companies with greater than $1.0 Million TTM EBITDA and less than $100 Million in annual revenues.

Cornhusker Capital was launched in November 2010 with the idea of providing superior and value-based services to lower middle market companies. Cornhusker Capital provides superior and imaginative financial services including mergers & acquisitions, buy-side and sell-side advisory services, free valuation analysis and corporate financial re-engineering. Cornhusker Capital is a leading middle market advisory firm. We are seasoned corporate finance executives with significant Fortune 500 experience.”

Visit Cornhusker Capital’s Profile

“TREP Advisors is an advisory firm focused on succession solutions for business owners. At TREP Advisors we know you want to be an owner who understands the future options for your business. In order to do that, you need a succession plan that fulfills your desires and addresses all the issues of estate planning and taxes. The problem is you are so busy with running the company that it makes you feel confused about addressing the issues of a succession plan.

We believe every owner is truly unique and that your succession plan is the single most important business decision you will make to achieve the freedom you deserve. We understand the struggles and opportunities you face every day because we have walked in your shoes, which is why we have been able to help owners like yourself sustain control over their business while liquidating equity in their business for financial security.”

“We are an M&A firm focusing on sell-side and buy-side transactions. Our areas of specialty include Energy, Manufacturing, Healthcare, Business Services and TMT. Primarily our market is 5-50 million in transaction value, although we are a bit flexible outside of that range. We welcome all opportunities and are open to discuss at any time.”

Visit BlackRose Group’s Profile

Unlike traditional league table structures that have remained the same for years, where firms are assessed against deal activity and deal dollar volume, Axial league tables surface data on investment banks that reveal their client quality, ability to manage a sell-side process, and down funnel effectiveness for their client.

The investment banks at the top of the Axial League Table are leaders across the following categories:

Together, the top 25 investment banks are those who work with the most in-demand clients; balance breadth, selectivity, and accuracy in the buyers they engage; and generate the largest number of positive outcomes for their clients.

Axial is the trusted deal platform serving the lower middle market ($2.5-$250M TEV).

Over 3,500 advisory firms and 3,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.