The Top 50 Lower Middle Market Technology Investors & M&A Advisors [2025]

Technology remains a steady presence in the lower middle market, representing ~13% of deals brought to market via Axial over…

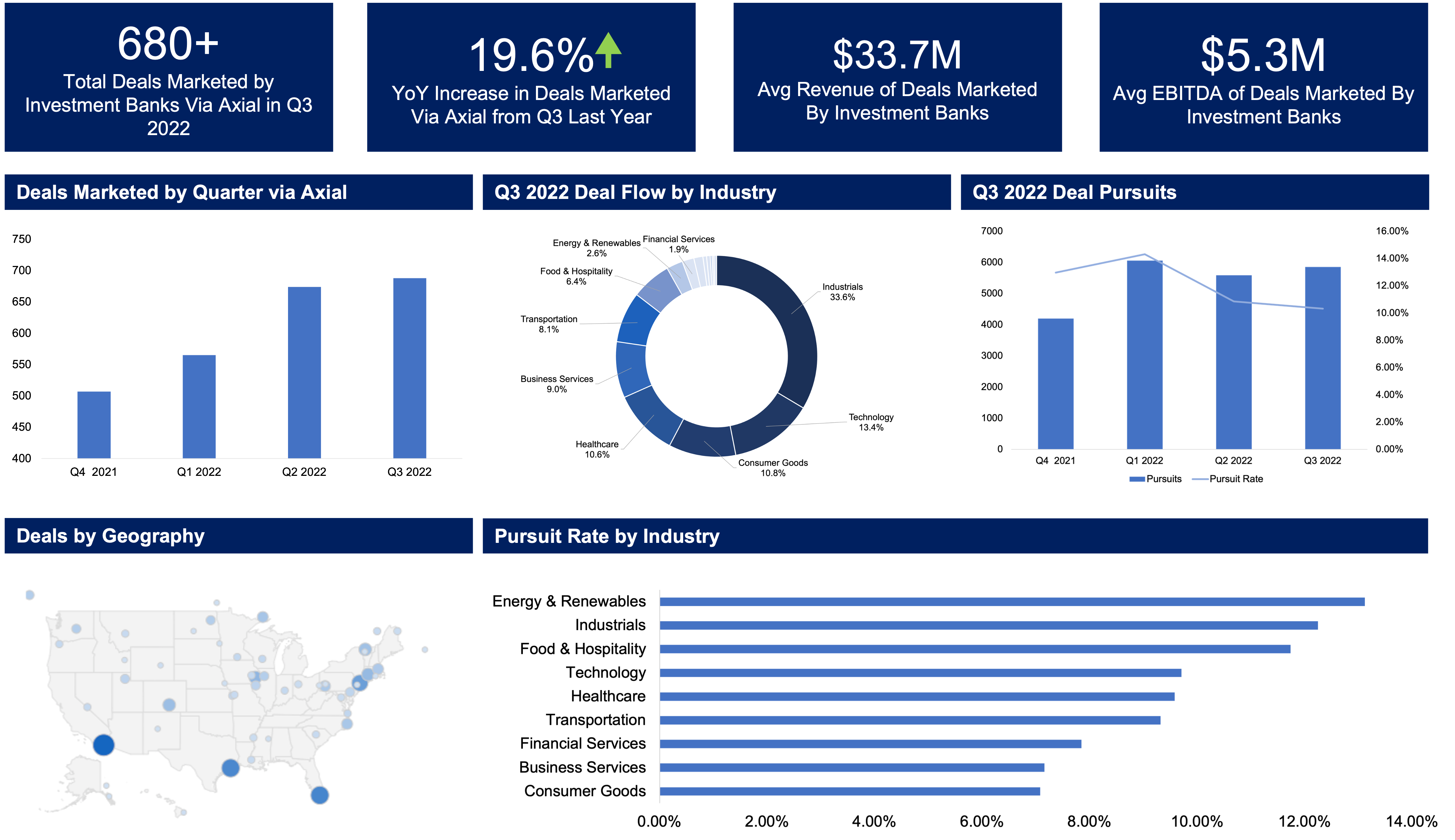

Axial is excited to release our Q3 2022 Lower Middle Market Investment Banking League Tables.

While inflation and the possibility of an economic recession remain headline news, an argument can be made that with growing employment, decreased oil prices, and a continued rise in consumer spending, there is a light – albeit faint – at the end of the macroeconomic tunnel. In the lower middle market, however, the bright light remains unwavering with yet another quarter of robust deal flow.

