Add-On Demand in the LMM: A Data-Driven Look at Buyer Activity

Most successful businesses adopt both organic and inorganic growth strategies. And add-on acquisitions remain one of the most widely used…

The 2022 M&A environment starkly contrasted with 2021, and reports indicate the overall market contracted ~25% YoY.

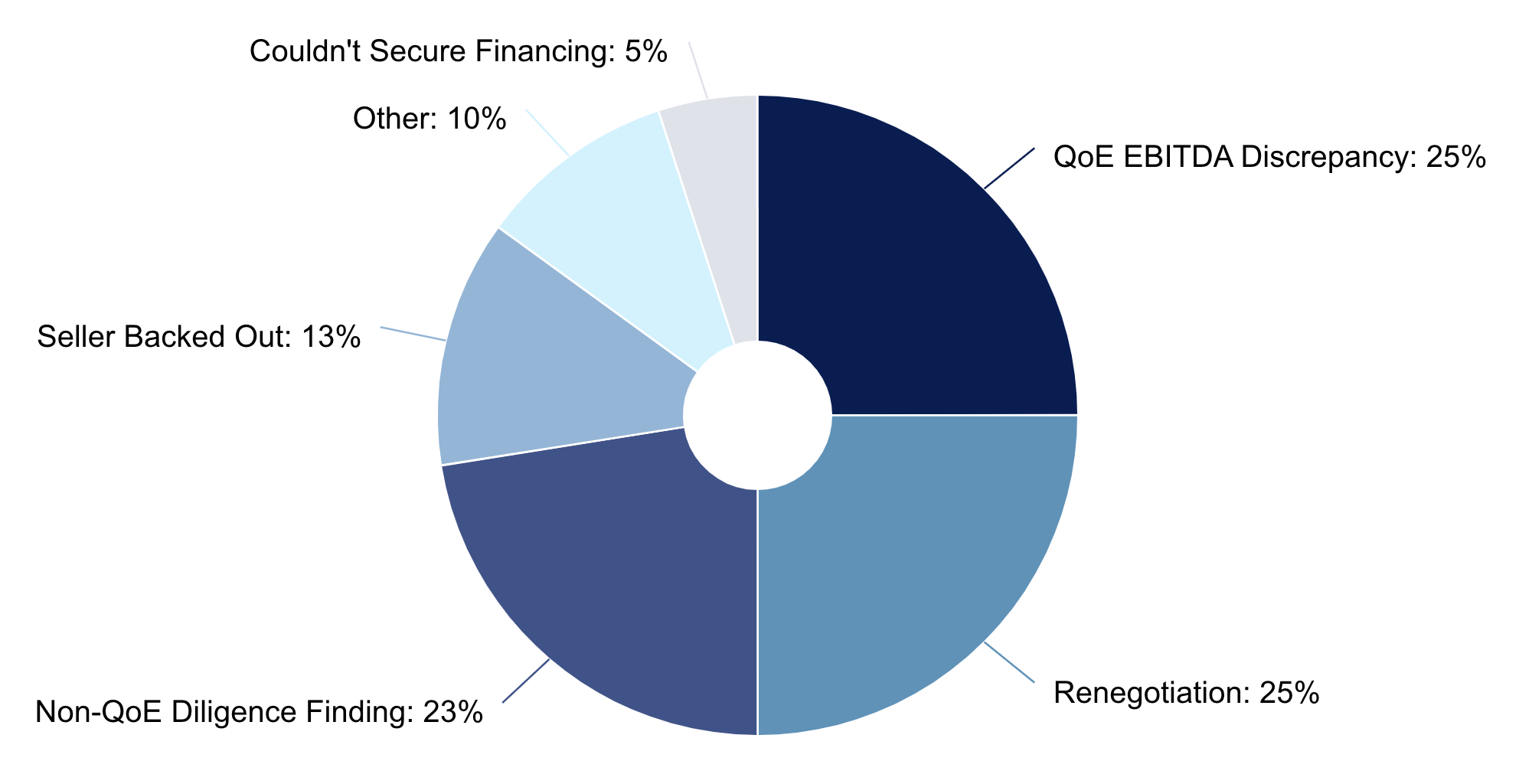

On Axial’s lower middle market deal sourcing platform, we saw slightly elevated LOI breakage rates and lower average deal sizes and decided to study it. We are grateful to the surveyed Axial members who provided both data and useful color on what in their eyes broke the deal. The below results were compiled and anonymized based on the 48 received replies.

Somewhat surprisingly, macro events weren’t the main event, although they likely raised the stakes and created more price discipline with buyers. Debt financing / availability was not the issue either, despite it being discussed ad nauseam by the financial media.

The main event was an all too familiar mix of seller financial under-preparedness, unsuccessful renegotiations post-diligence, and seller cold feet.

Cold feet happen and are hard to remedy. Financial under-preparedness is more avoidable.

To help Axial members avoid financial diligence blow-ups, we’ve secured several preferred relationships with respected lower middle market QoE providers. Usually buyers commission QoE work, but we are seeing the sell-side commission more and more QoEs.

If you’re an Axial member and need to put a sell-side or buyside QoE in motion, let us know here. We’ll be happy to make some introductions.

