For Business Owners

The Best Exits Tap Experts

Your expertise lies in running your business – let the experts in selling businesses guide your exit. Avoid costly mistakes and secure the best price with the right buyer through the help of a professional M&A advisor.

The Hidden Risks Of Selling Solo

The most significant transaction of your life has substantial risks if you do it alone.

A Tarnished Legacy

Risking the sale of your business to the wrong buyer over a trusted steward.

An Undervalued Outcome

Selling your life’s work for a fraction of its true value.

A Failed Process

Making mistakes that hinder the deal of a lifetime, forcing you to start over.

The Right Advisor Makes All The Difference

M&A advisors know the market and have the expertise to secure the best possible deal for you.

Increase in buyer coverage

More likely to sell your business

Higher sale price

Hours saved each week

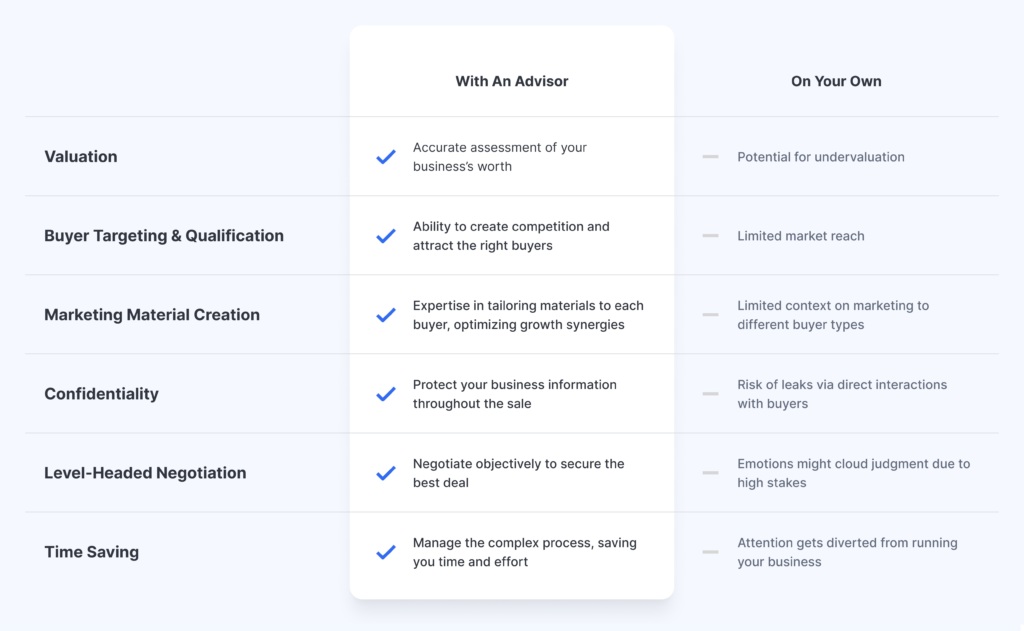

Are The Fees Really Worth It?

Advisors are incentivized to help you obtain the best terms and price. A failed exit might cost you much more in the long run.

-

Valuation

-

Buyer Targeting & Qualification

-

Market Material Creation

-

Confidentiality

-

Level-Headed Negotiation

-

Time Saving

-

Accurate assessment of your business’s worth

-

Ability to create competition and attract the right buyers

-

Expertise in tailoring materials to each buyer, optimizing growth synergies

-

Protect your business information throughout the sale

-

Negotiate objectively to secure the best deal

-

Manage the complex process, saving you time and effort

-

Potential for undervaluation

-

Limited market reach

-

Limited exposure of marketing to different buyer types

-

Risk of leaks via direct interactions with buyers

-

Emotions might cloud judgment due to high stakes

-

Attention gets diverted from running your business

Explore A Better Way To Sell Your Business

Axial matches you with the right M&A advisor to secure your best exit.

Axial’s exit consultants introduce you to the right M&A advisor to help you secure the best terms for your business sale. With more than 14 years of unparalleled access to the small business M&A landscape, we have the largest network of pre-vetted M&A advisors and the right resources to guide you through every step of your exit journey.

Don’t Settle For Less

Hear from business owners who made the right choice.

“My family got the best potential outcome we possibly could. I would’ve never been able to know the true value of my business if Axial hadn’t connected me with the M&A advisor that I ended up hiring.”

CEO, Blind & Shade Manufacturing

Aimed to sell his business for 5x profit but achieved 9x profit with the help of an advisor.