Quarter-over-quarter growth in sell-side projects brought to market via the Axial platform was minimal in Q3, however the YoY increase was up more than 19.6% from the same period last year. And despite deal flow remaining fairly flat, there is the consideration that we came off of a record-breaking Q2 and fairly consistent growth over the past six quarters. Furthermore, the quality of newly-marketed deals in Q3 rose notably: the average revenue of deals marketed in Q3 was up $12M from last quarter, and the average EBITDA increased $1.5M.

So… a big congratulations to Q3’s top 25 investment banks, who are sure to be busier than ever!

Axial’s Lower Middle Market Investment Banking League Tables aggregate and rank Axial sell-side M&A advisors based on their quarterly deal activity.

Three factors disproportionately drive league table ranking:

For detailed methodology, see the end of this feature.

| Rank | Firm | HQ |

|---|---|---|

| 1 | eMerge M&A | NY |

| 2 | Salt Creek Partners | TX |

| 3 | Align Business Advisory Services | FL |

| 4 | Peakstone | IL |

| 5 | Focus Investment Banking | VA |

| 6 | Janas Associates | CA |

| 7 | Everingham & Kerr, Inc | NJ |

| 8 | VERCOR | GA |

| 9 | Flatirons Capital Advisors | CO |

| 10 | Auctus Capital Partners | IL |

| 11 | Plethora Businesses | NC |

| 12 | The Hatteras Group | GA |

| 13 | RLS Associates | DE |

| 14 | Three Twenty-One Capital Partners | MD |

| 15 | New Direction Partners | PA |

| 16 | Lakeside Partners | WA |

| 17 | ACT Capital Advisors | WA |

| 18 | WhiteHorse Partners | TN |

| 19 | Business Capital Exchange | MA |

| 20 | GT Securities | CA |

| 21 | PCE Investment Bankers | FL |

| 22 | Meritage Partners, Inc | CA |

| 23 | SDR Ventures | CO |

| 24 | BMI Mergers & Acquisitions | PA |

| 25 | Global Wired Advisors | NC |

| Firm | HQ |

|---|---|

| Harris Northwest Advisors | WA |

| Wyndham Capital Group, LLC | FL |

| French Capital Advisors | TX |

| The Forbes M+A Group | CO |

| Kaulkin Ginsberg | MD |

| Firm | HQ |

|---|---|

| Southard Financial | TN |

| Apex Exit Advisors, LLC | GA |

| FourBridges Capital Advisors | TN |

| CRI Capital Advisors | AL |

| 41 North LLC | CA |

| Firm | HQ |

|---|---|

| Vista Business Group | KS |

| Ascend Strategic Partners, LLC | CA |

| Exit Partners, LLC | TX |

| Speedshift Advisors | DC |

| Aberdeen Advisors, Inc. | FL |

| Firm | HQ |

|---|---|

| Wood Warren & Co. | CA |

| Vertess Healthcare Advisors, LLC | TX |

| Stump & Company | NC |

| Baker Group M&A Consultants | KS |

| Mertz Taggart | FL |

“Originally founded in 1989, our mission is to provide a level of expertise, knowledge, and execution not typically available to owners of privately-held middle market companies.

With offices in New York, Pennsylvania, Florida, Texas, and California, eMerge M&A is perhaps the most experienced and data rich M&A firm serving this market segment. No one has more experience with privately-held companies.”

Industries: Aerospace & Defense, Business Services, Construction, Consumer, Distribution, Energy, Healthcare, Manufacturing, Media & Advertising, Technology, Transportation & Logistics

“Salt Creek Partners (“SCP”) is a boutique M&A advisory firm operating in the Southwest, Southeast, New England and Gulf Coast regions.

SCP serves business leaders in the emerging growth and middle markets, specifically on clients looking to be acquired and companies wanting to make an acquisition. We provide strategic consulting to reposition and optimize companies wanting to sell in order to ultimately increase valuation.”

Industries: Manufacturing, Financial Services, Consumer Goods, Industrials, Technology, Retail, Business Services, Health Care, Consumer Services, Life Sciences

“Align Business Advisory Services (“Align”) is a nationwide Mergers & Acquisitions Advisory firm focused on the lower-middle-market. Their team of industry professionals align buyers and sellers in successful transactions, providing advice and guidance before, during, and after the transaction.

Align’s mission is to provide lower-middle-market businesses with enterprise expertise and innovative and personalized service. We provide concierge service to ensure that the right buyers and sellers are aligned for success and enterprise value creation. To date, our firm has facilitated over $1B in M&A transaction volume across a variety of industries.”