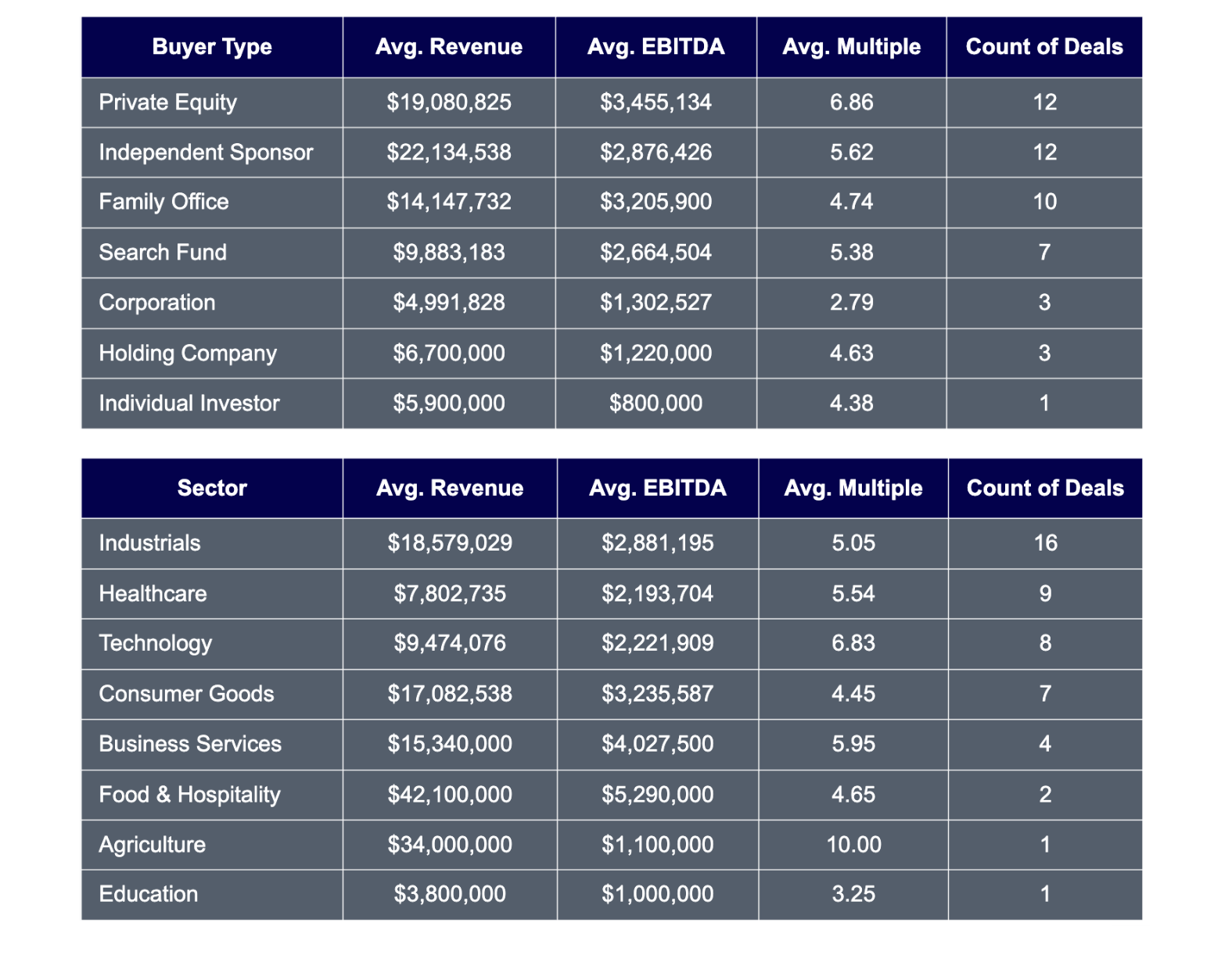

| Investor Type |

Industry |

Reason |

Anecdote |

| Independent Sponsor | Food & Hospitality | QoE EBITDA Discrepancies | A major customer was buying less product from the company. |

| Corporation | Technology Information & Software | Couldn’t Secure Financing | QoE revealed material EBITDA discrepancies prolonging the negotiation. The markets then turned and the buyer couldn’t secure attractive debt financing. |

| Private Equity | Industrial Services | QoE EBITDA Discrepancies | QoE revealed EBITDA was 80% lower than initially indicated. |

| Search Fund | Consumer Goods Manufacturing | Renegotiation | Fell apart due to a seller-initiated, last-minute renegotiation of key terms – seller note and working capital adjustment. The revised terms were not within the buyer’s risk parameters. |

| Independent Sponsor | Technology Services | Other | Diligence checked out, but interest rates rose and the cost of debt was at a level the CEO was not comfortable with. |

| Family Office | Industrial Construction | Non-QoE Diligence Finding | Post-LOI diligence revealed business wasn’t what was represented to us. |

| Independent Sponsor | Industrial Manufacturing | Renegotiation | Deferred capex issues were discovered during diligence – resulting in an adjusted purchase price which caused the seller to back out. |

| Holding Company | Technology Information & Software | Non-QoE Diligence Finding | Walked away from the deal after market opportunity and competitor research findings. |

| Family Office | Consumer Goods Manufacturing | Renegotiation | Terminated LOI due to poor seller financial performance during the diligence period and an inability to reset the purchase price. |

| Private Equity | Business Services | Other | Deal was a roll-up opportunity for multiple companies – two of which dropped out early on. |

| Corporation | Industrial Services | Non-QoE Diligence Finding | On-site visit revealed the company was run differently than originally portrayed. |

| Independent Sponsor | Healthcare Manufacturing | Seller Backed Out | Seller said he didn’t appreciate how much he and his family benefited from the business until going through the sale process. |

| Individual Investor | Industrial Distribution | Renegotiation | The company missed their 2021 projections. The owner backed out after renegotiation based on actual company performance. |

| Holding Company | Healthcare Services | Other | Inexperienced seller and broker had challenges with technology and due diligence requests. |

| Independent Sponsor | Technology Retail | QoE Discrepancies | QoE came back light making the deal too small for the buyside firm’s mandate. |

Axial is the trusted deal platform serving the lower middle market ($5-$250M TEV).

Over 3,500 advisory firms and 2,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.