Don’t Settle For Less

“My family got the best potential outcome we possibly could. I would’ve never been able to know the true value of my business if Axial hadn’t connected me with the M&A advisor that I ended up hiring.”

CEO, Blind & Shade Manufacturing

Aimed to sell his business for 5x profit but achieved 9x profit with the help of an advisor.

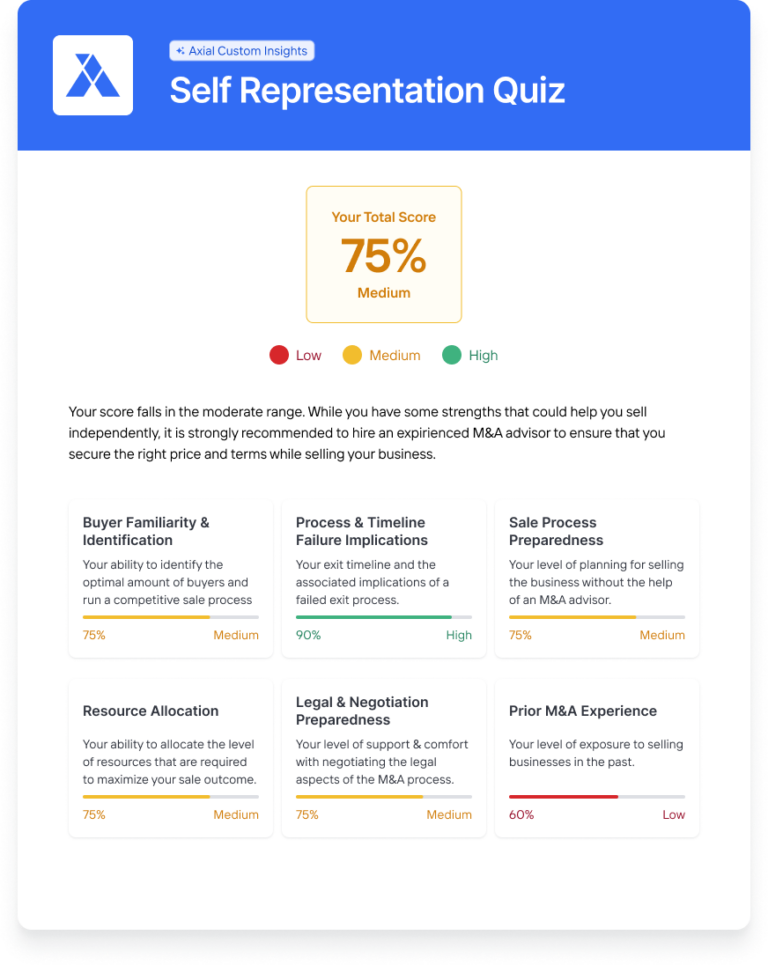

Still Considering Selling Without An M&A Advisor?

You might manage to sell your business independently if:

1. You have prior experience in selling a business.

2. You are transferring ownership to a family member or employee.

3. You have extensive bandwidth to learn about the process and navigate the common pitfalls that owners run into.

Take our Self Representation Quiz to see if selling without an M&A advisor is the right path for you.

Common Questions Answered

On the contrary, an experienced advisor can streamline the process, handling the complexities and negotiations more efficiently than doing it alone. This often results in a faster and smoother transaction.

Many business owners who choose to sell on their own find themselves overwhelmed by the time, effort, and expenses involved. Studies reveal they often leave significant money on the table compared to what they could achieve with a seasoned M&A advisor by their side.

Hiring an experienced advisor allows you to save time, ensuring you get the best possible deal with minimal disruption to your business.

When an interested buyer is on the table, an experienced advisor can create competitive tension to drive up the sale price, evaluate the offer to uncover hidden risks, and handle complex negotiations.

An experienced advisor not only safeguards your business’s full value but also steers you clear of common mistakes, ensuring you maximize your return.

Even with prior experience, the market and regulatory environments are constantly changing. An M&A advisor brings up-to-date knowledge and expertise, ensuring you navigate the complexities of the current market efficiently.

Not all advisors are the same. To truly benefit from engaging an advisor, it’s crucial to select the right one with a proven track record in representing businesses like your’s. Conducting a competitive selection process, where you interview multiple firms, helps you find the best fit.

Resources For Owners

Find all the resources you need to make smart decisions as you sell your company.

Hire the right M&A advisor. Achieve your ideal exit.