Industries: Manufacturing, Technology, Retail, Business Services , Consumer Goods, Distribution, Health Care, Media, Consumer Services, Industrials, Life Sciences, Telecommunications, Financial Services

“The Peakstone Group is an investment bank that specializes in mergers and acquisitions advisory and capital raising for middle market clients. Our team is comprised of senior investment banking professionals and operating executives, all of whom have decades of experience and have executed hundreds of transactions totaling billions of dollars.”

Industries: Business services, Consumer Goods, Financial Services, Food & Beverage, Health & Wellness, Healthcare, Industrials Manufacturing, Real- Estate, Retail, Tech Software/Saas

“With more than three decades of experience, FOCUS Investment Banking is a trusted name in M&A advisory services with a nationwide footprint and a global reach. Headquartered in the Washington, DC metro area, FOCUS also has corporate offices in Atlanta and the Los Angeles metro area. Its team of 37 senior bankers is supported by more than a dozen analysts, senior advisors and support staff. Each FOCUS banker maintains a core practice in one of the 13 industry verticals comprising the firm’s current areas of specialization, keeping FOCUS abreast of developments in today’s rapidly changing market environments.”

Industries: Technology, Industrials, Manufacturing, Consumer Goods, Business Services, Distribution, Health Care, Telecommunications, Financial Services, Retail

“Trusted M&A advisors with more than 20 years experience helping Middle Market business owners navigate and negotiate the constantly changing M&A markets across all industries. Janas has developed a customized, dynamic approach to the sale and acquisition of companies. Our focus allows us to regularly achieve above-market results.”

Industries: Manufacturing, Consumer Goods, Industrials, Materials, Distribution, Media, Retail, Technology, Business Services, Financial Services, Consumer Services, Energy & Utilities, Health Care, Real Estate, Life Sciences

“Founded in 1988, Everingham & Kerr, Inc. is a merger and acquisition advisory firm that specializes in providing intermediary services for lower middle market companies and entrepreneurs. We have assisted clients across virtually all industries. We offer various services including mergers, acquisitions, divestitures, valuations, and transaction consulting. Our client base has included public and private companies, investor groups, individual entrepreneurs, management buyout groups and family buyout participants.”

Industries: Business Services, Financial Services

Visit Everingham & Kerr’s Profile

“VERCOR, a leading middle market mergers and acquisitions firm, serves business owners who are interested in selling all or part of their company or who are seeking a private equity recapitalization. Our team manages the entire process – business valuation, assessing the market value of a company, pre-sale planning, marketing, negotiations, and closing the best possible deal. VERCOR brings national and international resources to the job of selling a business in the mid-size market. VERCOR merger and acquisitions consultants provide worldwide resources usually available only to companies with revenues in excess of $100,000,000.”

Industries: Manufacturing, Energy & Utilities, Technology, Consumer Goods, Distribution, Business Services, Industrials, Retail

“Flatirons is a premier lower middle-market M&A advisory firm with offices in Denver, Dallas, Chicago and Miami.

With decades of transaction advisory experience, our founders identified a growing need in the middle-market to bring together a more comprehensive suite of professional resources. The deal process is 100% managed by a senior team member and not pushed down to a junior analyst. This hands-on approach by senior team members ensures a strategic and robust process for our clients.”

Industries: Manufacturing, Energy & Utilities, Business Services, Distribution

“Auctus Capital Partners is a leading financial services and investment banking firm focused exclusively on creating value for the lower middle market. We specialize in merger & acquisition advisory, institutional private placements of debt and equity, financial restructuring, valuation, and strategic consulting. Our senior bankers have deep domain expertise across a range of industries, with the necessary foresight to navigate highly-complex transactions to maximize value and achieve optimal outcomes for clients.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Energy & Utilities, Retail, Business Services, Materials, Distribution, Health Care, Consumer Services, Media, Life Sciences, Telecommunications, Real Estate, Financial Services

“Plethora Businesses is a leading M&A Advisor for the lower middle market. We were formed in 1999 with the objective of creating a market place for buyers and sellers of privately held businesses. Throughout the years we have pursued this objective with constant vigor and dedication. We’re proud of our history, the relationships we’ve built and the hundreds of completed transactions and projects.

Whether an acquisition or merger, we believe these transactions are a significant milestone for every client. Each transaction helps to transform an individual’s life, create opportunities, transfer wealth and build upon prior success. We have fun doing what we do, enjoy the challenges and find satisfaction navigating and completing complex transactions”

Industries: Consumer Goods, Industrials, Materials, Retail, Business Services, Consumer Services, Media

“Advising Business Owners and Entrepreneurs since 1998, with valuing, buying and selling small to middle market companies. We follow a proven, comprehensive process to expose your business to a wide universe of possible buyers while maintaining your privacy and confidentiality of the transaction. Applying over 20 years of experience of working with business owners to successfully exit their business, we provide professional services tailored to the clients specific needs with the personal attention that is needed when managing a transaction that can carry an owner through a range of emotions. Owners can rely on the advice of The Hatteras Group to best understand the market value of their business and the various options available and they affect their personal and business goals.”

Industries: Industrials, Business Services, Health Care

Visit The Hatteras Group’s Profile

“RLS Associates is a middle market private investment banking firm specializing in Mergers, Acquisitions, Divestitures and Strategic Management Consulting services to middle market companies with sales of $1M to $100M. RLS serves a wide variety of industries, including manufacturing, distribution, service and technology. The common theme to most assignments is that at least one of the parties to each transaction will be closely-held business.”

Industries: Industrials, Manufacturing, Business Services, Technology, Health Care, Life Sciences, Materials

“Three Twenty-One Capital Partners is a leading Private Investment Bank and Advisory Firm providing premier service to the middle market. Our team of Wall Street veterans have advised sell-side and buy-side engagements with over $15 billion in value for entrepreneurs, family-run businesses and financial sponsors. We are a National Firm with a Global Reach, supporting clients throughout the United States with headquarters in Columbia, Maryland, and offices in Denver, Colorado and Los Angeles, California.

Three Twenty-One Capital Partners offers Strategic Advisory Services, Mergers & Acquisitions Services, and a Special Situations Platform. Our Strategic Advisory services span Healthy and Special Situations. Our team will employ cutting-edge research and years of experience with real-time Market Intelligence to analyze, assess and effectively address your business need. We also offer a full array of Sell-Side and Buy-Side Services for entrepreneurs, family-led businesses, and sponsors alike.”

Industries: Manufacturing, Consumer Goods, Industrials, Materials, Technology, Retail, Business Services, Distribution, Health Care, Consumer Services

Visit Three Twenty-One’s Profile

“New Direction Partners provides advisory services in investment banking, valuation, financial advisory and management consulting. Our partners have unparalleled experience, with involvement in over 200 sales and mergers since 1979. We specialize in providing services to the printing, packaging and allied graphic arts industries with an emphasis on mergers and acquisitions.”

Industries: Manufacturing, Business Services, Industrials, Media

![]()

“Lakeside Partners serves as a trusted advisor, providing mergers & acquisitions advisory services to business owners. Our principals have decades of experience executing transactions on behalf of business owners, boards of directors, and private equity owners. We bring a depth of experience across a variety of industries, business models, and ownership dynamics. We aim to achieve superior outcomes through intense focus on the details, unwavering commitment to our clients’ objectives, and tenacious execution and process management.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Retail, Business Services, Distribution, Consumer Services, Media, Telecommunications

Visit Lakeside Partners’ Profile

“ACT Capital Advisors has facilitated the mergers, acquisitions, and divestitures of hundreds of companies. Our principals have closed mergers and acquisitions totaling over $2 billion in total corporate transactional value. Our team consists of dedicated professionals who apply their extensive expertise and experience to achieve maximum value for their companies and clients.

We work closely with our client’s financial and legal advisors. With multiple decades of experience, ACT’s principals have represented a diverse range of industries, including manufacturing, contracting, wholesale, distribution and service industries. Our track record of success has provided us with an understanding and appreciation of the unique challenges presented by each industry, and allows us to continue to best realize the goals of our clients.”

Industries: Consumer Goods, Industrials, Materials, Energy & Utilities, Financial Services, Retail, Technology, Business Services, Health Care, Consumer Services, Media, Real Estate, Life Sciences, Telecommunications

“WhiteHorse Partners offers M&A services to the middle-market, specializing in sell-side engagements for owners of privately held companies. We work with only a select number of clients at any given time, which allows us to concentrate all of our creativity and talent on a small number of clients to whom we bring great value. We personally research, negotiate, and manage all aspects of every engagement, and pride ourselves on building long-term, mutually rewarding relationships.”

Industries: Aerospace & Defense, Business services, Distribution, Transportation, Energy, Health Care, Technology, Industrials, Manufacturing, Tech Software/Saas

“Business Capital Exchange, Inc. assists large corporations, private equity firms, and closely held companies with the sale of middle market businesses. Our experience ranges from selling highly profitable businesses to companies operating in Chapter 11.

We have successfully sold businesses across the United States, as well as in Europe and Asia. We target companies with values between $3 million and $300 million.”

Industries: Manufacturing, Technology, Energy & Utilities, Media, Distribution

Visit Business Capital Exchange’s Profile

“GT Securities provides investment banking services to emerging and middle market companies. We specialize in raising equity and debt capital and in executing acquisition, divestiture, and merger transactions for our clients. Our unique approach leverages Growthink’s two core services — growth strategy consulting and corporate finance to provide unparalleled corporate advisory and capital raising services.

GT Securities is the broker – dealer affiliate of Growthink, and is a member of FINRA and SIPC. Most boutique investment banks focus solely on corporate finance services and they fail to provide the strategic guidance that emerging and middle market companies need. Growthink Securities however, as the broker-dealer affiliate of Growthink, offers clients more than a decade of strategic management consulting and investment expertise in addition to expert financial advice. We understand your business because we have created firms ourselves and consulted with 2,000 companies at all stages of development and with all aspects of their business. We also have developed and launched sales and marketing strategies, operations plans, and studied the competitive landscape in your industry. We have started and built successful businesses and personally experienced many of the same challenges you face on a daily basis.”

Industries: Consumer Goods, Manufacturing, Technology, Energy & Utilities, Financial Services, Industrials, Distribution, Media, Real Estate, Consumer Services, Business Services, Health Care, Life Sciences, Telecommunications

“PCE is a leading financial services firm for middle market companies, offering clients a full range of investment banking, valuation and advisory services. PCE delivers M&A, ESOP, management buy outs (MBOs), bankruptcy, restructuring, and fairness and solvency opinion advisory services. Additionally, the firm offers management consulting, succession planning, strategic analysis, and litigation support.”

Industries: Financial Services, Consumer Goods, Energy & Utilities, Industrials, Manufacturing, Retail, Materials, Technology, Business Services, Distribution, Health Care, Consumer Services, Life Sciences, Telecommunications

“Meritage Partners is a multi-disciplined mergers and acquisitions advisory firm serving the lower-middle markets. Our advisors are made up of accomplished and experienced entrepreneurs with over 130 years of collective experience. Our team has advised on over $2 Billion of successful transactions with private equity firms, high net-worth individuals, and public companies. Our clients are privately-held businesses in a variety of industries throughout North America.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Retail, Business Services, Distribution, Energy & Utilities, Materials, Health Care, Financial Services, Life Sciences, Telecommunications

Visit Meritage Partners’ Profile

“SDR Ventures is a Denver-based investment banking firm serving private business owners in the lower middle market, including companies with values up to $300 million. The SDR Ventures approach of THINKING LIKE OWNERS helps businesses maximize their value. Whether owners are looking to sell a business, buy a business or raise debt or equity, SDR is committed to helping them succeed.”

Industries: Manufacturing, Consumer Goods, Industrials, Business Services, Technology, Distribution, Health Care, Energy & Utilities, Financial Services, Materials, Consumer Services, Life Sciences, Media, Real Estate

“For over thirty years, we have been successfully engaged in the practice of buying, selling and managing the business acquisition process. Our professionals have been engaged in transactions in a multitude of industries. They have completed multi-million dollar deals, and they have also successfully integrated businesses post-merger as executives in Fortune 500 companies. Whether your business is worth $1 million or $100 million, this experience is put to work to achieve your desired result. Mr. Kerchner, Mr. Clark, Mr. Fay and Mr. Tortora hold the securities licenses series 79 and 63.”

Industries: Consumer Goods, Industrials, Technology, Energy & Utilities, Materials, Business Services, Consumer Services

“Global Wired Advisors is a leading Digital Investment Bank focused on helping founders and families exit the highly successful companies they have built. The firm specializes in sell-side M&A Advisory engagements in the e-commerce ecosystem, including consumer brands and e-tailers, Amazon-centric businesses, SaaS companies, digital marketing agencies, and logistics and fulfillment businesses.”

Industries: Manufacturing, Consumer Goods, Technology, Retail, Business Services, Distribution

Unlike traditional league table structures that have remained the same for years, where firms are assessed against deal volume and deal dollar volume, Axial league tables surface data on investment banks that reveal their selectivity, the relative attractiveness of their client’s businesses, and their overall sell-side process efficacy.

The investment banks at the top of the Axial League Table are leaders across the following categories:

Together, the top 25 investment banks are those who work with the most in-demand clients; balance breadth, selectivity, and accuracy in the buyers they engage; and generate the largest number of positive outcomes for their clients.

Axial is the trusted deal platform serving the lower middle market ($5-$250M TEV).

Over 3,500 advisory firms and 2,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.

Email [email protected] to learn more.